Does the evidence suggest that Ben is right? Is the only way to achieve alpha to have access to information that others don’t have?

I think he partially is, but he misses one major exception. To understand what that exception is, I think it is important to take a step back and understand the major sources of edge in investing.

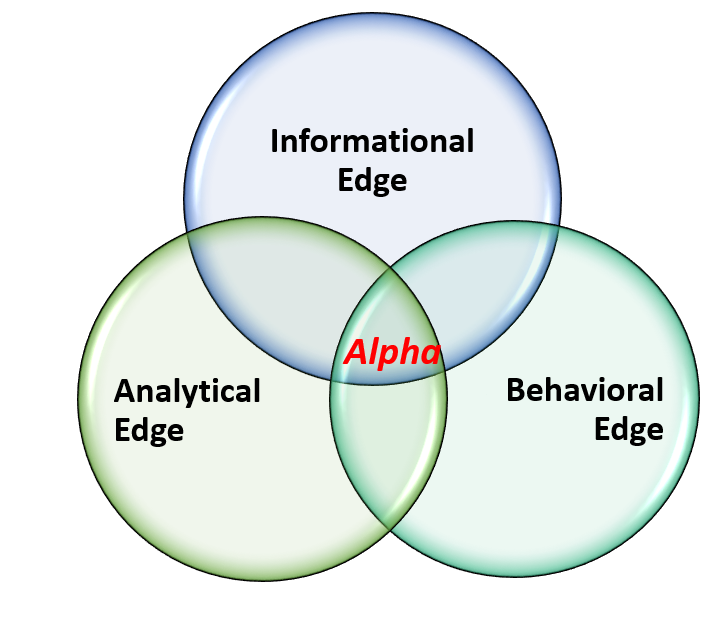

If I want to gain an edge in investing, there are three main ways I can do it:

- I Can Have Information Others Don’t

This is the edge Ben is referencing in his Tweet and is commonly referred to as an informational edge. This type of edge still exists, but it is extremely rare. In a world where information flows very freely and where regulation FD forces companies to disseminate information to everyone equally, an informational edge is very difficult to find. Even newer datasets like credit card data, satellite data etc will quickly be used by large numbers of investors if they can be used to achieve alpha, which will make that alpha go away.

- I Can Analyze the Information Better or Differently

Another potential source of an edge is the ability to analyze the information you have better than other investors. O’Shaughnessy Asset Management described this idea in the context of factors in their paper Alpha Within Factors. The point they made in the paper is that investing using standard factors is settled territory at this point. You can easily get beta exposure to something like value or quality through inexpensive ETFs (issuers like Vanguard offer standard factor exposure for fees around 10bps). A manager who uses factors needs to add value by producing alpha beyond the standard returns of the factor itself.

With many smart people and many high-powered computers analyzing the data, this is certainly not easy to do, but I do think it is possible, and the evidence shows that some firms and strategies have proven that it can be done over long periods of time. If alpha isn’t possible to obtain, you would expect that the best managers and models would not be able to outperform the returns of the factors they follow. But I think the evidence suggests that a select group have done that over time.

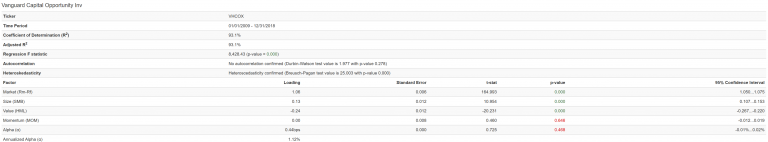

Here is one example. The Vanguard Capital Opportunity Fund (which is managed by PrimeCap) has one of the best long-term records in the mutual fund space. It is also a good example of a fund whose strategy tries to capitalize on an analytical edge. When you break down the fund’s long-term record using factors, you see significant alpha. I used Portfolio Visualizer to do that and these are the results.

Click here for larger, high quality image of table below.

The results can look a little intimidating if you don’t understand regression, but to simplify it, what this is looking at is how much of the return of this fund cannot be explained by the standard risk factors (value, momentum, size and beta). What is left after the portion of the return attributable to those factors is alpha. That is the value added by the manager. As you can see, alpha is 3.47% per year, which is excellent. You won’t find many funds with that kind of alpha.

But now let’s look at the same fund and look at the past decade. Click here for larger, high quality image of table below.

The alpha is still there, but it is now down to 1.12%. This is exactly what you would expect based on what we talked about above. There is still alpha, but as the game gets more difficult, it is reduced. This is an example of a fund that is still utilizing an analytical edge to produce alpha (they do not have non-public information).

Just to be clear, this fund is the exception rather than the rule. The vast majority of funds would show negative alpha over this period. But we aren’t debating whether producing alpha without non-public information is very hard. I would completely agree with that. We are debating whether it is possible. Although developing an analytical edge is clearly difficult and getting harder over time, I think it is still possible to use an analytical edge to produce alpha.

- I Can Be Better at Managing my Behavior

The third way to achieve an edge in investing is with your own behavior. If you can stay the course during periods of losses or underperformance when others can’t, that can certainly boost your returns relative to most investors. This is often referred to as the last edge left in investing )since the previous two are so difficult to capitalize on) and some have coined the term “Behavioral Alpha” to describe it. But it is important to understand that behavior isn’t alpha. Behavior does, however, allow you to realize the alpha and beta generated by an investment strategy. For example, the ability to stick with a strategy regardless of its volatility and tracking error would allow you to utilize a more focused value strategy, which would result in more exposure to the value factor, and likely a higher return. But it wouldn’t on its own allow you to outperform the value factor itself. Behavior can be an edge and it can help you achieve alpha using the other edges, but it isn’t alpha.

Visualizing Alpha

Does This All Matter?

Many of us in the investing business tend to get bogged down in arguing over semantics. If you beat the market over your 30-year investment lifetime and achieve your retirement goals, are you really going to care whether that was the result of alpha or beta? I don’t think so. So I am not sure that this argument matters all that much for your average investor. The most important message I think any investor can take from Ben’s tweet is that the market is really hard to beat, regardless of whether you are judging yourself based on outperformance or alpha. If you are going to attempt to do it, you better have a high level of conviction in your edge and the ability to stick with your investment process through very rough periods. If you can do that, I think alpha is still possible, even if you don’t have non-public information.

For more market trends, visit ETF Trends.