By Sara Rodriguez, ESG Research Analyst

Air Products and Chemicals, Inc., is an essential provider of industrial gases, related equipment and applications serving dozens of industries globally such as refining, manufacturing, and food and beverage. Based in Trexlertown, Pennsylvania, the company has come a long way since its inception as a supplier of oxygen generators during World War II, growing into a Fortune 500 company. The gases it produces enhance frozen foods, boost the quality of flat-screen LCD TVs, and enable of the use of MRI imaging. As a chemical company, Air Products faces numerous ESG risks—especially in the environment and social categories, however; the company is well positioned to benefit from sustainability opportunities.

The chemical industry has an opportunity to address sustainability issues from two perspectives—within its own operations, and with the effects of its product in the value chain. PwC Partner Oliver Golly put it well: “Expectations placed on chemical companies are high: in addition to improving their own footprint they are also supposed to promote sustainable solutions and innovative strategies in every customer industry they serve.” Perhaps unsurprisingly, the majority of the ESG risks faced by chemical companies fall under the environmental category. Energy, air emissions, and water and waste are a few of the concerning topics that could have direct impacts on a chemical company’s operations.

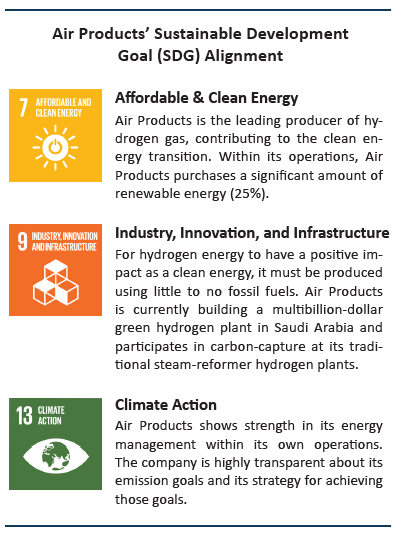

Industrial gas manufacturing is energy-intensive, as the technology used for creating gases requires energy for the processes that involve the heating and cooling of gas. This makes strong energy management critical, especially related to type of energy used, magnitude of energy consumption, and strategy for improvement, as energy purchases can represent a significant share of production costs. This idea is reinforced by the company’s 2021 Sustainability Report, which identifies energy consumption as the most significant variable in the cost of Air Products’ production processes. Therefore, strong energy management presents an area of opportunity for the company. Operational efficiencies related to energy can have an immediate and direct impact on a company’s costs and can be either positive or negative. One of Air Products’ environmental goals is to reduce CO2 emissions intensity by one-third by 2030 from a 2015 baseline. Air Products lists its mechanisms for delivering on its CO2 intensity reduction goal in its Sustainability Report, which is an admirable piece of disclosure, as often companies are not transparent about their plans for achieving carbon reduction or net zero commitments. This strategy includes executing carbon capture projects, producing carbon free hydrogen, improving operational efficiency, and increasing its use of renewable energy.

The company has made progress on its goals so far. In 2020, Air Products purchased 25% of its electricity from renewable sources. When coupled with efficiency improvements, this strategy has allowed Air Products to avoid $175 million in cumulative energy and water costs since 2015. Air Products’ main water use is cooling during industrial processes, tying water consumption closely to energy use. As the company achieved energy efficiency improvements, it was also able to reduce water intensity by 4% in 2020, for a total reduction of 26% since its 2015 baseline.

Energy and emissions are important considerations within Air Products’ operations and are also an area of opportunity when it comes to Air Products’ business model. The global turmoil in energy markets is clear: the increase in energy prices over the past two years has been the largest since the 1973 oil crisis. The war in Ukraine has dealt a major shock to commodity markets and global trade patterns, and experts are predicting that prices will stay at historically high levels through the end of 2024. This volatility coincides with shifting societal norms and preferences, as consumers turn to low-emission alternatives and sustainably made products more than ever. Air Products sees the opportunity in one alternative in particular — hydrogen. Currently, Air Products is the largest supplier of hydrogen in the world. It owns and operates over 100 hydrogen plants, producing more than seven million kilograms of hydrogen per day. The company also maintains the world’s largest hydrogen distribution network.

