Environmental, social, and governance (ESG) investing is not a new concept in China, but getting the whole country on board has been a challenge.

A CNBC article noted that in China, asset managers are “are no strangers to sustainable investing — but doing so in a way that fits into formal social responsibility frameworks is still ‘relatively new,’ said the chief executive of a Chinese financial services company.”

In the U.S., more companies are starting to adopt ESG metrics in order to score the alignment of business practices with ESG initiatives. Slowly but surely, China is doing the same.

“Responsible investing and looking at the long-term sustainability of our portfolio is not new to the investment community in China, but we didn’t really comply it within the regime of ESG,” Li Yimei, CEO of China Asset Management, told CNBC’s “Squawk Box Asia.”

Governmental Support

The Chinese government is doing their part in helping to push ESG initiatives to the forefront.

“Our policymakers actually are pushing very hard for standardized disclosure for the A-share listed companies, and we do think that will change relatively fast,” Li said.

″(This is) very localized information, so we would also want to help international companies get access to that information,” Li added.

ESG Back in the States

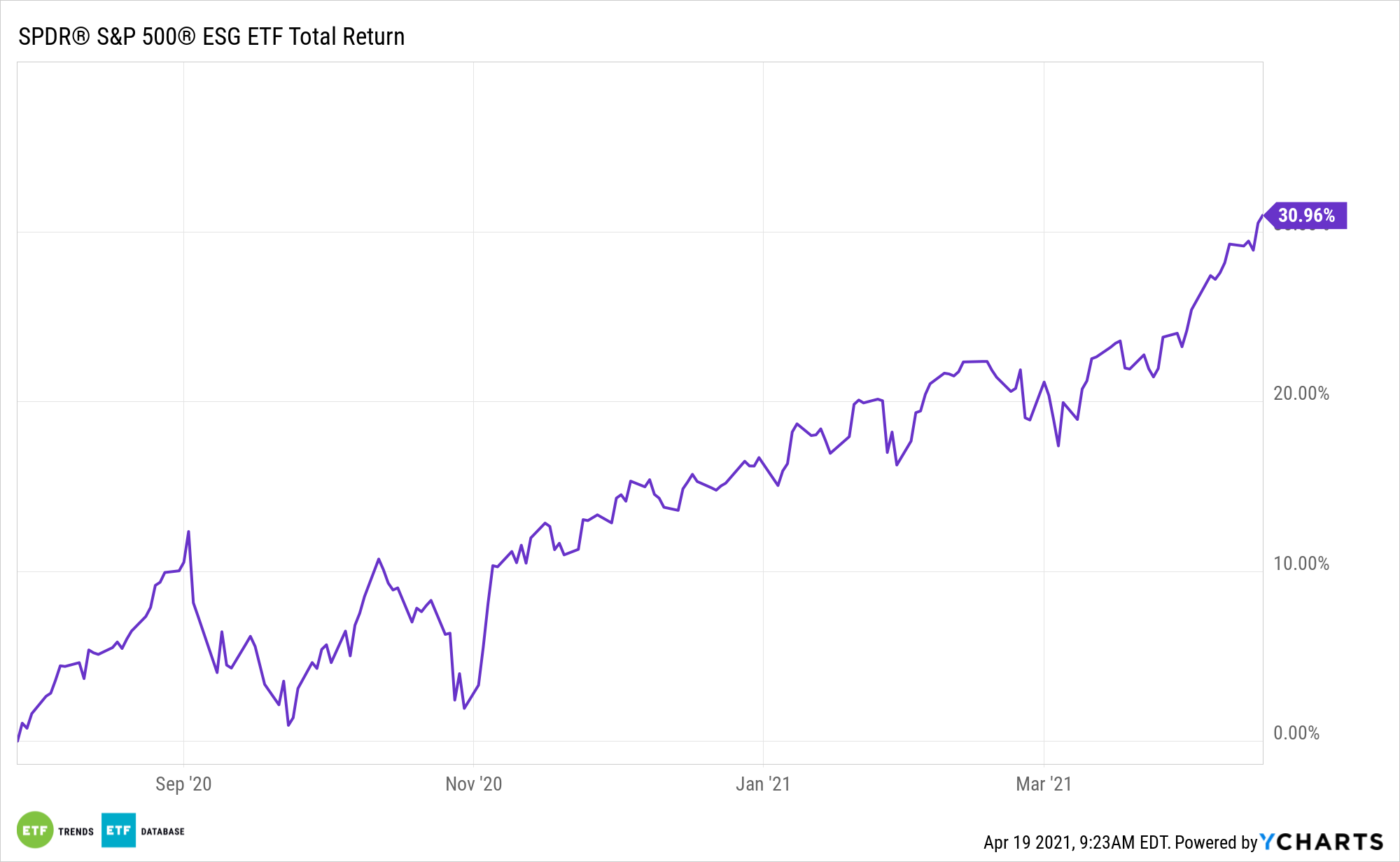

ESG exposure back in the U.S. is attainable with the S&P 500 ESG ETF (EFIV). At a 0.10% expense ratio, EFIV provides low-cost ESG exposure.

EFIV seeks to provide investment results that correspond generally to the total return performance of an index that provides exposure to securities that meet certain sustainability criteria (criteria related to ESG factors) while maintaining similar overall industry group weights as the S&P 500 Index.

In seeking to track the performance of the S&P 500 ESG Index, the fund employs a sampling strategy, which means that it is not required to purchase all of the securities represented in the index. Overall, EFIV gives ETF investors:

- Investment results that, before fees and expenses, correspond generally to the S&P 500 ESG Index.

- Potential ESG core exposure, based on its focus on sustainability criteria and comprehensive market coverage of the flagship core S&P 500 Index.

- A low expense ratio of 0.10%, 27 basis points below the category average.

- A strong 12-month performance, with a 31% gain.

For more news and information, visit the ESG Channel.