As the capital markets continue to swarm with activity over a renewed risk-on from investors and Reddit forums, there’s no shortage of volume occurring in the iShares ETF brand. Here are five funds that have been seeing the highest average daily volume as of late.

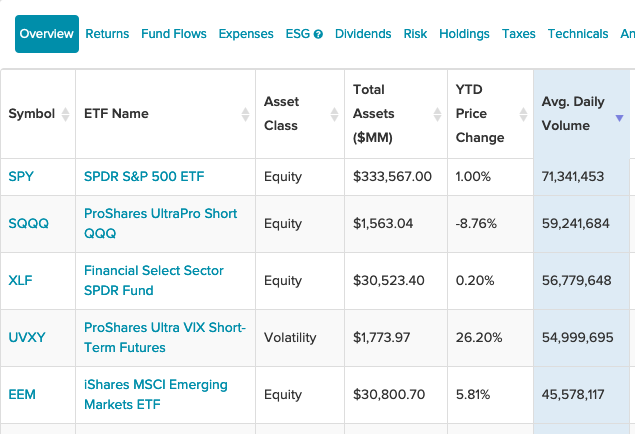

SPDR S&P 500 ETF (SPY): one of the largest and most heavily-traded ETFs in the world, offering exposure to one of the most well known equity benchmarks. While SPY certainly may have appeal to investors seeking to build a long-term portfolio and include large cap U.S. stocks, this fund has become extremely popular with more active traders as a way to toggle between risky and safe assets. A look at SPY’s daily turnover reveals the short average holding period and the popularity with active traders.

