By Jaspreet Duhra, Senior Director, Head of EMEA ESG Indices, S&P Dow Jones Indices

“Today, the Trump Administration officially left the Paris Climate Agreement. And in exactly 77 days, a Biden Administration will rejoin it.” –Joe Biden, Nov. 4, 2020. [1]

In a crowded field for “standout tweets from a U.S. president or president-elect,” for those of us who have dedicated careers to tackling sustainability challenges, this may be the most memorable tweet of them all.

Now, of course, we don’t want to be too premature in our celebrations. There are still several months until the inauguration of President-Elect Joe Biden and there are practical hurdles that need to be cleared. However, initial signs are promising, with the Biden transition team announcing John Kerry as special envoy on the climate crisis, a position that for the first time will include a seat on the National Security Council.[2]

What is the Paris Agreement and why does it matter so much that the U.S. rejoins? The Paris Agreement “sets out a global framework to avoid dangerous climate change by limiting global warming to well below 2°C and pursuing efforts to limit it to 1.5°C,[3]” as recommended by the Intergovernmental Panel on Climate Change (IPCC).

The U.S. is the world’s largest economy and is currently the second-largest emitter of greenhouse gases.[4] According to Climate Action Tracker, the U.S. pledge for net zero emissions by 2050, along with similar commitments from China, EU, Japan, and South Korea, means a tipping point is being approached that puts the goal of limiting warming to 1.5°C within reach.[5]

However, this is no reason for complacency. Alignment with the 1.5°C goal is not a commitment just for governments. The achievement of such an ambitious goal arguably requires participation from all stakeholders, including investors. Climate change ranks as the “highest priority ESG issue facing investors,” according to the Principles for Responsible Investment (PRI).[6] Investment portfolios and products may be exposed to climate risks as follows:

- Transitional risks of climate change (e.g., stranded assets, rising carbon prices, etc.); and

- Physical risks of climate change (e.g., sea level rise, hurricanes, etc.)

But it isn’t just climate change risks that investment product providers should consider; there are also opportunities available to potentially finance the transition to a lower-carbon economy.

What are the practical tools available to investment product providers who want to manage the risks and opportunities and align their investment products with the Paris Agreement?

At S&P DJI, we have created two benchmarks that align with the 1.5°C scenario: the S&P Paris-Aligned Climate Indices and the S&P Climate Transition Indices, together known as the S&P PACTTM Indices (S&P Paris-Aligned & Climate Transition Indices). The S&P PACT Indices offer an information tool for investment product providers looking to address a number of climate objectives while still staying as close as possible to the underlying benchmark index.

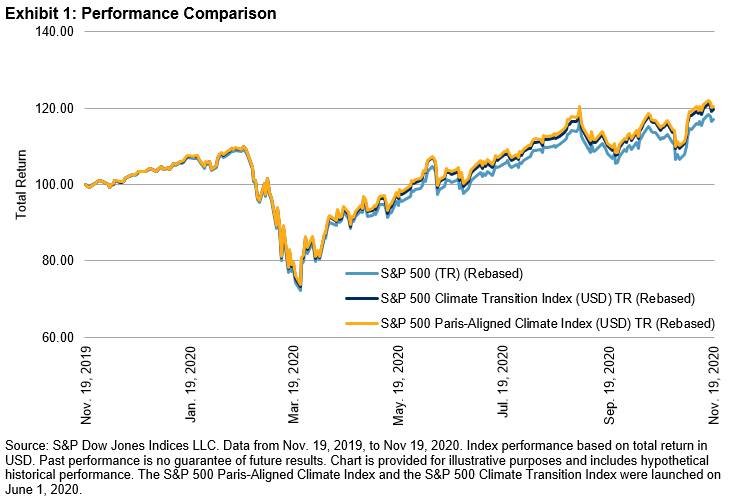

The S&P Paris-Aligned Climate Indices set stricter relative decarbonization objectives of the two benchmarks and include a range of fossil fuel exclusions. The S&P Climate Transition Indices still incorporate significant relative decarbonization objectives but are designed for broader exposure. Crucially, both sets of indices decarbonize at an absolute rate of 7% year-over-year, in line with, or beyond, the decarbonization trajectory from the IPCC’s 1.5°C scenario. From a U.S. equities perspective, the S&P 500® Paris-Aligned Climate Index and the S&P 500 Climate Transition Index both outperformed the broad U.S. benchmark over a period of one year.

There are of course great challenges ahead. President-Elect Biden now has to consensus build and implement strategies to meet ambitious climate targets. We have already seen major investors taking the lead in aligning their investments to the 1.5°C scenario. Benchmarks such as the S&P PACT Indices are designed to make this vital transition much more feasible.

There are of course great challenges ahead. President-Elect Biden now has to consensus build and implement strategies to meet ambitious climate targets. We have already seen major investors taking the lead in aligning their investments to the 1.5°C scenario. Benchmarks such as the S&P PACT Indices are designed to make this vital transition much more feasible.

Originally published by Indexology, 12/4/20

1 https://twitter.com/JoeBiden/status/1324158992877154310

2 https://www.theguardian.com/us-news/2020/nov/23/john-kerry-biden-climate-envoy-appointment

3 https://ec.europa.eu/clima/policies/international/negotiations/paris_en

4 https://www.theguardian.com/us-news/2020/nov/08/joe-biden-paris-climate-goals-0-1c

6 https://www.unpri.org/climate-change. The PRI is a UN-supported international network of investors working together to implement its six aspirational principles.

The posts on this blog are opinions, not advice. Please read our Disclaimers.