By Steve Laipply, U.S. Head of iShares Fixed Income ETFs, iShares

Key takeaways

- A surge of investor demand drove the U.S. bond ETF assets under management over $1 trillion in assets

- Flow trends in 2020 show how bond ETFs can offer benefits to many types of investors in various market conditions

- iShares, the world’s most comprehensive bond ETF platform, with unmatched breadth and deep liquidity, recorded numerous asset-gathering milestones this year

U.S. bond exchange traded funds (ETFs) this month eclipsed $1 trillion in assets under management, a testament to their versatility for market participants in various market conditions.[1]

This growth milestone is the result of many types of investors finding traditional and novel uses for bond ETFs: individual investors using bond ETFs to help seek income, active managers using them as tools in portfolio strategies designed to beat their benchmarks, and institutions such as insurance companies and pension funds using them for purposes such as liquidity and risk management. In a demonstration of growing awareness of their value, U.S bond ETFs have pulled in $168 billion in 2020, on pace for a record one-year inflow.[2]

A record-breaking 2020 for U.S. bond ETFs comes after global bond ETF assets under management topped $1 trillion a year ago. Now at $1.4 trillion, bond ETFs are one of the fast-growing categories in asset management.[3]

Bond ETFs have made it simpler for individuals and institutions to access global fixed income markets since iShares pioneered the first U.S. bond ETFs in 2002.[4] Like all innovations, bond ETFs streamlined what was previously a cumbersome process by making it convenient to buy and sell bundles of bonds in real-time. Wider adoption of bond ETFs drives more trading activity, which can help decrease transaction costs and increase pricing transparency for investors. This flywheel effect helps explain why more investors are relying on bond ETFs in a variety of market conditions. Furthermore, bond ETFs represent a leap forward for fixed income markets because they help drive efficient pricing and trading of individual bonds.[5]

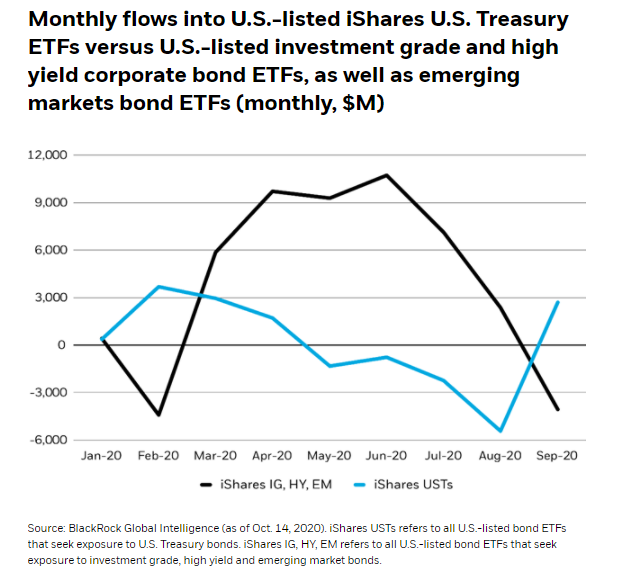

A look at flow trends during the roller-coaster market environment in 2020 underscores the benefits of bond ETFs and highlights the different potential uses for the iShares bond ETF platform.

iShares bond ETFs for various market conditions

At the start of 2020, financial market participants focused on tit-for-tat trade policies, the potential for a modest economic slowdown, and the strength of the longest-ever bull market for U.S. stocks.

The narrative changed rapidly as the COVID-19 pandemic triggered extreme market volatility in February and March. Amid market turmoil, investors increasingly turned to bond ETFs for clarity on what was happening in fixed income markets and to adjust their portfolios accordingly. Over that period, the iShares 7-10 Year Treasury Bond ETF (IEF), among the industry’s first bond ETFs, surpassed $20 billion in assets under management.[6]

A rebound in riskier asset prices followed quickly after a coordinated policy response to help stabilize financial markets. Once again, investors turned to bond ETFs to help reposition portfolios in response to evolving economic conditions. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) surpassed $50 billion in assets under management in June, and the iShares Core U.S. Aggregate Bond ETF (AGG), which provides exposure to thousands of U.S. investment-grade fixed income securities, crossed $80 billion in July.[7]

Investors sought new ways to help boost income in portfolios after major central banks anchored policy rates near zero or below. In August, U.S.-listed suite of iShares iBonds® ETFs collectively surpassed $10 billion in assets under management.[8] These funds hold a diversified portfolio of bonds with similar maturity dates, and for a decade they have helped income-seeking investors build bond “ladders.”

