It’s an interesting time for investors as markets digest historic inflation, a hawkish Fed, and rising interest rates on top of the economic pressures of the ongoing pandemic. Leaders from State Street Global Advisors, Astoria Portfolio Advisors, and Citadel Securities discussed their general outlooks for 2022 and investing strategies and ideas for the year in a webcast hosted by Dave Nadig, CIO and director of research for ETF Trends and ETF Database.

Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors, opens the discussion by reviewing trends in 2021 and examining how those have changed already in these first days of 2022. The release of the Fed minutes has spooked equity markets, Bartolini explains, and stocks and bonds have both fallen simultaneously.

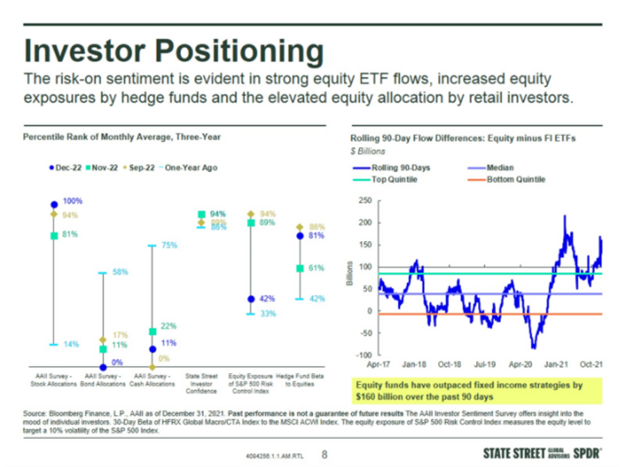

“The volatility environment has started to become a little bit more elevated than it was… one or two months ago,” Bartolini explains further. “What is interesting though is that the buying behavior… really didn’t reflect the elevated volatility from that perspective.”

Image source: SSGA

Markets are currently seeing an influx of money into equity ETFs, while bond ETFs have seen outflows, particularly in government bonds and high-yield funds. Bank loan ETFs have remained positive for the fourteenth consecutive month, and Bartolini anticipates that this trend will continue because these loans generally have lower downside deviation, drawdowns, and lower volatility compared to fixed rate high-yield funds.

According to SSGA, areas of valuation opportunity within equities for investors going forward include small-caps within the S&P Small Cap 600 Index, as well as the financials, energy, and real estate sectors based on their valuations, momentum, and earnings sentiment.

Within bonds, SSGA anticipates that the yield curve will flatten over the course of the year, with periods of steepening driven by economic data, but remaining bearish overall.

“I think there’s enough support where we’re not going to have a bear market. I think we might see an elevated volatility environment,” Bartolini says.

A Look Ahead

Cory Laing, head of institutional equity and ETF sales at Citadel Securities, discusses ETF trends in 2021 and highlights the growth of the retail investor, with net inflows into single stocks last year of over $47 billion. While retail investors are a trend for the short term, ETFs ultimately are the long-term drivers, with over $470 billion of flows in 2021.

For 2022, Laing believes that emerging markets are under-owned, and it’s an area that Citadel Securities is watching, as are changes in fixed income portfolios with rising interest rates and Fed tightening, and more advisor strategy changes. As a firm, Laing explains that Citadel is seeing changes in the approach of investors that started in November of last year.

It’s a “shift from clients searching for returns and better risk-adjusted returns. One of the things that we were watching for was whether we were going to see a shift towards minimum volatility products, a shift towards quality as a factor products, where clients were looking for companies that maybe had a little bit safer income stream and balance sheets,” Laing says.

These changes are being seen now in current market environments as investors move to more conservative areas and strategies.

2022 Themes and Investing for Inflation

John Davi, CEO and CIO of Astoria Portfolio Advisors, closes out discussing the themes that Astoria sees for investing in 2022. These themes are: inflation, dividend income, real estate, MLPs, blockchain, homebuilders, defensive equity, overwriting, fixed income alternatives, and international equities.

Davi explains that inflation isn’t something that just turns on and off, but instead typically takes years to play out its full cycle. The solution Davi sees for investors is to create a barbell portfolio that contains ETFs such as the AXS Astoria Inflation Sensitive ETF (PPI), the Health Care Select Sector SPDR Fund (XLV), and the SPDR Blackstone Senior Loan ETF (SRLN), among others.

David Clark, president and head of business development for Astoria Portfolio Advisors, discusses that the biggest risk for advisors currently is continuing to weight towards growth and funds that avoided value and cyclicals. These funds performed well in previous market conditions, but with tax liabilities shifting, advisors need to reconsider their allocations.

Previously, advisors only had a singular way to hedge against inflation risk, but the AXS Astoria Inflation Sensitive ETF (PPI) offers a one-stop solution to mitigating risk through cyclical stocks, commodities, and TIPs all in one fund.

“We think that it’s appropriate to hedge your risk because that 60/40 portfolio, it just has too much exposure towards growth stocks and also traditional interest rate products which are going to suffer if rates continue to go up,” Davi says.

Financial advisors who are interested in learning more about investment ideas for 2022 can find the webcast here.

For more news, information, and strategy, visit the ESG Channel.