Uncertainty and skepticism are a cause of sickness in the tried-and-true health care sector, which has been the worst performer in the S&P 500 in 2019–up a paltry 3.8 percent compared to the broader index’s 16 percent. Can the typically-reliable health care eventually cure itself?

Putting the sector under the microscope reveals two trends–middling performance for conventional health care, but astounding gains for biotechnology. The biotech space has been fueled by a spate of mergers as of late, including Bristol-Myers Squibb offering $74 billion to take over Celgene–a deal that could allow Bristol to become a top five pharmaceutical giant. In addition, Eli Lilly offered $8 billion to purchase Loxo Oncology.

“It’s kind of been a tale of two cities–biotech and conventional health care,” said ETF Trends CEO Tom Lydon. “Conventional health care year-to-date–mid single digits. Biotech–some up almost 20 percent year-to-date still after the big correction last year.”

One ETF to take advantage of the latter is the iShares Nasdaq Biotechnology ETF (NasdaqGM: IBB). IBB seeks to track the investment results of the NASDAQ Biotechnology Index, which contains securities of companies listed on NASDAQ that are classified according to the Industry Classification Benchmark as either biotechnology or pharmaceuticals and that also meet other eligibility criteria determined by Nasdaq, Inc.

A Giant Headache Coming for Health care ETFs?

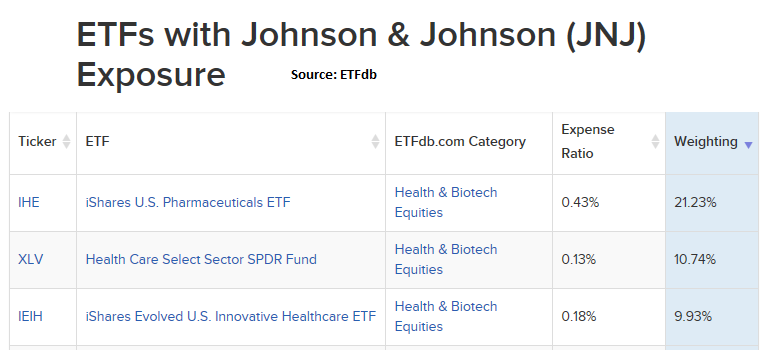

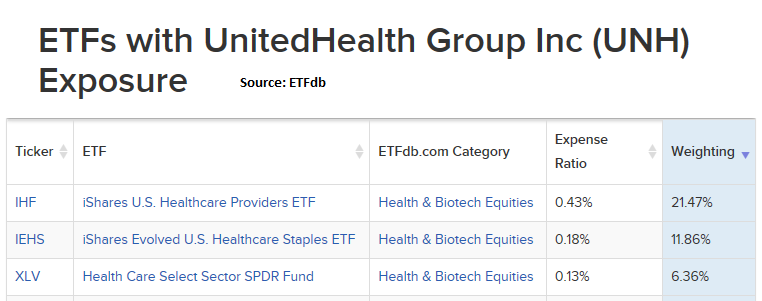

One vital sign for investors’ taste of health care ETFs will be the release of first-quarter earnings from Johnson and Johnson (JNJ) as well as UnitedHealth Group (UNH)–two giants in not only their industries, but with respect to weightings in the largest health-related ETFs.

The same can be said for UnitedHealth Group.

The same can be said for UnitedHealth Group.

While health care has been relatively unloved by investors as of late, the sector doesn’t reveal weakness in terms of hiring. The Labor Department recently reported better-than-expected payrolls to bring the three-month average to a strong 180,000 jobs created per month–that number is lower than the 223,000 jobs created in 2018, but falls in line with a robust labor market.

Of the 196,000 jobs created, over 35 percent came from the education and health services sector. Specifically, strong hiring came from ambulatory care, hospitals, and nursing and residential care facilities.

“If you look at the trends–Q4 of last year, we saw big declines the stock market, but health care buoyed because of their value,” said Lydon. “Value is a little out of favor today so that’s another reason why the big health care stocks aren’t doing as well.”

Uncertainty Remains as Governmental Regulation Looms

Big pharmaceutical companies were on the hot seat at Capitol Hill last week with CVS Health, Cigna, Prime Therapeutics, Humana, and UnitedHealthcare’s OptumRx testifying before the Senate Finance Committee on the rising cost of prescription drugs. Among the topics discussed included rebates paid by drug makers contributing to the high costs and the drug industry’s pursuit of profits–all to shift the blame from the pharmaceutical companies to the drug makers.

U.S. President Donald Trump has already lambasted the pharmaceutical industry for the rising costs associated with prescription drugs. In 2017, health spending rose 3.9 percent and the trends is likely to persist.

For more market trends, visit ETF Trends.