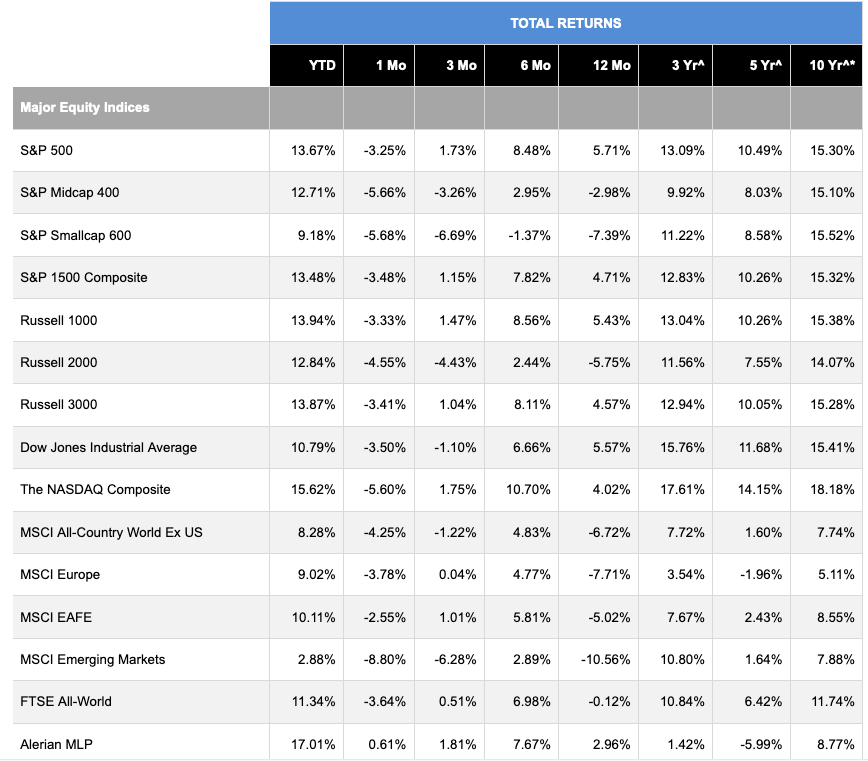

When it comes to the major equity indexes, it’s been master limited partnerships sitting atop the leader board when it comes to year-to-date returns thus far in 2019. The flagship index, the Alerian MLP Index, is up over 17 percent despite the May market volatility.

The Alerian MLP Index is the leading gauge of energy infrastructure MLPs. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis and on a total-return basis.

Exchange-traded funds (ETFs) structured as a partnership are unincorporated business entities so they are not subject to the double taxation of a corporation. If the partnership does not elect to be taxed as a corporation, then it also benefits from pass-through taxation so any realized gains and losses flow directly to investors in the fund.

Partnerships are flexible in terms of the types of investments they can make. Unlike grantor trusts, partnerships can invest in other types of commodities like oil or natural gas due to their flexibility.

However, ETFs structured as a partnership fall under the regulatory measures of the U.S. Commodity Futures Trading Commission. As such, these ETFs are subject to reporting and other financial disclosures.

One specific type of partnership in the ETF world is the MLP.

MLPs are typically classified into three categories:

- Upstream MLPs: involved in the exploration, recovery, development and production of crude oil and natural gas.

- Midstream MLPs: involved in the gathering, processing, storage and transportation of oil and gas.

- Downstream MLPs: involved in the distribution of fuels to end customers such as residential, industrial and agricultural entities.

MLP ETFs, in particular, are gaining traction as their own niche market in the energy sector.

“MLPs have gone through a transition of rectifying their balance sheets, changing your corporate structures. The energy space are on firmer footing as well as we go forward. So, we do think there’s an opportunity going forward as the energy markets continue to work through their recent problems,” Todd Sunderland, Partner and Head of Risk Management and Quant Strategies at Cushing Asset Management, said at Inside ETFs.

Some exchange-traded funds (ETFs) to take advantage of in this space include the Cushing Utility & MLP ETF (XLUY), Cushing Energy & MLP ETF (XLEY), Cushing Energy Supply Chain & MLP ETF (XLSY), and Cushing Transportation & MLP ETF (XLTY).

To improve tax efficiency, MLP-related ETFs limit exposure to MLPs to 24% at each quarterly rebalance. Traditional MLP funds that hold more than 25% of their portfolios in MLPs are structured as C-Corporations and must pay corporate income tax on distributions before passing them on to investors, which incurs additional tax headaches come tax season that translates to lower overall returns.

“We believe that these sectors are vital to the U.S. economy and thus may be appropriate for portfolio inclusion,” said Sunderland.

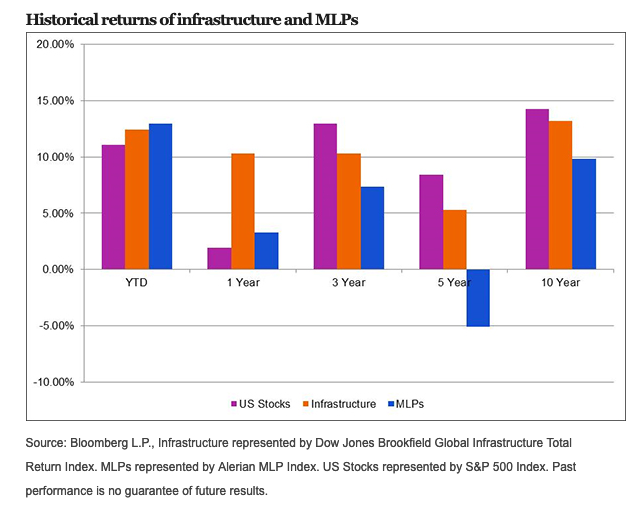

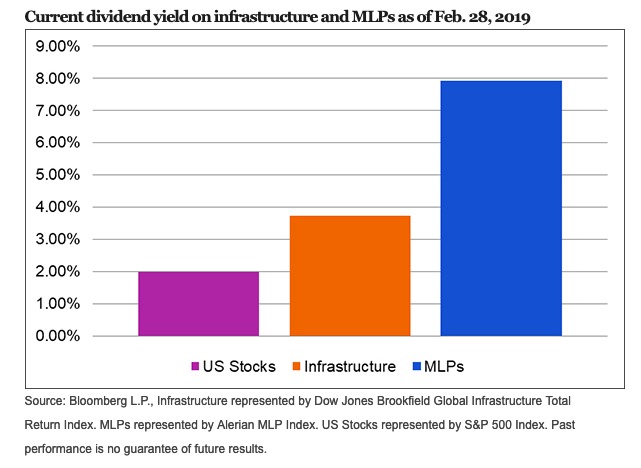

Sunderland stated that midstream and MLP businesses are included in the ETF strategies because the segment is fundamentally related to the sector company businesses, can potentially increase yield generation and are historically excluded from S&P 500 and Dow Jones Averages, providing another layer of diversification benefits.

For more market trends, visit ETF Trends.