Given the latest trade talk debacle, it might seem that investors are putting international market plays under the “things to avoid” list in addition to the plague. However, diversification overseas is still a necessary component for a balanced portfolio and investors can look for this exposure via the Vanguard Total International Stock Index Fund ETF Shares (NasdaqGM: VXUS).

U.S. President Donald Trump lobbed a grenade at the capital markets more tariffs on China after ongoing media news hinted that a deal was close to getting done. The initial tariff rate was pegged at 10 percent before the Trump administration upped them to 25 percent.

Much of the strength in U.S. equities has come as a result of a trade deal getting priced in, but this latest move in addition to a subsequent China retaliation triggered a volatile May replete with sell-offs.

Nonetheless, a fund like VXUS can still give investors the much-needed overseas exposure. Like sports, it can also be easy to cheer for the home team when it comes to making investments.

However, as the U.S. capital markets make their way out of the late cycle, it can be opportunities overseas that can be more attractive alternatives.

VXUS fund characteristics:

- Seeks to track the performance of the FTSE Global All Cap ex US Index, which measures the investment return of stocks issued by companies located outside the United States.

- Broad exposure across developed and emerging non-U.S. equity markets

- Follows a passively managed, index replication approach.

Strength overseas could be challenged by the strong labor market in the U.S. The U.S. created 263,000 new jobs in April, which fed into a generational-low unemployment rate–the lowest in 49 years.

That increase in new jobs bested the 213,000 forecast of economists surveyed by MarketWatch.

“The bottom line is effectively unchanged,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors. “Job creation remains solid, and should provide continued support for consumer spending sufficient to keep the economy on a solid growth path.

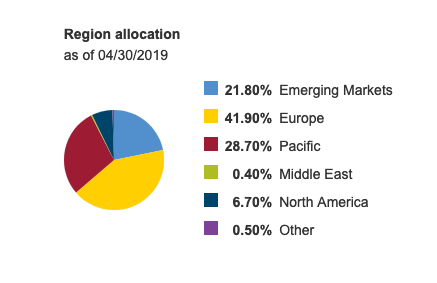

Nonetheless, investors can still use international exposure to complement their portfolios. VXUS delves into a well-balanced mix of international developed and emerging markets–both were seeing strength to begin 2019 before May’s bout of volatility.

VXUS is up 13.32 percent year-to-date. Furthermore, the fund features an ultra-low 0.09 percent expense ratio–down from its previous 0.11 percent.

Just recently, Vanguard decided to cut fees on 21 of its ultra low-cost ETF funds. This includes eight of its ten biggest ETFs.

For more market trends, visit ETF Trends.