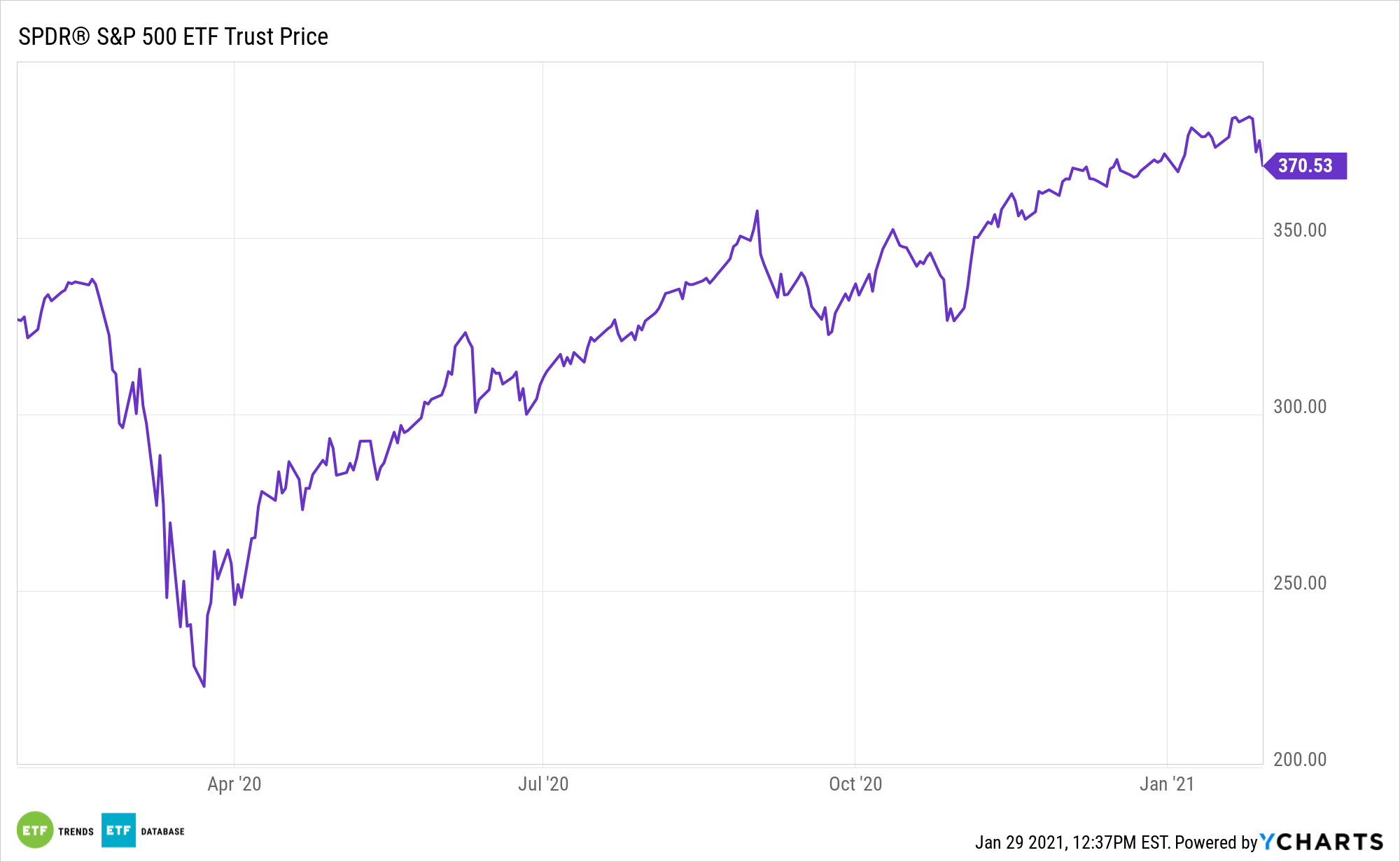

ProShares UltraPro Short QQQ (SQQQ): offers 3x daily short leverage to the NASDAQ-100 Index, making it a powerful tool for investors with a bearish short-term outlook for nonfinancial equities. Investors should note that SQQQ’s leverage resets on a daily basis, which results in compounding of returns when held for multiple periods. SQQQ can be a powerful tool for sophisticated investors, but should be avoided by those with a low risk tolerance or a buy-and-hold strategy.