Hydrogen is the most abundant element in the universe. The simplest element, each atom of hydrogen has only one proton. Combustible, hydrogen can be used to power engines and replace fossil fuels used for heat in manufacturing. Unlike fossil fuels, which when burned produces CO2 as a byproduct, hydrogen’s waste product is simply water vapor. Hydrogen has the potential to become a key player in clean energy, but creating hydrogen can be carbon intensive. To use hydrogen as an energy source, it needs to be in its pure gas form. However, natural occurring hydrogen gas is extremely scarce — the element is almost exclusively found in compound form with other elements. Hydrogen combined with oxygen is water, hydrogen combined with carbon forms hydrocarbons, or fossil fuels.

There are a handful of common methods for producing hydrogen, often referred to by their assigned ‘color,’ which relates to how environmentally friendly the production process is. Gray hydrogen, currently the most common method of production, uses a process known as steam-methane reforming. This involves rearranging the molecular structure of methane (CH4) using energy-intensive steam. With natural gas as its input and steam energy derived from fossil fuels, this process is just as emission heavy as the use of fossil fuels. With gray hydrogen, about 10kg of CO2 are released into the atmosphere for every 1kg of hydrogen produced. Gray hydrogen is commonly used in the chemical industry to make fertilizer and refine oil. If the CO2 emissions produced are captured and stored underground, the end product is known as blue hydrogen. Air Products currently produces blue hydrogen at its Texas plant in Port Arthur, capturing one million tons of CO2 per year, and the company is building two more blue hydrogen facilities in Louisiana and Alberta, Canada.

The most environmentally friendly method of producing hydrogen is known as green hydrogen, which follows an entirely different process than gray and blue hydrogen. Green hydrogen is produced using electrolysis, which separates the hydrogen molecules from water (a renewable resource) by applying an electrical current. If the electricity supplied comes from renewable sources, green hydrogen has the lowest carbon footprint of produced hydrogen. Although ideal, this process is costly, and energy from renewable sources is limited in supply. Despite this barrier, Air Products is building a green hydrogen plant in Saudi Arabia expected to open in 2026. By expanding is clean hydrogen operations, Air Products is taking advantage of the shift toward a lower carbon future.

Another topic of financial importance in the chemical industry is product efficiency. Resource scarcity and increasing regulation drive the need for greater materials efficiency. Companies that develop solutions to address customers’ needs for improved efficiency can benefit from increased revenues and market share, stronger brand value, and a competitive advantage. Air Products Sustainability Report boasts that over 50% of its revenue comes from sustainable offerings. Hydrogen supplied by Air Products is used for oil recycling, which helps contribute to a circular economy. Overall, we find that Air Products shows strength in its management of environmental risks and has had little to no environmental controversy.

While environmental issues are certainly prominent for the chemical industry, there are financially material social concerns that require strong management as well. The nature of chemical substances elevates the risk of events that may harm workers or nearby communities. Employees face risks from exposure to heavy machinery, harmful substances, and high temperatures and pressures. Strong safety management can reduce operational downtime, prevent costs from fines and litigation, and promote workplace productivity. Air Products markets itself as being the “safest and most profitable gas company in the world.” While that statement may prove difficult to validate, we do find the company to have strong safety management practices. Air Products’ Basic Safety Process (BSP) is the framework for its safety performance, utilizing preventative activities like planned inspections and frequent safety meetings. The company has improved its lost-time injury rate by 83% and its recordable injury rate by 48% since 2014. Its Sustainability Report discloses a contractor fatality in 2020 and assures that steps were taken to identity and address the risks leading to the incident.

