The U.K. was one of the first countries to pass legislation regarding emissions and carbon goals in 2008. Now the country is struggling as more U.K. power companies continue to go under with rising natural gas prices in an ill-equipped system to handle the transition, reports The Wall Street Journal.

Power prices and natural gas in Europe have skyrocketed recently at a time when they should be at seasonal lows, hitting fresh highs on Tuesday as the beleaguered U.K. power suppliers continue to crumble under the mismatch of customer price caps against increasing supply prices. As of the end of last week, a total of nine power companies had gone under in the U.K., with the potential for further bankruptcies looming if the winter is even remotely harsh.

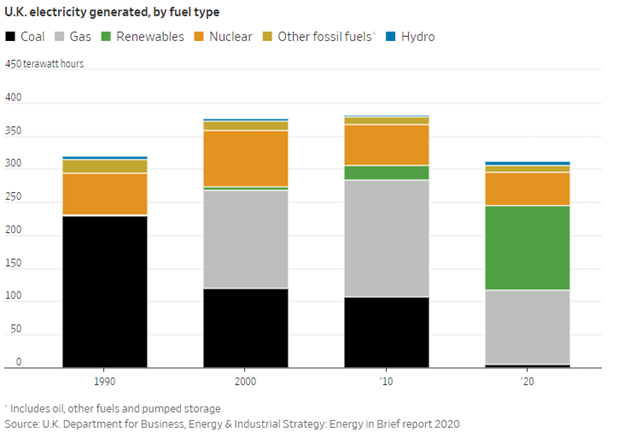

Britain’s struggle in converting to lower emission options is two-fold; when the country pledged to decarbonize, instead of overhauling the power grid, it instead chose to piecemeal around the edges; the market structure and existing regulations need to be overhauled to allow for flexibility that can cope with stressors to the system, such as rising natural gas prices.

The existing power grid is geared towards large, centralized power sources, such as fossil-fuel plants, but in a low-carbon power-driven grid, the power sources would be smaller and spread apart, incorporating things such as wind, solar, and hydropower. This requires a smart grid that can balance inputs and demand from multiple sources.

With power supply struggles came rising prices, and in 2016 it was estimated that U.K. citizens paid $1.9 billion more annually than they should have. To attempt to lever the prices, regulations were enacted to bring new suppliers into the market, but with intense competition and most people staying with their original power company, prices continued to rise, causing a cap to be enacted in 2019 on how much per energy unit a consumer could be charged. It has created a crunch as companies are caught between fixed customer prices and rising supply prices.

Source: The Wall Street Journal ‘How Not to Do an Energy Transition’

“It’s a bit of a mixed market, rather than anything that might be called a fully liberalized market at the moment,” says Malcolm Keay, a researcher at the Oxford Institute for Energy Studies.

To even out the market, flexibility and a willingness to rely on neighboring power markets, customers voluntarily cutting back on usage during peak periods, and creating backup power plants and energy storage for any missing gaps from renewable energy sources are necessary.

SPDR Invests in Clean Energy

For investors looking to invest in inherently ESG companies, one such option is a pure-play based on the clean energy sector that has continued growth opportunities as companies seek to find more environmentally efficient ways to reduce carbon emissions and run their businesses.

The SPDR S&P Kensho Clean Power ETF (CNRG) invests in clean energy and tracks the performance of the S&P Kensho Clean Power Index.

This benchmark combines artificial intelligence with a quantitative weighting methodology to invest in global stocks that drive innovation in the clean energy sector concerning both products and services. This includes firms manufacturing technology used for renewable energy and companies that have services and products related to the generation and transmission of renewable energy and supply chain companies.

CNRG allocates 17.94% of its portfolio to electrical components & equipment companies, 15.41% to electric utilities, 14.19% to semiconductors companies, and 10.62% to renewable electricity firms.

CNRG has an expense ratio of 0.45% and an AUM of $347 million.

For more news, information, and strategy, visit the ESG Channel.