By Stephen McBride

What’s the greatest company in history?

You could make a strong case for shopping disruptor Amazon (AMZN). Its stock has handed early investors 100,000% gains and counting.

Some will point to phone disruptor Apple (AAPL). It invented the iPhone—the most successful product in history—and was the world’s first trillion-dollar company.

Oil giant ExxonMobil (XOM) has to be in the mix too. While its stock has “only” handed investors 15X their money, Exxon has dominated in energy for half a century.

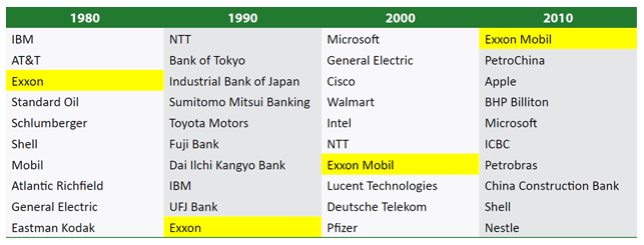

This Table Charts the World’s Largest Companies by Decade Since 1980

Keep in mind, this is a lineup of the best of the best. It’s a “who’s who” of business juggernauts. Yet of all these powerful companies, only Exxon managed to stay in the top 10 from 1980–2017.

In fact, although the table doesn’t go back this far, Exxon claimed a top-10 spot every decade all the way back to 1950! 57 years is a long time to stay on top…

But not even mighty Exxon can outrun disruption.

Today it’s nowhere to be found in the top 10. Exxon stock has dropped 35% since 2014. And you can’t blame its bad performance on the stock market. The S&P 500 is up 58% in that time.

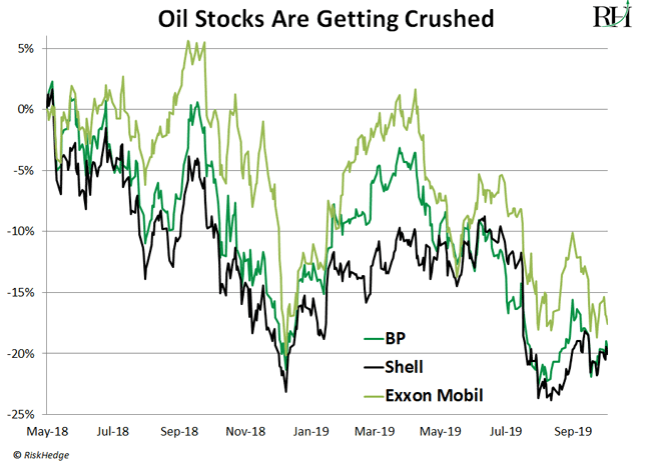

In fact, many formerly powerful “Big Oil” stocks are trading like they’re going out of business. Exxon, BP (BP), and Shell (RDS.A) have all plunged around 20% in the past year, as you can see here:

Energy Investors Have Had a Horrible Few Years

The Energy ETF (XLE) has sunk to levels last seen during the financial crisis. But one corner of the energy market is red hot.

Solar stocks have shot up 60% over the past year, as you can see from the performance of the solar ETF TAN:

It’s been a wild ride for solar stocks. Do you remember the Super Bowl-level hype around solar a couple of years ago?

Promoters claimed solar panels would soon power the whole country. Soon the sun would put the big oil giants out of business. That may well turn out to be true, but the claim was about 10 years too early.

In 2008, investors got carried away and plowed billions into clean energy stocks. The largest solar stock First Solar (FSLR) shot up 1,000% in less than two years. But solar wasn’t ready for prime time.

In 2009 it cost $360 to produce a megawatt-hour of electricity using solar. Compare that to less than $70 for natural gas. The sky-high cost of solar power meant it was not going to power America any time soon.