By Tianyin Cheng, Senior Director, Strategy and Volatility Indices, S&P Dow Jones Indices

Water is essential to the production and delivery of nearly all goods and services. Many businesses are reliant on a sufficient flow of clean water to operate and realize their growth ambitions. Overconsumption of water, water pollution, environmental degradation, and changing climatic conditions are making clean water an increasingly scarce resource.1 As the world population grows and competition for water resources between industry sectors intensifies, nations are set to experience a 40% shortfall in water by 2030.2

As these demands for clean water increase, companies involved in water-related business activities stand to grow in the coming years. Allocation to water can be systematically captured by rules-based, transparent index construction. Market participants could utilize index-linked water strategies to gain exposure to water, manage water risk, express their sustainability views, or allocate as part of a broader natural resource theme.

THE S&P GLOBAL WATER INDEX

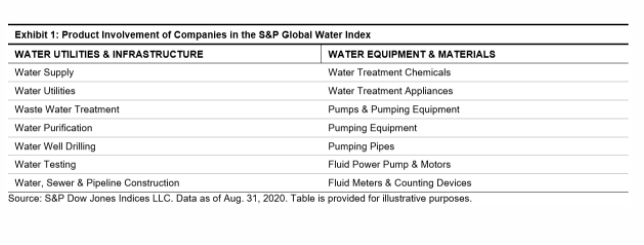

The S&P Global Water Index is designed to track 50 of the largest publicly traded companies involved in water-related business activities through two distinct clusters: Water Utilities & Infrastructure and Water Equipment & Materials.

The underlying universe consists of securities trading on a developed market exchange with a minimum three-month average daily value traded of USD 1 million (USD 500,000 for current constituents), a total market capitalization of USD 250 million, and a float-adjusted market capitalization of USD 100 million after each rebalancing.

Given that companies can have multiple business segments and not all may derive from water-related business, it is helpful to separate those with pure exposure to water and those with mixed exposure. Hence, we assign an exposure score of 1.0, 0.5, or 0 for each company, based on its primary business, and select and weight companies based on their exposure score and market capitalization. Hence, the index attempts to provide a balanced, yet reflective view of the global water market by recognizing the full ecosystem of companies and pure-play names to be more focused areas.

RISK/RETURN CHARACTERISTICS

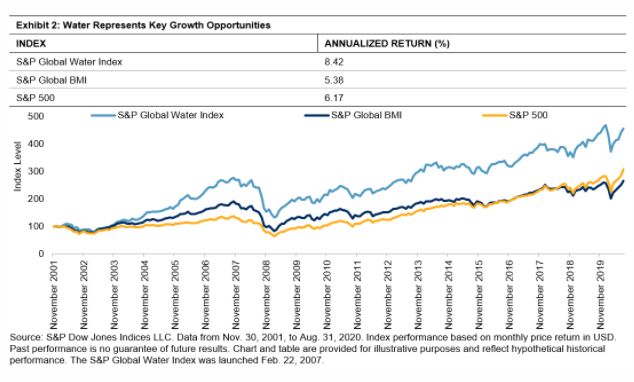

Over a long-term investment horizon, the S&P Global Water Index performed better than the broad-based global equity benchmark, the S&P Global BMI, by 3.04% per year since its inception on Nov. 30, 2001 (see Exhibit 2).

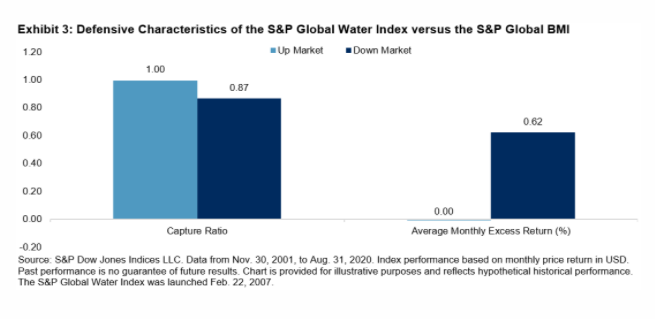

The S&P Global Water Index demonstrated stronger defensive characteristics than the global equities market, with a lower downside capture ratio and higher upside capture ratio (see Exhibit 3).

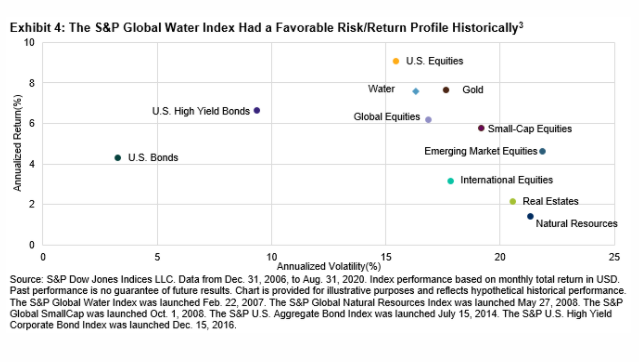

The S&P Global Water Index also provided favorable risk/return characteristics over the long run compared with key traditional asset classes, including real estate, small-cap equities, international equities, emerging market equities, and gold (see Exhibit 4). The favorable long-term risk/return characteristics compared with the S&P Global Natural Resources Index could be attractive for investors looking to diversify from other natural resource exposure.

The S&P Global Water Index also provided favorable risk/return characteristics over the long run compared with key traditional asset classes, including real estate, small-cap equities, international equities, emerging market equities, and gold (see Exhibit 4). The favorable long-term risk/return characteristics compared with the S&P Global Natural Resources Index could be attractive for investors looking to diversify from other natural resource exposure.

For more information on the S&P Global Water Index, please refer to the index methodology and our recently published paper, Investing in Water for a Sustainable Future.

1 “Integrating water stress into corporate bond credit analysis.” UNEP Finance Initiative, Natural Capital Declaration (NCD), Deutsche Gesellschaft für Internationale Zusammenarbeitand (GIZ), and German Association for Environmental Management and Sustainability in Financial Institutions (VfU), 2015, https://www.unepfi.org/publications/ecosystems-publications/integrating-water-stress-into-corporate-bond-credit-analysis/.

2 “The United Nations World Development Report 2015: Water for a Sustainable World.” UNESDOC Digital Library, United Nations Educational, Scientific and Cultural Corporation, 2015, http://unesdoc.unesco.org/images/0023/002318/231823E.pdf.

3 “Water” represents the S&P Global Water Index, “Natural Resources” represents the S&P Global Natural Resources Index, “Global Equities” represents the S&P Global BMI, “U.S. Equities” represents the S&P 500®, “International Equities” represents the S&P Developed Ex-U.S. BMI, “Emerging Market Equities” represents the S&P Emerging BMI, “Small-Cap Equities” represents the S&P Global SmallCap, “U.S. Bonds” represents the S&P U.S. Aggregate Bond Index, “U.S. High Yield Bonds” represents the S&P U.S. High Yield Corporate Bond Index, “Gold” represents the S&P GSCI Gold, and “Real Estate” represents the Dow Jones Global Select Real Estate Securities Index.

Originally published by Indexology Blog, 10/15/20

The posts on this blog are opinions, not advice. Please read our Disclaimers.