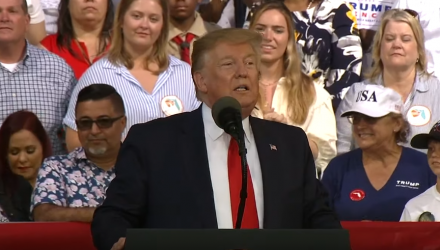

Regarding the latest breakdown in trade deal negotiations with China, U.S. President Donald Trump said the latest tariff threats were a necessity given that China “broke the deal.” President Trump’s latest comments came while speaking at a rally in Florida.

“By the way, you see the tariffs we’re doing? Because they broke the deal. They broke the deal,” Trump said. “So they’re flying in, the vice premier tomorrow is flying in — good man — but they broke the deal. They can’t do that, so they’ll be paying.”

Trump also said hat the United States “won’t back down until China stops cheating our workers and stealing our jobs.”

“That’s what’s going to happen. Otherwise, we don’t have to do business with them,” he added. “We can make the product right here if we have to — like we used to.”

The reason for the China pullback & attempted renegotiation of the Trade Deal is the sincere HOPE that they will be able to “negotiate” with Joe Biden or one of the very weak Democrats, and thereby continue to ripoff the United States (($500 Billion a year)) for years to come….

— Donald J. Trump (@realDonaldTrump) May 8, 2019

China responded to the latest tariff threats by U.S. President Donald Trump by promising to take “necessary countermeasures” if the Trump administration follows through on its threat to increase tariffs on Chinese goods this Friday.

China’s Commerce Ministry said on Wednesday that it will make retaliatory moves if U.S. tariffs on $200 billion of Chinese goods are increased to 25% from 10% as promised by the Trump administration.

“The escalation of trade friction is not in the interests of the people of the two countries and the people of the world,” the ministry said. “The Chinese side deeply regrets that if the US tariff measures are implemented, China will have to take necessary countermeasures.”

In the meantime, investors can take advantage of the latest dip in Chinese equities as a buying opportunity for China-focused exchange-traded funds (ETFs).

One ETF to consider is the Xtrackers Harvest CSI 300 China A ETF (NYSEArca: ASHR) as a way for investors to gain exposure to China’s biggest, best and most authentic equities via the country’s A-shares. ASHR seeks investment results that track the CSI 300 Index that is designed to reflect the price fluctuation and performance of the China A-Share market.

In essence, ASHR is composed of the 300 largest and most liquid stocks in the China A-Share market, including small-cap, mid-cap, and large-cap stocks. Without a majority of its holdings in state-owned enterprises compared to other ETFs, ASHR provides a more diversified representation of gaining access to the world’s second largest economy.

For more market trends, visit ETF Trends.