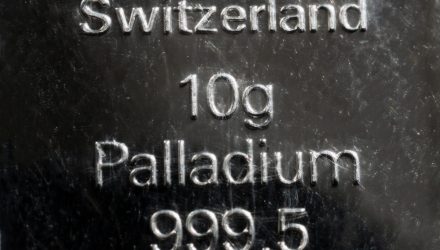

While most were preparing for Thanksgiving dinner on Thursday, palladium investors were feasting off gains as the precious metal reached $1,841. Analysts are already predicting that the precious metal should reach the $2,000 price market ahead of gold.

“Palladium is the only one moving higher, which is bucking the trend a little bit, not only relative to gold but to industrial metals as well. Aluminum didn’t have a particularly good day this morning, neither did copper. And here’s palladium, just hitting record after record here,” TD Securities head of global strategy Bart Melek told Kitco News.

Even if gold makes a rally, Melek is predicting late next year that palladium will cross $2,000 per ounce first.

“It is not particularly surprising that palladium is doing well. We think it will hit $2,000 at the latter part of next year when gold does better as well,” Melek said. “We formally have $2,000 average in Q4 2020, but given normal volatilities, it could be $2,100-2,150. We wouldn’t be shocked if that happened.”

ETF investors who want to get in on the palladium action can look to the Aberdeen Standard Phys PalladiumShrs ETF (NYSEArca: PALL). PALL seeks to reflect the performance of the price of physical palladium, less the expenses of the Trust’s operations.

The fund is designed for investors who want a cost-effective and convenient way to invest in palladium with minimal credit risk. Based on Morningstar performance numbers, PALL is up 43%.

Key features of the fund per PALL’s fact sheet:

- Physically-Backed: Cost-effective and convenient access to physical palladium.

- Transparency: The metal is held in allocated bars and a bar list is posted daily on aberdeenstandardetfs.us

- Pricing: The metal is priced off the LPPM’s specifications for Good Delivery, which is an internationally recognized and transparent benchmark for pricing physical palladium.

- Vault Location: Metal is held in London, United Kingdom at a secured vault of J.P. Morgan Chase Bank, N.A.

- Vault Inspection: Inspectorate International, a leading physical commodity auditor, inspects the vault twice per year (including once at random).

Investors looking to gold and silver could try the SPDR Gold MiniShares (NYSEArca: GLDM) as well as the SPDR Gold Shares (NYSEArca: GLD), while silver bulls could look at the iShares Silver Trust (SLV) and the Aberdeen Standard Physical Silver Shares ETF (SIVR)–two of the largest exchange traded funds backed by holdings of physical silver.

Traders looking for leverage can use funds like the Direxion Daily Gold Miners Bull 3X ETF (NYSEArca: NUGT), VanEck Vectors Gold Miners (NYSEArca: GDX) and the Direxion Daily Jr Gold Miners Bull 3X ETF (NYSEArca: JNUG).

For more market trends, visit ETF Trends.