Environmental, social, and governance (ESG) investing is starting to make its way into executive compensation.

The move toward including ESG in executive compensation is already making its way into European companies. It’s just the beginning of a move toward more ESG metrics.

“Many European companies already incorporate ESG metrics into executive pay. In a study of 365 issuers from major indexes in continental Europe and the UK, 68 percent have at least one ESG metric in their incentive plans, according to Willis Towers Watson,” an IR Magazine article said. “But companies are under pressure to go further. Investors want to see stronger links between ESG, strategy and pay. In particular, they are pushing for significant metrics on key sustainability topics, like climate change and diversity.”

A Crash Course in ESG Investing

Adding more ESG incentives could also, in turn, boost ESG-focused ETFs. One of those funds that could see strength is the low-cost S&P 500 ESG ETF (EFIV).

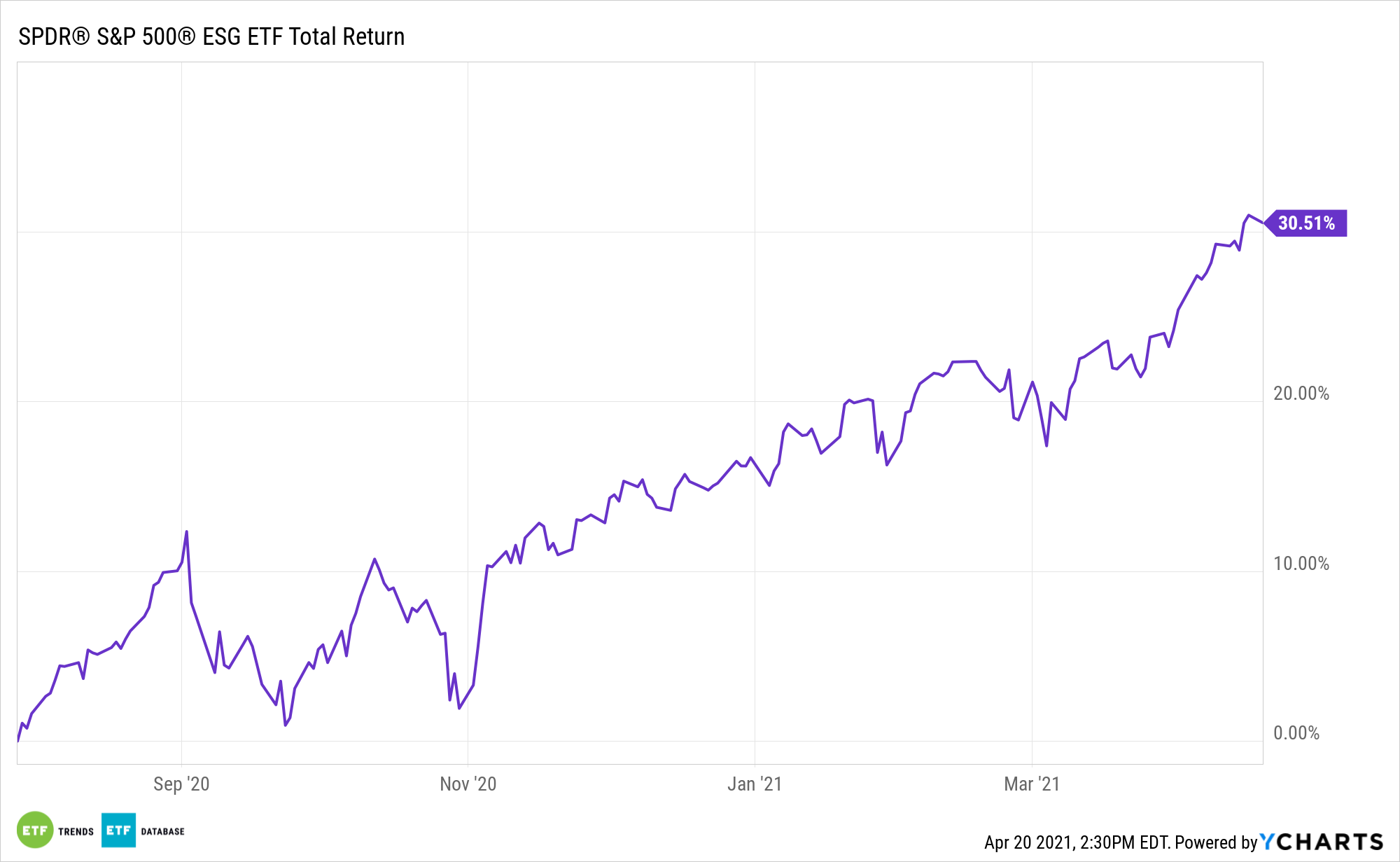

EFIV, which is up 11% for the year, seeks to provide investment results that correspond generally to the total return performance of an index that provides exposure to securities that meet certain sustainability criteria (criteria related to ESG factors) while maintaining similar overall industry group weights as the S&P 500 Index.

In seeking to track the performance of the S&P 500 ESG Index, the fund employs a sampling strategy, which means that it is not required to purchase all of the securities represented in the index. Overall, EFIV gives ETF investors:

- Investment results that, before fees and expenses, correspond generally to the S&P 500 ESG Index.

- Potential ESG core exposure, based on its focus on sustainability criteria and comprehensive market coverage of the flagship core S&P 500 Index.

- A low expense ratio of 0.10%, 27 basis points below the category average.

- A strong 12-month performance, with a 31% gain.

For more news and information, visit the ESG Channel.