Air Products has about 19,000 employees, somewhat evenly split between the Americas (37%), Asia (31%), and Europe, the Middle East, and Africa (32%). In terms of diversity, the company has a goal of achieving at least 28% female representation globally and at least 20% minority U.S. representation in professional and managerial population by 2025. These goals represent increases from 25% and 17% representation (2020 baseline), respectively. As Air Products operates internationally, performance on health and safety is also material in its foreign operations. Regulations vary from country to country, and a lax global safety standard can expose a company to risk. We do not find this to be a problem with Air Products. In 2020, the company’s safety efforts were recognized by various prominent trade associations and governments throughout North America, Europe, and Asia.

Product Safety is another financially material social issue for companies in the chemical industry. Air Products conducts product safety reviews for its commercial products, including characterizing the intrinsic environmental and health hazards of the products, examining product uses, and creating management actions to address concerns. The liquid and bulk industrial gas products the company produces are not toxic and can be handled safely with appropriate procedures and training. The company generates less than 2% of its revenue from toxic substances, which positions it as lower risk for product safety issues than some industry peers.

As always, we believe strong governance to be the foundation of a successful sustainability strategy for any company regardless of industry. One governance risk the chemical industry is particularly susceptible to is bribery and corruption, as companies often operate globally and their operations require regulatory approval. Air Products has achieved 100% training and certification in its Code of Conduct, which provides detailed guidance on its policies in place to prevent, detect, report, and address ethics violations. As for the company’s board of directors, two out of eight board members are women. The chair of the board is not considered independent; however, an independent lead director has been appointed to ensure the separation between managerial and supervisory functions. Air Products’ sustainability performance is reviewed by its Board of Directors and Sustainability Leadership council, and sustainability targets are integrated into the variable remuneration of executives, which can positively influence sustainability performance. The company produces internal reporting of sustainability results monthly and publishes an external Sustainability Report annually.

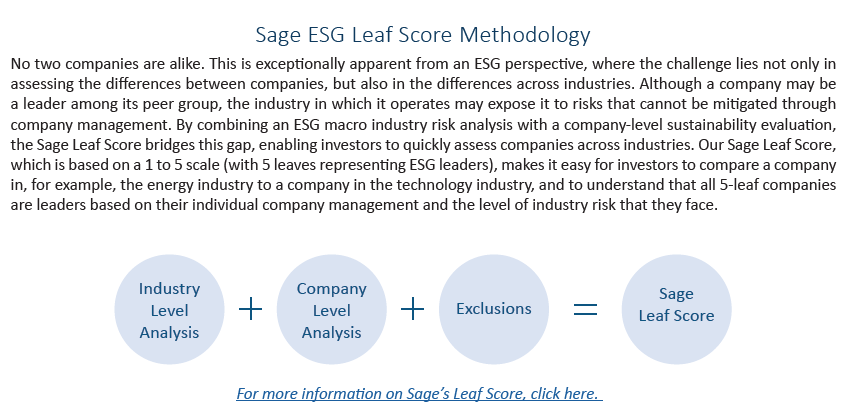

We often use these reports to dissect the sustainability risks a company faces and the potential financial impact that poor performance on those issues can lead to. However, when it comes to ESG performance, sustainability opportunities can have just as much financial impact as risks — and those impacts can be positive. Air Products is a great example of a company that is finding financial benefits through sustainability opportunities. Through its strong energy management, commendable safety record, and innovative work in the hydrogen space, Air Products sets itself apart as a sustainability leader within the chemical industry. We expect that the company will continue its strong ESG performance and score it a 5/5 on the Sage Leaf Score.

Sources

- 2021 Sustainability Report. Air Products and Chemicals.

- Institutional Shareholder Services (ISS) ESG Corporate Rating Report for Air Products and Chemicals, Inc.

- Air Products and Chemicals, Inc. SASB Standards. Value Reporting Foundation.

- Golly, Oliver. Sustainability in the chemicals industry.

- Food and Energy Price Shocks from Ukraine War Could Last for Years. The World Bank. April 2022.

- Hydrogen explained.S. Energy Information Administration. January 2022.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.