Precious metals like gold and silver saw their prices fall on Monday, which could present a buying opportunity for investors looking to add alternative safe havens to their portfolios. This could make gold and silver ETFs a value proposition for investors looking to capitalize on the weakness.

“Gold and silver prices are sharply lower in midday U.S. trading Monday,” wrote John Wyckoff of Kitco News. “Gold notched a seven-week low and silver prices hit a five-week low. A strong U.S. dollar index that hit a new high for the year on Monday is credited with putting much of the downside pressure on the precious metals today. Better risk appetite in the market place early this week is also bearish for the safe-haven metals.”

The move comes after two consecutive interest rate cuts by the Federal Reserve, which could have investors looking to precious metals like gold and silver as a hedge against a falling dollar. However, early indications in Monday’s trading showed that the risk-off sentiment was more lukewarm than piping hot.

“There was less risk aversion in the marketplace Monday, following markets being roiled last Friday by reports the U.S. was considering limiting U.S. investors’ investment in China, including the U.S. stock exchanges de-listing Chinese companies,” wrote Wyckoff. “Weekend reports, including a statement from the U.S. Treasury Department, then said the Trump administration is not considering such moves.”

Nonetheless, a volatile October could be forthcoming given history’s penchant for market volatility during this time of the year. As such, the latest fall in precious metals could have investors looking at options in gold and silver exchange-traded funds (ETFs).

Investors looking to invest in precious metals ETFs could try the SPDR Gold MiniShares (NYSEArca: GLDM) and SPDR Gold Shares (NYSEArca: GLD) as a great way to play the market, while silver bulls could try the iShares Silver Trust (SLV) and the Aberdeen Standard Physical Silver Shares ETF (SIVR), two of the largest exchange traded funds backed by holdings of physical silver.

Gold has long been used as a safe haven asset, particularly when the value of the dollar declines. Furthermore, it provides a hedge for inflation since its price typically rises in conjunction with consumer prices.

During the Great Depression of the 1930s, gold was also a hedge against deflation. While the prices of assets were dropping during this time, the purchasing power of gold rose to prominence.

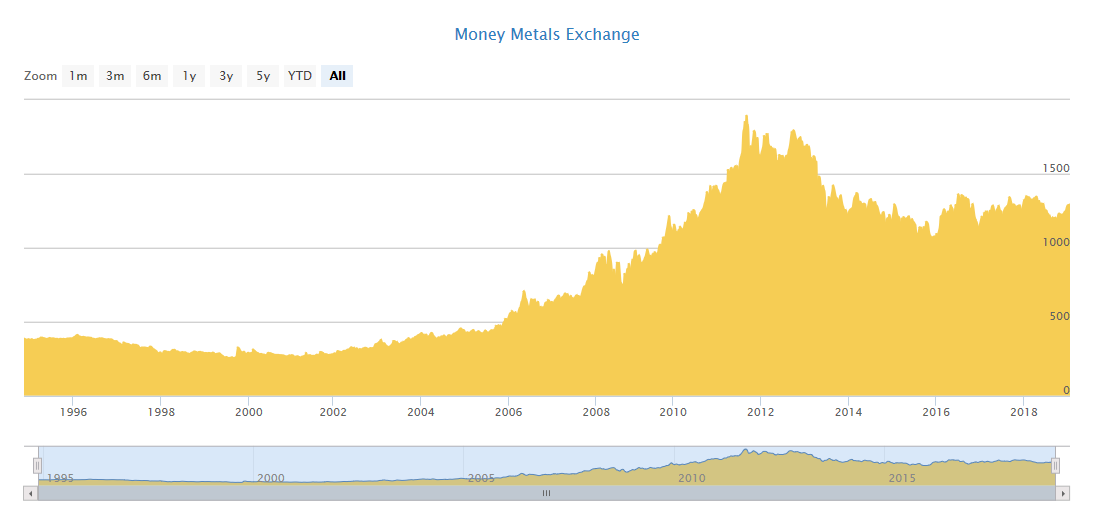

Fast forward to the financial crisis in 2008, the price of gold increased sharply while faith in U.S. equities was languishing. In essence, gold has proven to withstand times of geopolitical and economic uncertainty.

Furthermore, the value of gold has risen steadily over the years.

For more market trends, visit ETF Trends.