State Street Global Advisors recently conducted a survey in May of 358 institutional investors globally, asking about where they see fixed income investing now and its evolution moving forward. Over the course of the next three years, 61% of institutional investors said that ESG integration is a high priority for their fixed income portfolios.

Those surveyed included institutional investors from pension funds, wealth managers, asset managers, and sovereign wealth fund personnel. The survey focused on the four key trends that SSGA is seeing in fixed income portfolios, reflecting shifting priorities going forward. These included a move to indexing-based strategies, increasing the use of ETFs in core/global aggregate fixed income portfolios and non-core/satellite exposures, increasing emerging market exposure to countries like China, and “deeper/more comprehensive ESG integration” over the course of the next three years, according to the authors of the survey.

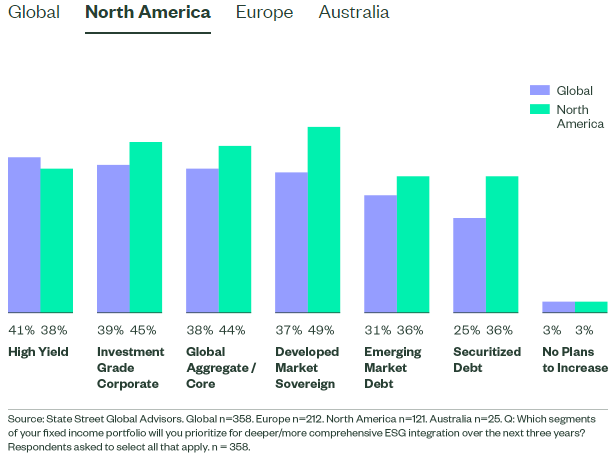

The increasing focus on ESG in equity investing is now carrying over into the fixed income investing space. Investors believe that ESG gives them a “quality” lens through which they can assess fixed income investment strategies. While European institutional investors were more likely to prioritize yield, North American institutional investors surveyed responded that they would prioritize developed market sovereign funds the highest.

Of perhaps greatest interest to ETF fans was that over half (58%) of all surveyed said that they would most likely be using ETFs to increase their allocations to fixed income ESG exposure and strategies within the next three years.

Currently, institutional investors approach ESG primarily by analyzing and selecting best-in-class options (49%); this follows a strategy that selects issuers with the strongest ESG scores compared to their industry. The other most common investment strategy for ESG exposure was to assess the impact that an issuer was making in ESG (39%). These must be positive, measurable environmental and/or social impacts that usually align with the UN Sustainable Development goals. They are also typically project-specific.

Of those surveyed, there were three main types of fixed income ESG strategies that they planned to follow in the coming years: broad ESG tilt or theme, targeted social tilt or theme, and targeted climate/environmental tilt or theme. These findings were found to be true across both active and index-planned strategies.

Asset managers should recognize the important role that ESG plays in index manager selection checklists, SSGA concluded. “Managers that are not prepared to discuss ESG for FI (fixed income) fully should prepare themselves for rejection,” the authors of the survey stated.

Fixed Income ESG Investing with State Street

SSGA currently offers a fixed income ETF with an ESG lens, the SPDR Bloomberg SASB Corporate Bond ESG Select ETF (RBND). The fund tracks the Bloomberg SASB US Corporate Ex-Controversies Select Index and provides a sampling strategy to generally carry the same risk and returns of the Index.

The Index measures the performance of investment-grade corporate bonds issued by companies with certain ESG qualities that also have risk and return qualities of the parent Index, the Bloomberg Barclays US Corporate Index. The parent Index has public issued, fixed rate, taxable, U.S. dollar-denominated corporate bonds. These bonds are issued by U.S. and non-U.S. industrial, utility, and financial institutions with a maturity of a year or greater and with $300 million or more of par amount outstanding.

The Index uses a Responsibility (R-Factor) developed by SSGA to score companies in the parent Index for ESG criteria. The R-Factor takes into account ESG and corporate governance factors when scoring companies. It excludes companies that derive significant revenue from any of the following: extreme event controversies, controversial weapons, UN Global Compact Violations, Civilian Firearms, Thermal Coal Extraction, and Tobacco. Companies that do not have an R-Factor in the parent Index are also removed.

The securities within the Index are weighted to maximize the R-Factor of the Index while also minimizing total risk compared to the parent Index.

RBND can be used as a core building block for ESG investing and carries an expense ratio of 0.12%.

For more news, information, and strategy, visit the ESG Channel.