Hate it or love it, the polarizing Tesla Cybertruck already has almost 200,000 orders according to Tesla CEO Elon Musk. The unveiling of the Cybertruck drew heavy skepticism from Wall Street as analysts wondered whether the radical design of the truck would actually garner interest from current and prospective truck owners.

Musk took to Twitter to tout the pre-orders:

200k

— Elon Musk (@elonmusk) November 25, 2019

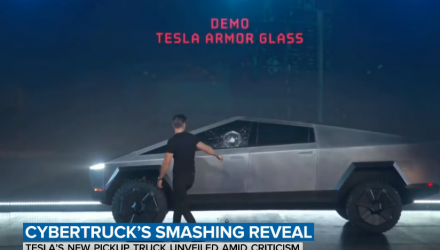

Despite its avante-garde looks, Musk tried to highlight the durability of the truck, going as far as asking a Tesla designer to smash the truck’s door with a sledgehammer and hurl metal balls at the “armor-glass” windows.

“We threw wrenches, we threw everything even literally the kitchen sink at the glass and it didn’t break. For some weird reason, it broke now,” Musk said at the debut. “I don’t know why. We will fix it in post.” The stunt helped make the Cybertruck the subject of memes and media coverage around the world.

Wall Street wasn’t amused by the display.

“Tesla tried to throw a lot of stones at the legacy pickups on the market, with Tesla highlighting advantages in durability, towing, payload, and 0-60,” Credit Suisse wrote in a note. “Yet we think the legacy OEMs can breathe a sigh of relief, as we don’t expect Cybertruck to encroach on large pickup share.”

ETFs to watch with heavy weightings of Tesla:

- ARK Industrial Innovation ETF (NYSEArca: ARKQ): seeks long-term growth of capital. The fund is an actively-managed fund that will invest under normal circumstances primarily in domestic and foreign equity securities of autonomous technology and robotics companies that are relevant to the fund’s investment theme of disruptive innovation. Most of the fund’s assets will be invested in equity securities, including common stocks, partnership interests, business trust shares and other equity investments or ownership interests in business enterprises.

- VanEck Vectors Low Carbon Energy ETF (NYSEArca: SMOG): seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Ardour Global Index. “Low carbon energy companies” refers to companies primarily engaged in alternative energy, including renewable energy, alternative fuels and related enabling technologies (such as advanced batteries).

- First Trust NASDAQ Clean Edge Green Energy Index Fund (NasdaqGM: QCLN): seeks investment results that correspond generally to the price and yield (before the fund’s fees and expenses) of an equity index called the NASDAQ® Clean Edge® Green Energy Index. The index is designed to track the performance of small, mid and large capitalization clean energy companies that are publicly traded in the United States.

For more market trends, visit ETF Trends.