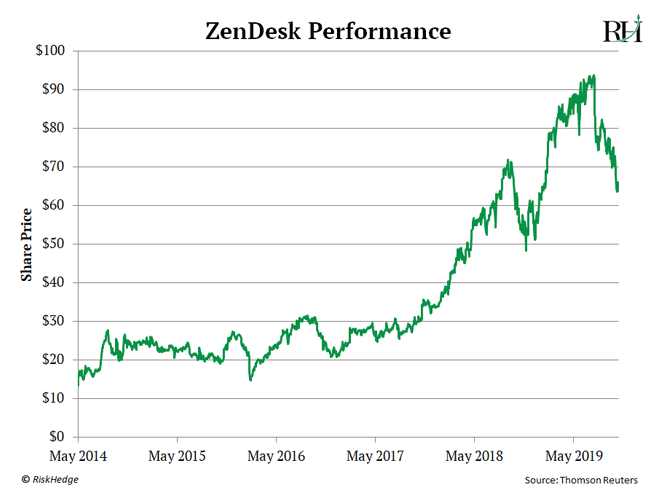

ZenDesk (ZEN) helps companies work better with their customers. It jumped 758% after going public in 2014…

There are plenty of others…

Paycom Software (PAYC) skyrocketed 1,595% in under three years. Twilio (TWLO) soared 538% after going public in 2016. ServiceNow (NOW) rallied 1,228% following its 2012 IPO. And Atlassian (TEAM) spiked 465% in under four years.

SaaS Companies Are Some of the Fastest-Growing Businesses Around

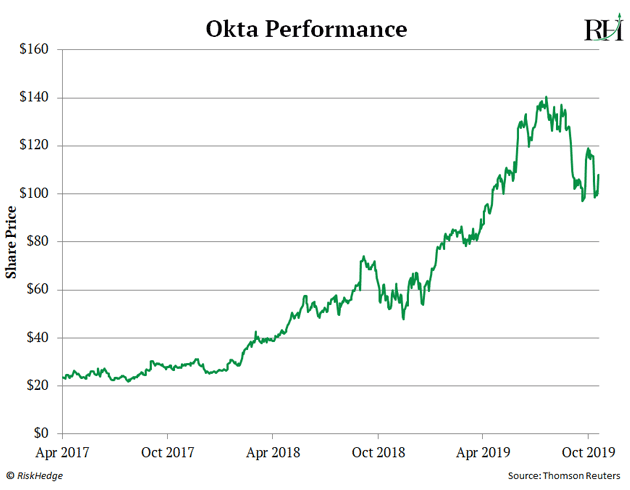

Alteryx’s sales are growing at a blistering 48% per year… Okta’s at 42% per year… and ZenDesk at 35% per year. For perspective, the S&P 500’s sales are growing at about 8% per year.

And let’s not forget about Salesforce. Its sales are still growing around 27% per year. That’s incredible for a giant $120 billion company that went public 15 years ago.

Why are SaaS companies growing at warp speed?

For one, customers love the pay-as-you-go model. They’re happy to avoid shelling out a ton of money on software upfront. And many CEOs are thrilled they no longer need to maintain a warehouse of servers…or hire a small army of highly paid computer engineers… or worry about constantly upgrading the software.

The SaaS provider takes care of all that overhead.

Investors Love the SaaS Model, Too

And not just because it supercharges growth.

Subscription revenue is recurring—which is the best kind of revenue. Subscription revenue is predictable, consistent, and comes in month after month.

Software is also what’s known as “scalable.” It’s not like selling cars where you have to pay for the material and labor to manufacture every car you sell. Once the software service is up and running, the incremental cost to serve a new customer is often dirt cheap.

Many SaaS companies enjoy sky-high gross profit margins above 70%.

If You Missed Out On These Incredible SaaS Stock Runs…

Don’t worry. There’s a new crop of cash-gushing SaaS companies getting ready to go public.

Like Salesforce, many of these companies won’t get nearly as much attention as companies like Uber (UBER) or Lyft (LYFT).

I get it… software is boring.

But these are exactly the sort of IPOs you should be buying into on the ground floor.

Here are two private SaaS to keep an eye on. Both should go public in the near future:

Snowflake Computing helps companies like Netflix, Square, and Adobe analyze their data. Like other SaaS companies, it’s growing at warp speed. Snowflake’s customer base has quadrupled over the past year, and its sales are growing about 30x faster than its peers.

In May, Snowflake brought in Frank Slootman as CEO. Slootman previously headed up ServiceNow, which—again—has surged 1,228% since it went public in 2012.

Databricks also helps companies make sense of their data… and business is booming. Its subscription revenue has tripled since last year.

Databricks is aiming to have its financials “IPO ready” before the end of the year, suggesting that an IPO is likely around the corner.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money”

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.