Inflation fears have crept back into the capital markets, according to global investment firm Goldman Sachs. A recent Reuters article noted that a confluence of other factors like a weaker dollar and rising demand for commodities could accompany inflation.

“A weaker U.S. dollar, rising inflation risks and demand driven by additional fiscal and monetary stimulus from major central banks will spur a bull market for commodities in 2021, Goldman Sachs said on Thursday,” the article said. “The bank forecast a return of 28% over a 12-month period on the S&P/Goldman Sachs Commodity Index (GSCI), with a 17.9% return for precious metals, 42.6% for energy, 5.5% for industrial metals and a negative return of 0.8% for agriculture. Markets are now increasingly concerned about the return of inflation, the Wall Street bank said.”

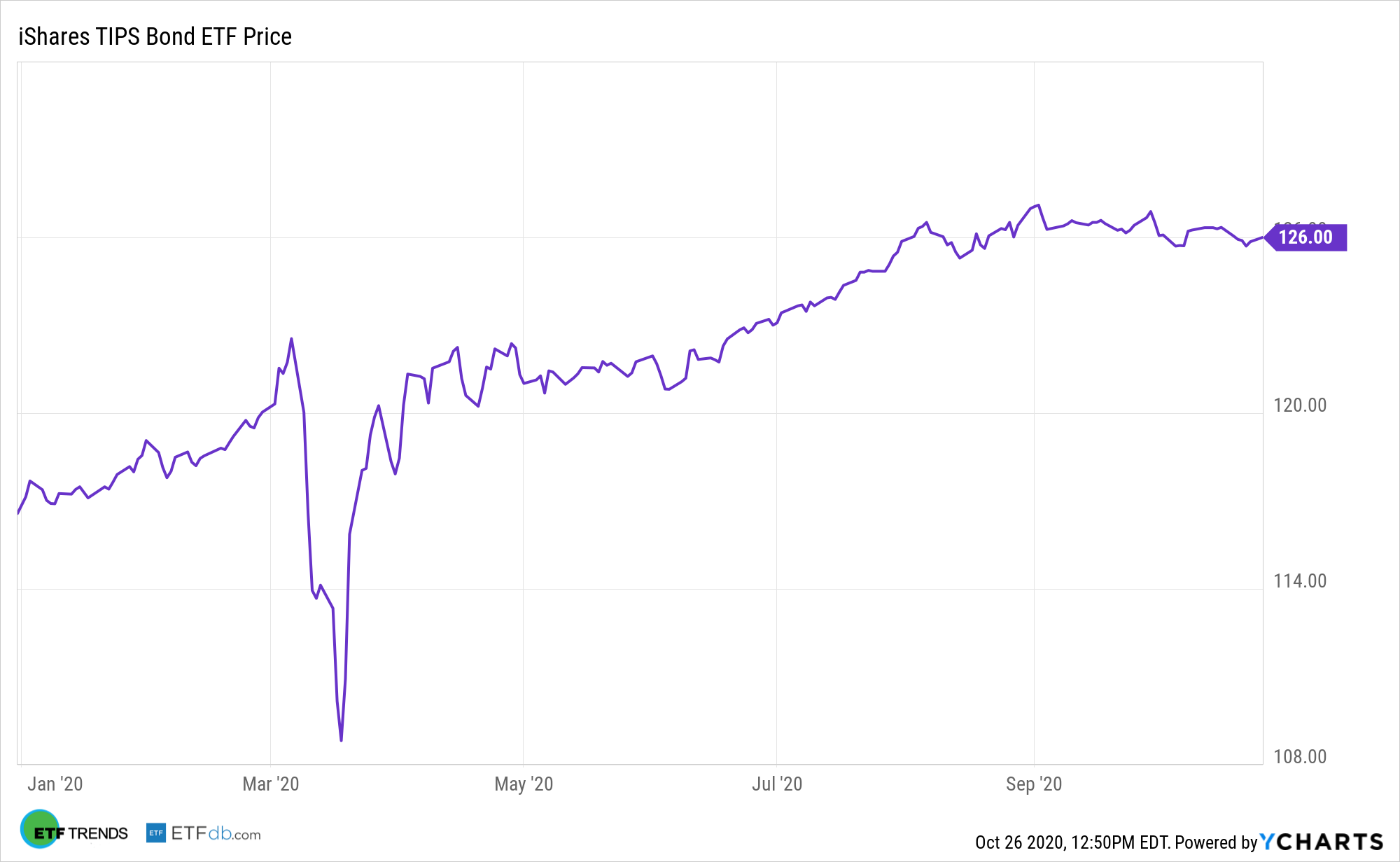

With inflation ahead, one ETF to consider is the iShares TIPS Bond ETF (TIP). TIP seeks to track the investment results of Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index (Series-L) which composed of inflation-protected U.S. Treasury bonds.

The fund generally invests at least 90% of its assets in the bonds of the underlying index and at least 95% of its assets in U.S. government bonds. It may invest up to 10% of its assets in U.S. government bonds not included in the underlying index, but which BFA believes will help the fund track the underlying index, and may also invest up to 5% of its assets in repurchase agreements collateralized by U.S. government obligations and in cash and cash equivalents.

TIP gives investors:

- Exposure to U.S. TIPS, which are government bonds whose face value rises with inflation.

- Access to the domestic TIPS market in a single fund.

- Seek to protect against intermediate-term inflation.

“Gold, widely viewed as a hedge against inflation and currency debasement, has gained 26% this year, benefiting from unprecedented global stimulus and near-zero interest rates,” the article added.

That said, another iShares ETF to consider is the iShares Gold Trust (IAU). IAU seeks to reflect generally the performance of the price of gold, and the Trust seeks to reflect such performance before payment of the Trust’s expenses and liabilities.

The Trust does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of gold. The advisor intends to constitute a simple and cost-effective means of making an investment similar to an investment in gold. An investment in physical gold requires expensive and sometimes complicated arrangements in connection with the assay, transportation, warehousing, and insurance of the metal.

For more market trends, visit ETF Trends.