Just when it seemed safe to assume that economies will slowly transition back to normalcy, more coronavirus cases are throwing a wrench into the plan. Germany and France have already implemented lockdowns amid rising cases, which could cause other nations to follow suit, With all the uncertainty, safe haven government exposure could see an uptick.

“Both Germany and France announced new nationwide lockdowns on Wednesday as Europe enters a deadly new phase of the coronavirus pandemic,” an NBC News article reported. “Chancellor Angela Merkel says German officials have agreed to a four-week shutdown of restaurants, bars, cinemas, theaters and other leisure facilities in a bid to curb a sharp rise in coronavirus infections.”

“We are deep in the second wave,” European Commission President Ursula von der Leyen told reporters in Brussels. “I think that this year’s Christmas will be a different Christmas.”

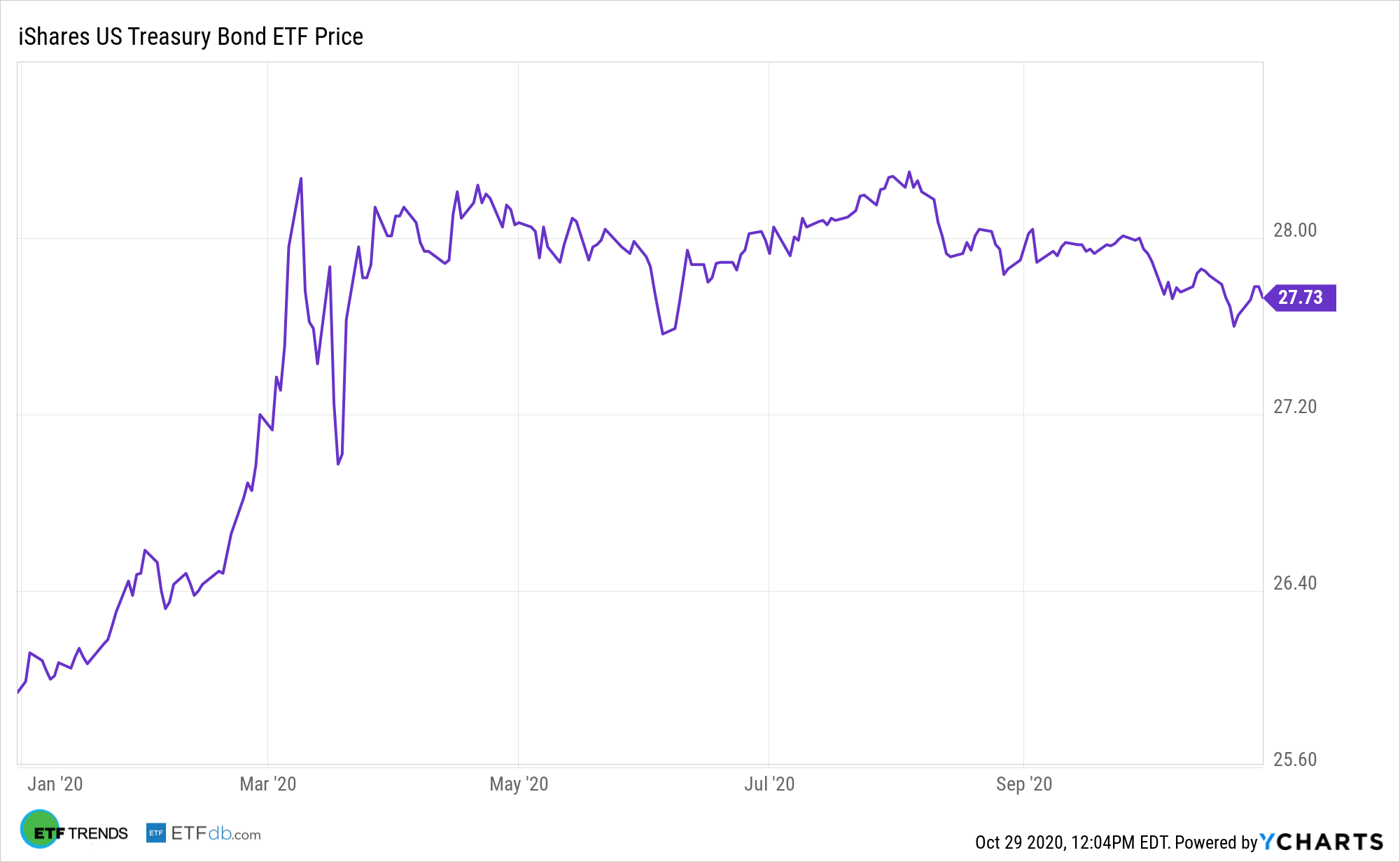

With that said, one fund to consider as a safe haven government debt option is the iShares U.S. Treasury Bond ETF (GOVT). The fund seeks to track the investment results of the ICE U.S. Treasury Core Bond Index.

The fund generally will invest at least 90% of its assets in the component securities of the underlying index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the index. The underlying index measures the performance of public obligations of the U.S. Treasury that have a remaining maturity greater than one year and less than or equal to thirty years.

- Exposure to U.S. Treasuries ranging from 1-30 year maturities

- Low cost access to the broad U.S. Treasury market in a single fund

- Use at the core of your portfolio to seek stability in your portfolio and pursue income

Investors can also take a look at the iShares 20+ Year Treasury Bond ETF (NasdaqGS: TLT). TLT seeks to track the investment results of the ICE U.S. Treasury 20+ Year Bond Index (the “underlying index”). The underlying index measures the performance of public obligations of the U.S. Treasury that have a remaining maturity greater than or equal to twenty years.

Some advantages of adding TLT to your portfolio:

- Exposure to long-term U.S. Treasury bonds

- Targeted access to a specific segment of the U.S. Treasury market

- Use to customize your exposure to Treasuries

For more news and information, visit the Equity ETF Channel.