September brought renewed market volatility ahead of the U.S. presidential election. Amid increased uncertainty, some fixed income investors found opportunities to allocate to sustainable bond strategies. The iShares ESG Aware US Aggregate Bond ETF (EAGG) crossed $500 million, and the iShares Global Green Bond ETF (BGRN) crossed $100 million in assets under management.[9]

Summing it up

Now with a U.S. marketplace at $1 trillion, bond ETFs are a blockbuster innovation that offers potential benefits to many investors. Up-and-down market conditions throughout 2020 have provided a demonstration of their utility. Even so, at $1 trillion, U.S. bond ETFs represent just 2% of the total U.S. bond market and we believe they are poised for rapid growth over the next few years.[10]

Looking ahead, iShares — the world’s largest bond ETF platform — can help investors who are focused on U.S. elections and the potential for post-COVID economic recovery navigate market conditions and seek resilience, income and liquidity to their portfolios.

Related iShares Funds

- iShares 7-10 Year Treasury Bond ETF (IEF)

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- iShares Global Green Bond ETF (BGRN)

- iShares Core U.S. Aggregate Bond ETF (AGG)

- iShares ESG Aware U.S. Aggregate Bond ETF (EAGG)

Originally published by iShares, 10/16/20

© 2020 BlackRock, Inc. All rights reserved.

1 BlackRock, Bloomberg (as of Oct. 14, 2020). U.S.-listed bond ETF assets under management reached $1 trillion on Oct. 2, 2020, up from $793 billion in assets in October 2019.

2 BlackRock, Bloomberg (as of Oct. 14, 2020).

3 BlackRock, Bloomberg (as of Oct. 14, 2020); Global bond ETF assets were $1.4 trillion as of Oct. 14, 2020.

4 BlackRock. The Canada-listed iShares Canadian Universe Bond Index ETF launched in November 2000; the iShares 1-3 Year Treasury Bond Fund (SHY), iShares 7-10 Year Treasury Bond Fund (IEF), iShares 20+ Year Treasury Bond Fund (TLT) and the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) launched in July 2002.

5 BlackRock, “The modernization of the bond market,” 2019.

6 BlackRock, Bloomberg (as of Oct. 14, 2020).

7 BlackRock, Bloomberg (as of Oct. 14, 2020).

8 BlackRock, Bloomberg (as of Oct. 14, 2020).

9 BlackRock, Bloomberg (as of Oct. 14, 2020).

10 Markit, BlackRock (as of June 30, 2020).

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

A fund’s environmental, social and governance (“ESG”) investment strategy limits the types and number of investment opportunities available to the fund and, as a result, the fund may underperform other funds that do not have an ESG focus. A fund’s ESG investment strategy may result in the fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. In addition, companies selected by the index provider may not exhibit positive or favorable ESG characteristics.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

Shares of ETFs trade at market price, which may be greater or less than net asset value. The iShares® iBonds® ETFs (“Funds”) will terminate within the month and year in each Fund’s name. An investment in the Fund(s) is not guaranteed, and an investor may experience losses and/or tax consequences, including near or at the termination date. In the final months of each Fund’s operation, its portfolio will transition to cash and cash-like instruments. As a result, its yield will tend to move toward prevailing money market rates, and may be lower than the yields of the bonds previously held by the Fund and lower than prevailing yields in the bond market.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial advisors for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Barclays, Bloomberg Finance L.P., BlackRock Index Services, LLC, Cohen & Steers Capital Management, Inc., European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Services, LLC, India Index Services & Products Limited, JPMorgan Chase & Co., Japan Exchange Group, MSCI Inc., Markit Indices Limited, Morningstar, Inc., The NASDAQ OMX Group, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), New York Stock Exchange, Inc., Russell or S&P Dow Jones Indices LLC. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE nor NAREIT makes any warranty regarding the FTSE NAREIT Equity REITS Index, FTSE NAREIT All Residential Capped Index or FTSE NAREIT All Mortgage Capped Index; all rights vest in NAREIT. Neither FTSE nor NAREIT makes any warranty regarding the FTSE EPRA/NAREIT Developed Real Estate ex-U.S. Index, FTSE EPRA/NAREIT Developed Europe Index or FTSE EPRA/NAREIT Global REIT Index; all rights vest in FTSE, NAREIT and EPRA.“FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2020 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are registered and unregistered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

ICRMH1120U-1390098