As the exchange-traded fund (ETF) world ages, the space undergoes its own maturation process, and that’s evident in funds like the Invesco QQQ ETF (NASDAQ: QQQ). While it may be easy to pigeonhole QQQ as being the basic run-of-the-mill technology sector ETF, that is no longer the case.

QQQ made its debut in the capital markets on March 10, 1999 and has provided a long-standing contributions to investors by providing the necessary exposure to some of the most innovative companies to rise up over the years. After 20 years, QQQ has become one of the largest U.S.-listed ETFs with well over $60 billion in assets under management.

Furthermore, its expansive resume makes it one of the most heavily traded ETFs in the U.S. based on average daily volume to go along with one of the longest performance histories available for an ETF.

“Invesco is proud of the 20 years of innovation that have been marshaled through the Invesco QQQ and the access it has provided investors to pioneering companies that impact each of us daily. Through products, such as QQQ, Invesco continues to focus on creating tools to help investors build portfolios that exceed expectations. We look forward to the next 20 years,” Dan Draper, Managing Director, Global Head of Invesco ETFs, said in a note.

Additionally, ETF traders love the QQQ because of its high volume, which makes it easy to get in and out of the fund for tactical purposes.

“It’s usually one of the top two or three most liquid ETFs,” said Draper.

Despite these accolades, one of the reasons why the ETF has been able to stand the test of time is because it was also able to change with the times–not necessarily the transformational type of change where it loses its identity, but one that stresses evolution as opposed to revolution.

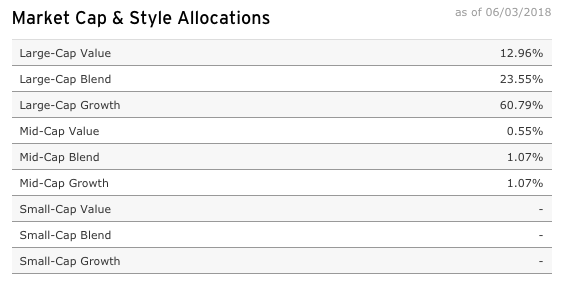

If you look under the hood of QQQ, there’s still the momentum-growth component seen in its top holdings:

Its top three investments consist of the who’s who in the tech sector–Microsoft, Apple and Amazon. However, these companies have grown from being the momentum-fueled growth stocks into the tech staples with global reach in terms of their products and services.

Its top three investments consist of the who’s who in the tech sector–Microsoft, Apple and Amazon. However, these companies have grown from being the momentum-fueled growth stocks into the tech staples with global reach in terms of their products and services.

Amazon, for example, has become a retail powerhouse that’s far removed from its days as simply an online bookstore. While the QQQ still maintains its hefty exposure to the tech sector, the companies that it holds are also evolving and in turn, so does the fund.

“It (QQQ) still represents some of the best growth characteristics, particularly of U.S.-based companies with global presence,” said Draper. “But it’s become more of a diversified index. Obviously, as you look though, the kind of unicorn-type IPOs, many still continue on to the Nasdaq and those are going to be your future constituents if they continue to grow.”

“It remains a very vibrant-type of ETF,” added Draper.

For more market trends, visit ETF Trends.