By Todd Rosenbluth, Head of ETF & Mutual Fund Research, CFRA

Key Takeaways

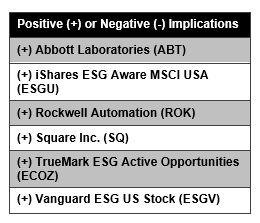

- Environmental, Social and Governance (ESG) ETF assets have risen sharply in 2020 off a low base, with iShares’ three largest broadly diversified funds alone gathering $13 billion year-to-date through October 16 and Vanguard also boasting success.

- iShares ESG Aware MSCI USA ETF (ESGU) and Vanguard ESG US Stock ETF (ESGV) have outperformed the S&P 500 Index in the past year, showcasing that ESG investors are not giving up performance to be more responsible.

- In March, TrueMark ESG Active Opportunities ETF (ECOZ) launched — combining ESG screening criteria with fundamental and valuation analysis to select stocks. The fund recently held Abbott Laboratories (ABT), Rockwell Automation (ROK), and Square (SQ) among its top-10 holdings

Fundamental Context

ESG Equity ETFs assets continue to climb in 2020. This year, a growing number of institutional and retail investors have chosen relatively cheap products from iShares, Vanguard, and others to serve as the core of their portfolios replacing traditional S&P 500 and MSCI EAFE index based strategies, while providing exposure to sustainable and social impact investing. These ESG funds cover the three pillars of ESG with companies that meet sufficient criteria for inclusion, rather than just excluding companies that are deemed unworthy.

iShares offers the three largest of these ETFs with one covering each of the popular regions of the globe: the $11 billion ESGU, the $4.5 billion iShares ESG Aware MSCI EM ETF (ESGE) and the $3.2 billion iShares ESG Aware MSCI EAFE ETF (ESGD). Combined these three funds gathered more than $12 billion of net ETF inflows year-to-date through October 16, with ESGU alone adding $1.8 billion in the past month.

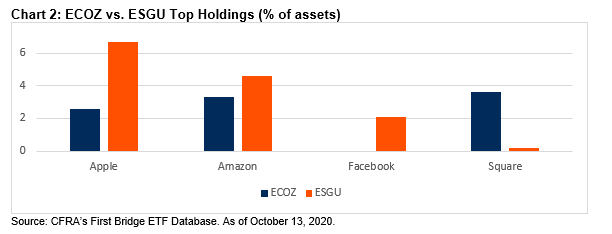

ESGU and the $2.1 billion ESGV, which added $1 billion of new money in 2020, track different U.S. equity indexes but have overlaps in their portfolios. For example, they both recently had 22% of assets in the five largest U.S. public companies–Apple (AAPL 119 ****), Microsoft (MSFT 220 *****), Amazon.com (AMZN ), Facebook (FB 266 ***), and Alphabet (GOOG.L 1,568 *****) (GOOG 1,573 NR)–even though ESGV has 1,467 positions, quadruple the number ESGU holds.

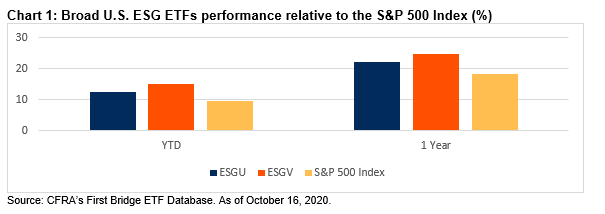

Both also outperformed the S&P 500 Index in the past year ended October 16, with ESGV’s 25% gain ahead of ESGU’s 22% and easily ahead of the 18% total return for the widely followed ‘500’, disproving the concern some have that ESG strategies can’t keep up with broaden market. CFRA five-star rated ESGU also outperformed the S&P 500 Index by more than 100 basis points over the three-year period, while five-star rated ESGV only launched in September 2018.

Active ESG ETFs combine two popular trends in 2020. In addition to growing interest in ESG products this year, investors have also embraced actively managed ETFs. Year-to-date, active ETFs pulled in $38 billion to grow the sub-category to $146 billion in assets. Net inflows were largely split between active fixed income ($21 billion) and equities ($14 billion), with ARK Funds, First Trust, Janus, JPMorgan, and PIMCO generating significant inflows. This year established active mutual fund providers, such as American Century and T Rowe Price, also launched new active equity ETFs.

ECOZ also launched in 2020 providing investment analysis and not just ESG screening. The TrueMark fund, similar to index-based ESG strategies, filters out heavy polluters and applies sector-specific systematic criteria to identify ESG “champions”. However, fund management incorporates traditional fundamental and valuation metrics such as return on capital and intrinsic value assessments, making the ETF different than ESGU and ESGV. ECOZ also owns AAPL, AMZN, MSFT, and GOOGL, but the company weightings were approximately 12% of assets. Meanwhile, the ETF held larger individual stakes in SQ and Enphase Energy (ENPH). Other recent top-10 holdings included ABT, ROK, and Tesla (TSLA). FB was not one of ECOZ’s approximately 75 recent ETF holdings.

In the six-month period since mid-April, ECOZ’s 32% gain was ahead of ESGV (28%), ESGU (25%) and the S&P 500 Index (22%).

CFRA’s forward-looking ETF ratings focus on the fund’s holdings, performance, and costs, but are not ESG specific. Our five-star ratings for ECOZ, ESGU, and ESGV are aided by our forecast that these ETFs have a high likelihood of outperforming the broader U.S. equity category. However, our fundamental risk and reward analytics are not solely focused on a company’s environmental practices, the diversity of its board, or other favorable ESG attributes.

Want to learn more about why demand for ESG has been climbing and understand how one asset manager selects stocks using ESG criteria? Join CFRA on October 21 at 1pm ET https://go.cfraresearch.com/truemark for a webinar.

Conclusion

Demand for ESG as well as active equity ETFs has climbed in 2020, as some investors sought differentiation from traditional market-cap weighted strategies. However, not all ESG ETFs own the same stocks or perform the same. CFRA clients can benefit from deeper analysis using our forward-looking ratings.

Originally published by CFRA

Contact CFRA

1 New York Plaza, 34th Floor

New York, NY 10004

USA

P: +1-800-220-0502

www.cfraresearch.com

———————–

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2020 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.