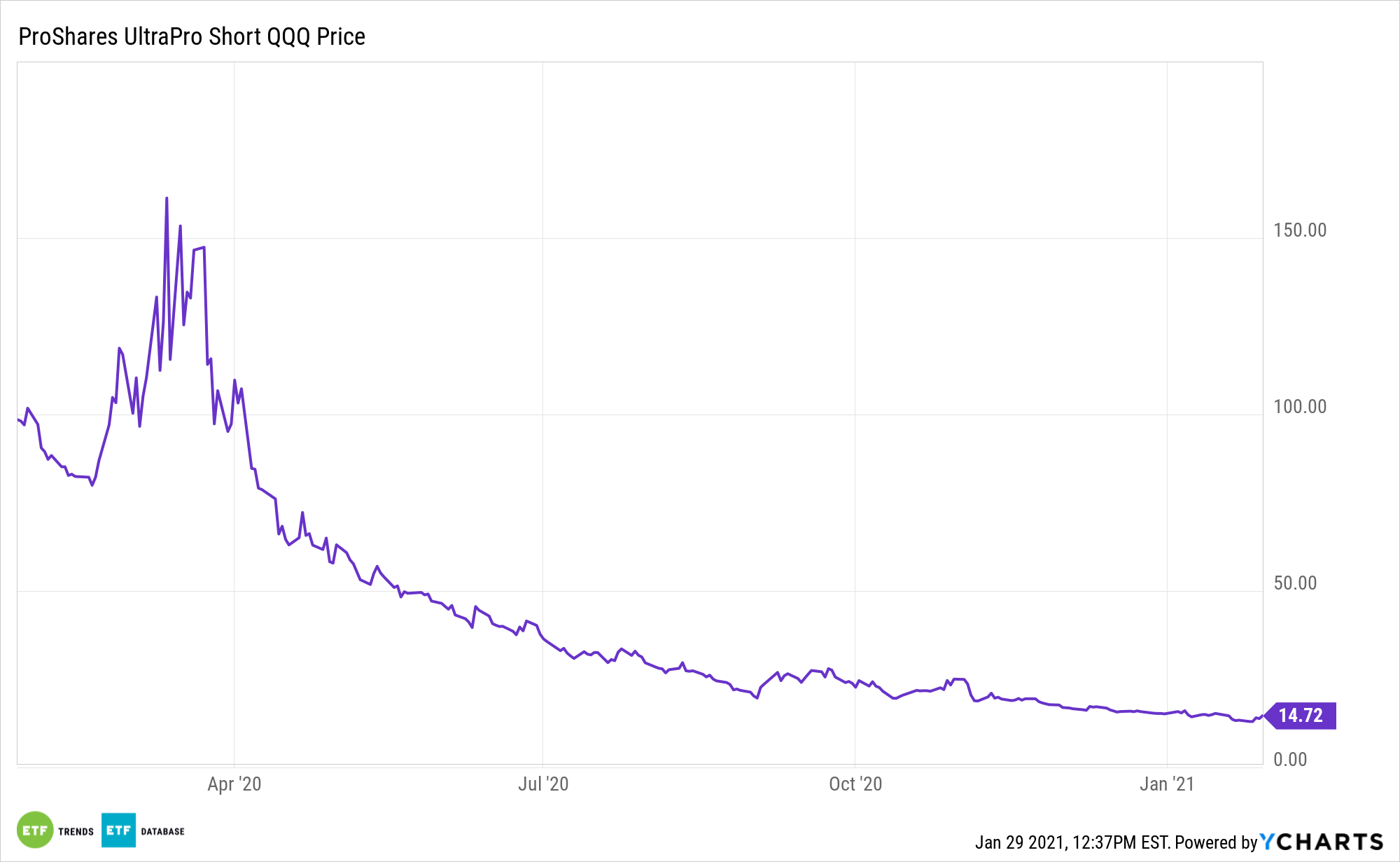

Financial Select Sector SPDR (XLF): provides exposure to an index that includes companies from the following industries: diversified financial services; insurance; commercial banks; capital markets; real estate investment trusts; thrift & mortgage finance; consumer finance; and real estate management & development. XLF contains the who’s-who of the financial players in the domestic economy, including JP Morgan, Wells Fargo, and more. This makes it an ideal play on the U.S. financials world, which has not always been stable.

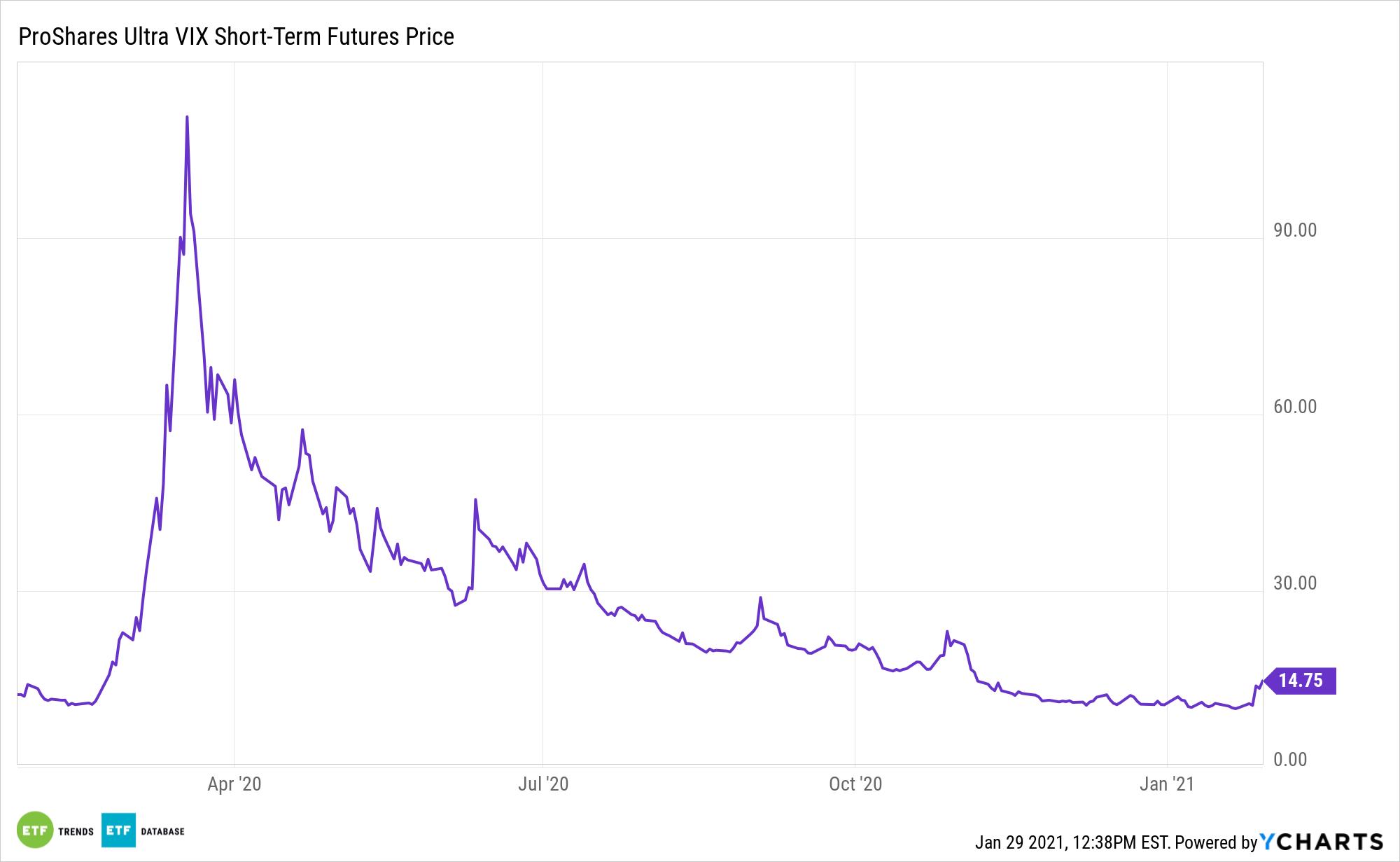

ProShares Ultra VIX Short-Term Futures (UVXY): offers leveraged exposure to an index comprised of short-term VIX futures contracts, making it a very powerful tool for those looking to implement sophisticated strategies requiring exposure to the VIX. The VIX, also known as the ‘fear index’, is a widely followed indicator of equity market volatility. Because the VIX tends to spike when stock markets struggle, this asset class has become appealing to investors looking for negative correlations to stocks.

