While a U.S.-China trade deal looms and various media outlets are reporting that a deal is close, the threat of trade protectionism to global growth remains, according to Bank of Japan Governor Haruhiko Kuroda.

“There (is) some sort of protectionism” said Kuroda during a CNBC interview on Monday. “That is I think most serious risk involved in the global economy.”

Amid the trade scuffle between the U.S. and China, discussions between Japanese Prime Minister Shinzo Abe and U.S. President Donald Trump regarding trade have largely been positive. Both leaders have managed to eschew the back-and-forth barbs that President Trump and Chinese President Xi Jinping have been exchanging during the height of the trade wars last year.

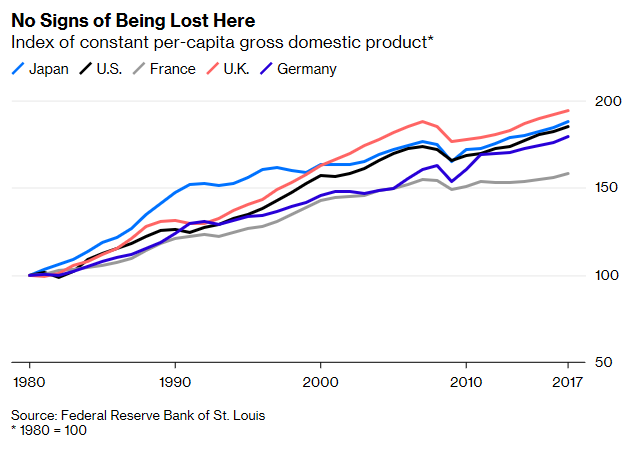

Japan itself is recovering from its own economic doldrums with employment rates and wage growth starting to come to life. This is a welcome sign, particularly after the last 30 years have been marked by stagnant growth following an asset bubble burst that spawned the “Lost Decade” of Japan in the early 90s to the early 2000s.

Investors who are seeking single-country exposure to Japan can look to the following ETFs for broad-based exposure or tactical trading:

- iShares MSCI Japan ETF (NYSEArca: EWJ): seeks to track the investment results of the MSCI Japan Index, which consists of stocks traded primarily on the Tokyo Stock Exchange. It may include large- or mid-capitalization companies.

- WisdomTree Japan Hedged Equity Fund (NYSEArca: DXJ): seeks to track the price and yield performance of the WisdomTree Japan Hedged Equity Index, which is designed to provide exposure to Japanese equity markets while at the same time neutralizing exposure to fluctuations of the Japanese yen relative to the U.S. dollar.

- Direxion Daily Japan Bull 3X ETF (NYSEArca: JPNL): seeks daily investment results equal to 300% of the daily performance of the MSCI Japan Index. The index itself is designed to measure the performance of the large- and mid-cap segments of the Japanese equity market, covering approximately 85% of the free float-adjusted market capitalization of Japanese issuers.

Weaker Global Growth Centers on Trade

Kuroda’s comments mirror the view of the International Monetary Fund (IMF) who cut its global growth forecast to the lowest level since the financial crisis, citing the impact of tariffs and a weak outlook for most developed markets. According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January.

“By the way, (the) IMF world economic outlook main scenario does assume the U.S.-China trade conflict will not worsen,” Kuroda said.

In addition, the global volume of trade in goods and services will increase 3.4 percent in 2019, which represents a drop from the 3.8 percent gain last year. The IMF, however, did mention that recent policy implementations like the U.S. Federal Reserve keeping interest rates steady are positive signs moving forward.

“Amid waning global growth momentum and limited policy space to combat downturns, avoiding policy missteps that could harm economic activity needs to be the main priority,” said the IMF.

For more market news, visit ETFTrends.com.