By Michael Orzano, Senior Director, Global Equity Indices, S&P Dow Jones Indices

For a U.S. investor, developed market exposure outside of the U.S. is a core building block in forming a comprehensive global portfolio. In part because of its status as the world’s first international equity index, MSCI EAFE enjoys a commanding market presence for international equity benchmarks. It also serves as the underlying index for many of the largest international equity ETFs and index funds. However, what many don’t realize is that MSCI EAFE excludes Canadian securities entirely, which may create an unintended gap in exposure or reflect an unfair performance benchmark for a manager focused on developed ex-U.S. equities.

In our third blog in a series highlighting key features of the global equity benchmark landscape, we explore the limitations of choosing MSCI EAFE as a regional representation of the international equities asset class.

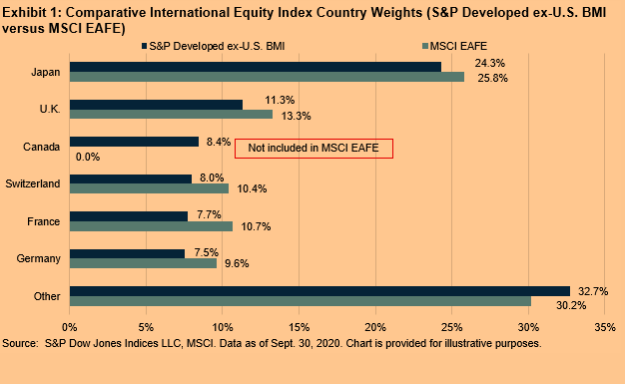

Exhibit 1 depicts the country composition of MSCI EAFE compared to the S&P Developed ex-U.S. BMI, which includes all developed markets excluding the U.S. With an 8.4% weight, Canada was the third largest market out of the 24 countries included in the S&P Developed ex-US BMI as of Sept. 30, 2020.

Without a separate, standalone allocation to Canada, a global equity portfolio based on the S&P 500®, MSCI EAFE, and an emerging markets equity index would exclude Canada, the world’s fifth largest equity market, entirely.

When evaluating international equity index exposures, it is critical to fully understand the underlying benchmark being tracked to ensure it is covering all countries you expect it to include. Similarly, an actively managed fund should not be benchmarked to an index that excludes Canada if its mandate is to invest in all developed markets excluding the U.S. Remember to look under the hood or you might be inadvertently excluding major countries from your global equity opportunity set.

To learn more about the comprehensive coverage of the S&P Global BMI Index Series, see The S&P Global BMI: Providing Consistent Insights into Global Equity Markets since 1989.

Originally published by Indexology, 11/5/20

The posts on this blog are opinions, not advice. Please read our Disclaimers.