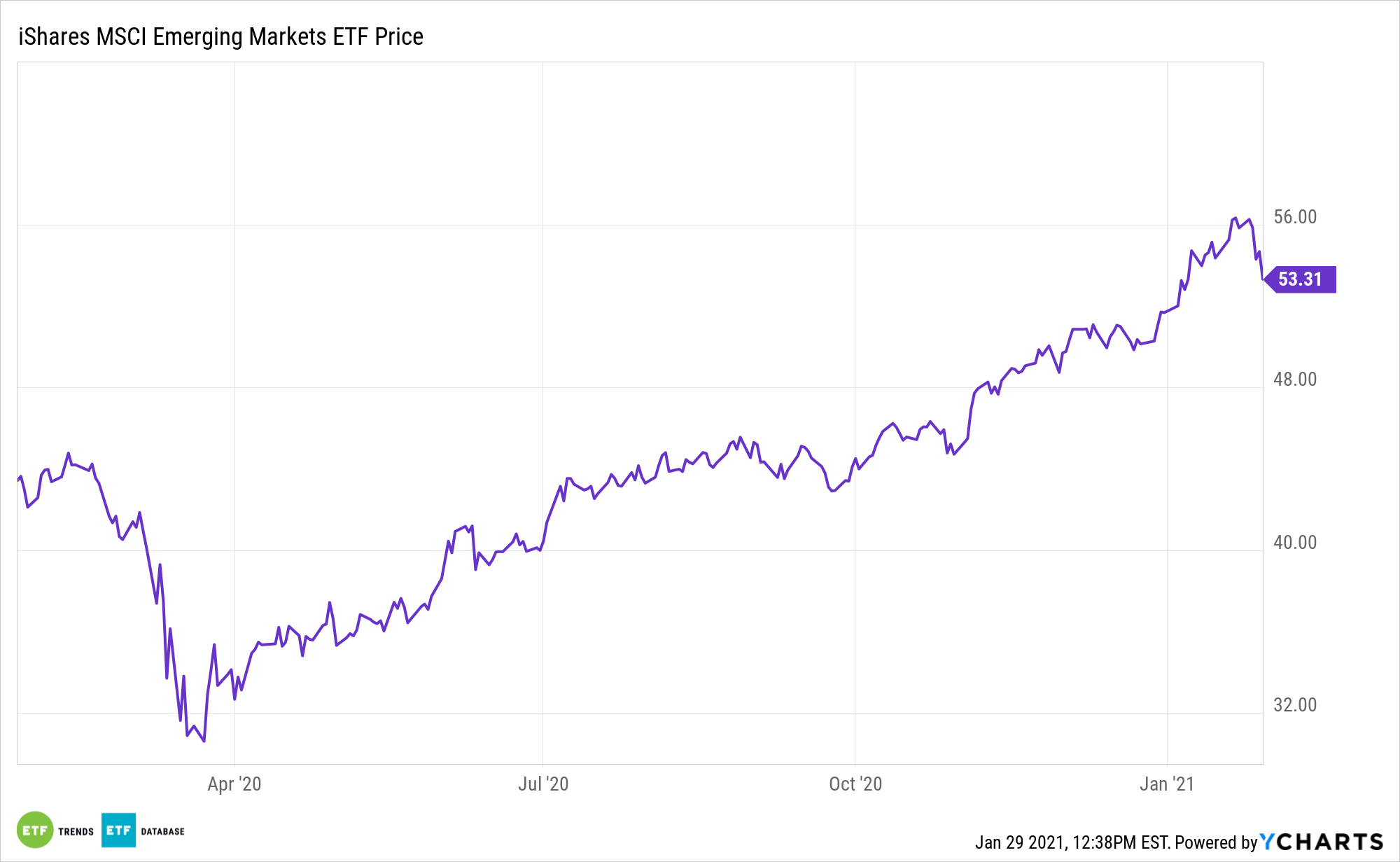

iShares MSCI Emerging Markets ETF (EEM): one of the most popular ETFs in the world, and one of the oldest products on the market offering exposure to stock markets of emerging economies. Given this objective, EEM can be used in a number of different ways and can be equally useful as a short-term trade to increase exposure to risky assets or as a core holding in a long-term, buy-and-hold portfolio. EEM certainly qualifies as a portfolio ‘building block’ given the importance of the asset class covered.

For more news and information, visit the Equity ETF Channel