Last week, the tech sector got a boost when Apple bested analyst expectations in earnings and revenue for its fiscal first quarter, muting previous warnings by CEO Tim Cook that results would disappoint due to lackluster iPhone sales.

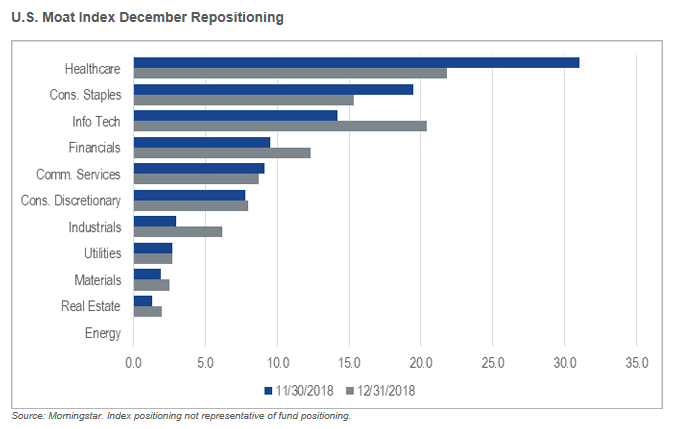

“The most notable shift in the portfolio was the increase in information technology exposure. The U.S. Moat Index weighting of roughly 20% to information technology is now back to market weight relative to the S&P 500. Information technology was a significant underweight for most of 2018,” wrote Rakszawski.

The Morningstar Economic Moat Rating methodology assigns an economic moat rating to companies, but in addition, it focuses on companies exhibiting attractive valuations relative to its price. Furthermore, the indexing methodology uses five sources of economic moats:

- Intangible assets with brand recognition for premium pricing options

- Switching costs that make it too expensive to stop using a company’s products

- Network effect that occurs when the value of a company’s service increases as more use the service

- A cost advantage helps companies undercut competitors on pricing while earning similar margins

- Efficient scale associated with a competitive advantage in a niche market

The moat strategy itself “offers global exposure to Morningstar’s best ideas, which are really rooted in their equity research process of identifying quality companies – those companies with economic moats as Warren Buffett coined that term, but also identifying their attractiveness in terms of valuations, so making sure you’re not overpaying for those quality companies,” Rakszawsk told ETF Trends.

For more information on the MOAT ETF, click here.

For more market trends, visit ETFTrends.com.