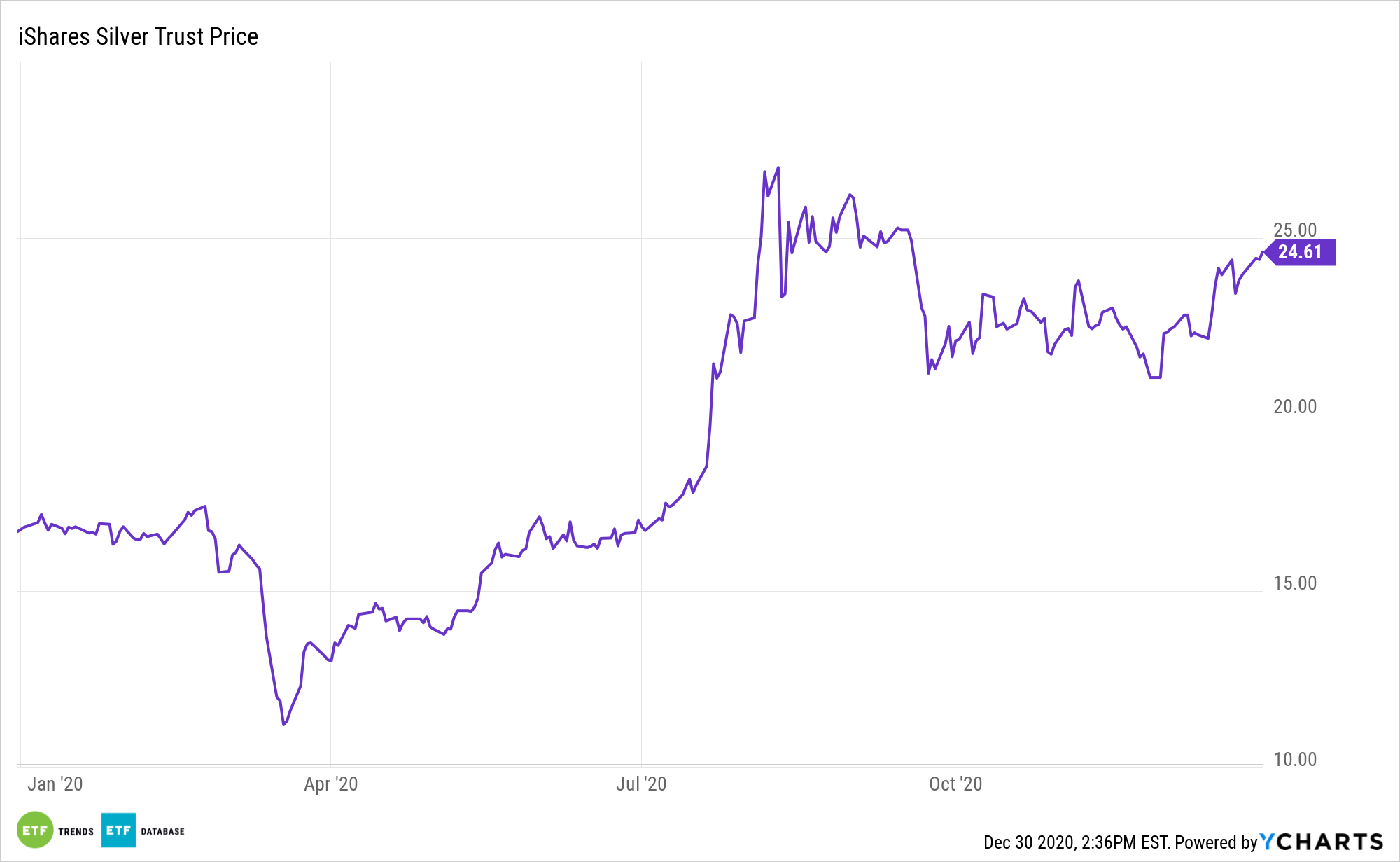

As the year comes to a close, precious metals and metals ETFs have take a well-deserved breather after a solid performance in 2020. Gold, silver and platinum continue to stay in uptrends, despite falling from their ultimate highs, but have been in consolidation for several months now.

One of the most promising metals of the group is silver, which is up 1.38% Wednesday, to trade at $26.58 an ounce.

With inflation likely a factor in the coming years, silver and gold are poised to benefit. Unlike paper currency and stocks, physical precious metals such as gold and silver are more insulated from inflation because they derive their value differently than paper currency. In addition, a combination of industrial demands for the metal and a preoccupation with safety could bolster silver, according to recent comments from analysts.

“Analysts see the white metal rising to $30 an ounce in the next year from the current $23.36, and even higher given the large-scale stimulus needed to revive economies. It would be a continuation of the trend this year, which has led to the surge in gold and silver prices as investors hunt for havens,” reports Liz Moyer for Barron’s.

“Citigroup analysts are even more bullish, with a $40 price target on silver over the next 12 months, driven by investor desire for safety as well as industrial demand once the recovery picks up. They see a return of the 2010-11 bull market in silver as demand rises 6% in China, from both industrial buyers and retail investors,” added Barron’s.

Are the Silver Bells Tolling?

Some analysts also see a technical advantage for silver.

“March silver futures bulls have the firm overall near-term technical advantage amid a four-week-old price uptrend in place on the daily bar chart. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the December high of $27.635 an ounce. The next downside price objective for the bears is closing prices below solid support at $25.00. First resistance is seen at this week’s high of $26.98 and then at $27.635. Next support is seen at today’s low of $26.26 and then at $26.00,” writes Jim Wyckoff for Kitco News.

For investors looking to allocate silver into their portfolios using ETFs, there are several options. The iShares Silver Trust (SLV) is a popular choice, and recently boasted $171.1 million dollars in inflows recently. Aberdeen also has quite a collection of metals ETFs, including those focused on silver. Aberdeen’s suite includes the Aberdeen Standard Gold ETF Trust (SGOL), which comes with a 0.17% expense ratio, and the Aberdeen Standard Physical Silver Shares ETF (SIVR), which has a 0.30% expense ratio. Additionally, the Aberdeen Standard Physical Precious Metals Basket Shares (NYSEArca: GLTR), which has a 0.60% expense ratio, offers a cornucopia of metals including gold, silver, platinum, and palladium.

For more news, information, and strategy, visit the Equity ETF Channel.