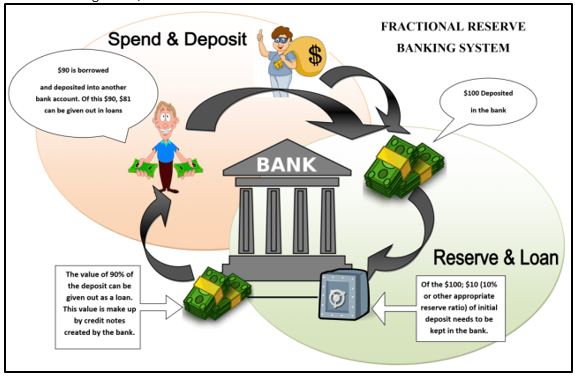

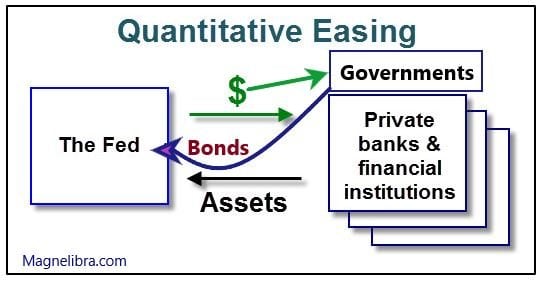

Here is how QE works plain and simple and you can see who actually gets the benefit:

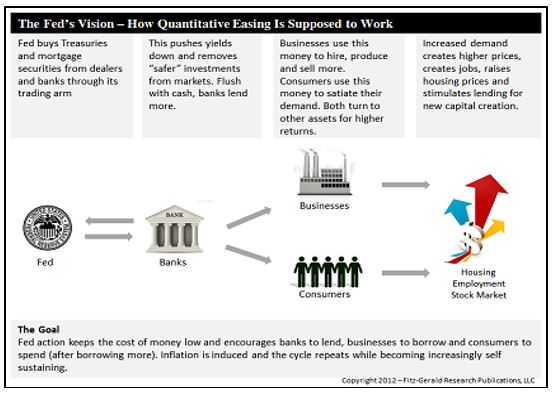

Now here is how the FED envisions and sells it to the commoner:

Notice the “Goal” at the bottom of the graphic, “Fed action keeps the cost of money low and encourages banks to lend, (yea right, to only well qualified buyers and at a large spread to O/N funding), businesses to borrow and consumers to spend (after borrowing more money they don’t have). Inflation is induced (Wrong, lower real rates creates deflation, not inflation, think Japan for 3 decades now), and the cycle repeats while becoming increasingly self-sustaining…Well at least they got the last part right, “self-sustaining” what they truly mean is that the FED itself becomes self-sustaining. Not only that, but the global central banks use QE to buy real stakes in real assets, such as public corporations, they buy influence in almost every government they support.

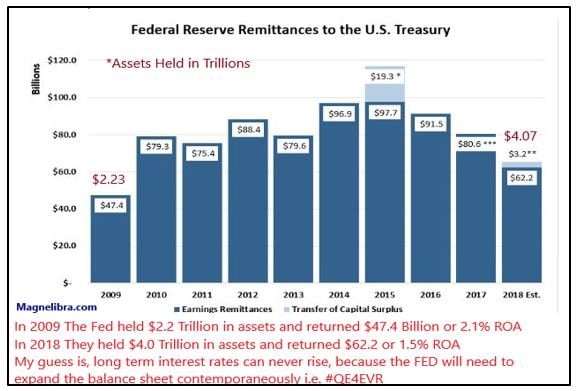

Another part of this circular financial scheme is the remittance back to the US treasury from the FEDs massive interest in US govt. debt. Here is the latest graphic. What it will show is the fact that despite record holdings, the Return on Assets is actually declining and declining rapidly. Many will say that the FED and central banks can sustain losses, well they really can’t. Why? Because their cost of funds is zero and they are guaranteed a profit by decree and their 6% dividend. We know who loses, citizens and governments of these heavily indebted nations as the income disparity grows wider and wider as QE benefits those at the top of the pyramid who hold all the assets and deflation destroys any sense of ability to save or generate returns for those that don’t:

However, as an investor, we can’t worry about the why and the what, but rather we must take the how and cultivate investments and trading accordingly. What does it all mean, it means for now, the future depends upon whether or not the global central banks can work together and whether or not on a geopolitical front, they all get along? I think the former is a no brainer, the latter, well not so much. History has shown that tensions run high when the commoner starts standing up and asking questions. As much as western media hides the fact that the populist revolt continues on in France and other places around the globe, the fact is, people are getting angry and it only takes a small fuse to light a very big powder keg…till next time, cheers!

For more market trends, visit ETF Trends.