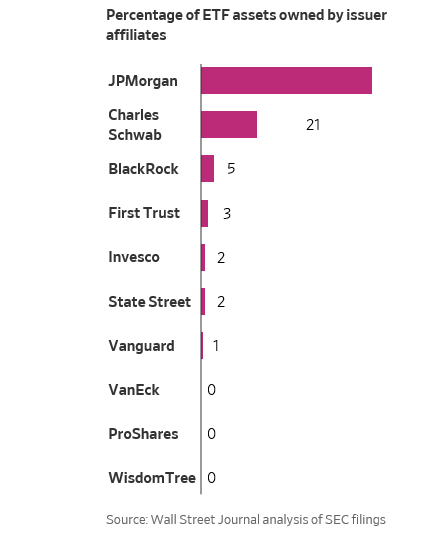

JP Morgan isn’t the only firm leveraging this practice. Others like Charles Schwab and Northern Trust Corporation are quick to snatch up its own ETF products on the behalf of its clients.

Related: The Enablers: The Fed and the Central Banks

The end of 2018 saw Northern Trust clients owning of 23 of its 26 FlexShares ETFs. Furthermore, in-house clients amounted to 67 percent of the $15 billion invested in funds, according to a Wall Street Journal analysis.

“They’re clearly doing it to get their own products off the ground,” said Nicole Boyson, a finance professor at Northeastern University who studies conflict-of-interest disclosures. “These are brand new products, and the way they’re raising money is by putting client money into them.”

For more market trends, visit ETF Trends.