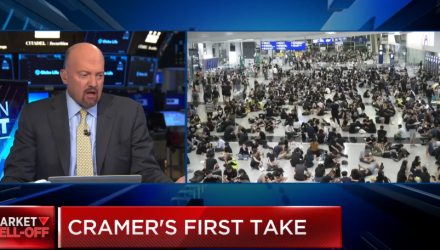

Market maven and CNBC’s “Mad Money” host Jim Cramer said that an even greater tail risk to the markets is the Hong Kong protests. The ramifications of the situation could hit the markets harder than the U.S.-China trade war.

Due to Hong Kong being a major financial hub in Asia, a potential shutdown could put global markets in a tailspin.

“I just don’t think the Chinese communists can avoid it anymore,” Cramer said. “The Chinese government is more worried about Hong Kong than they’re worried about trade. Because Hong Kong is something that’s very visible in Europe.”

“This is more serious than the trade talks,” he added. “If you want to know what could tip you into a worldwide recession, it is just a shutdown of Hong Kong.”

While the markets are fixated on the U.S.-China trade deal, there is another potential economic risk looming that might not be getting the attention it deserves. That is the rising Hong Kong protests, which could upset any chance of a trade deal even happening.

“I think the potential black swan, if there is a black swan right now, is what’s happening in Hong Kong right now,” said famed investor Steve Eisman, who was the subject of the book and film “The Big Short.” “If things escalate even further in Hong Kong, that would have a real impact back on the global economy.”

“That’s actually what I’m worried about the most right now, because every weekend we’ve got this drama where the people of Hong Kong are having protests in the millions and its starting to get very violent,” Eisman added.

The protests, which have been festering since the start of the summer, poses a potential market risk that could translate to a black swan event. In financial sector vernacular, a black swan is a major disruption that could obliterate the markets and economy.

For investors sensing an opportunity in Hong Kong-focused exchange-traded funds (ETFs), they can look to funds like the SPDR Solactive Hong Kong ETF (NYSEArca: ZHOK), Franklin FTSE Hong Kong ETF (NYSEArca: FLHK) and iShares MSCI Hong Kong ETF (NYSEArca: EWH). Despite the latest geopolitical concerns, all three funds are up thus far in 2019.

Year-to-date performances of all three funds per Yahoo Finance performance numbers:

- ZHOK: 6.73 percent

- FLHK: 14.73 percent

- EWH: 16.21 percent

However, investors should proceed with caution as the violence escalates. However, an investor with a cast-iron stomach may find value in these ETFs.

For more market trends, visit ETF Trends.