From the hospitals where they assist with Covid-19 patients to homes where they vacuum floors, robots are everywhere. They are also making a name for themselves in the world of ETFs through one iShares fund: the iShares Robotics and Artificial Intelligence Multisector ETF (IRBO).

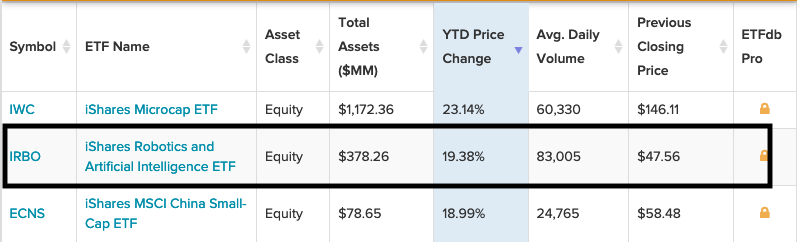

The fund is one of the ETF provider’s best-performing funds so far this year with a 19% gain. Within the past year it’s up almost 70%.

IRBO seeks to track the investment results of the NYSE® FactSet® Global Robotics and Artificial Intelligence Index. The underlying index measures the performance of equity securities across multiple sectors.

Overall, IRBO lends investors:

- Exposure to companies at the forefront of robotics and artificial intelligence innovation

- Exposure to an equal-weighted index composed of global companies across the robotics and AI value chain

- Long-term growth with companies that can shape the global economic future

Looking at its 1-year chart more closely, the ETF was still trending higher as its 50-day moving average fell below its 200-day moving average back on April 3, 2020. Then it continued higher after the ‘golden cross’ occurred on June 11, 2020 when the moving averages switched places.

The relative strength index (RSI) is currently reading 78.79, which confirms the strong momentum behind the fund. With robotics set to proliferate over the coming years, the disruptive tech space will only see more strength.

More Robots, Please

The impact of robotics can be felt in many sectors. Social distancing measures brought on by Covid-19 only further facilitated their use, as businesses look for ways to continue operations without putting employees at risk.

As the cost of parts and labor to produce robots decreases, robotics becomes more accessible and less cost prohibitive for businesses of all sizes.

“Labor-intensive industries are facing challenges of rising labor cost and lack of skilled workforce is boosting adoption of the robots,” a KSU Sentinel report said. “This has pushed companies to adopt robotic technology to automate operations.”

“The automotive, aerospace, and healthcare industries for reduction of labor-cost and overcoming the lack of skilled labor globally,” the report added. “Industrial robots are able to performing numerous programmed tasks across numerous manufacturing and production. These robots are able to perform such task which are often dangerous for human workers. Service robots are increasingly assisting human beings for jobs that are typically repetitive and are dangerous. The aforementioned factors are fueling growth of the global robotics market.”

For more news and information, visit the Equity ETF Channel.