The major indexes are roaring back as Biden’s new administration gets ready to take the helm of the White House. While it’s easy to get lost in the good vibrations of green markets, it’s hard to forget the sea of red in the beginning of the year. To protect from another market downturn, investors can consider funds like the iShares Edge MSCI Minimum Volatility USA ETF (USMV).

USMV seeks the investment results of the MSCI USA Minimum Volatility (USD) Index. The fund will invest at least 90% of its assets in the component securities of the index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents.

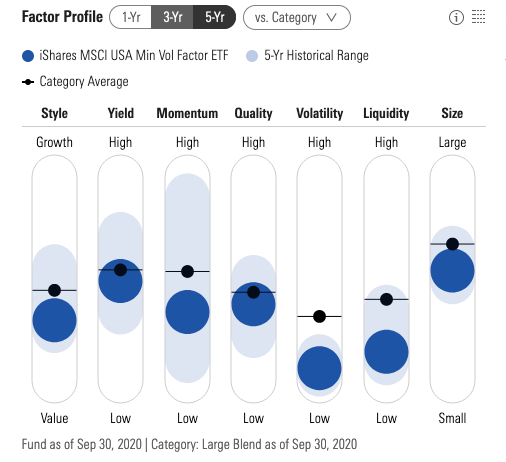

The index measures the performance of large and mid-capitalization equity securities listed on stock exchanges in the U.S. that, in the aggregate, have lower volatility relative to the broader U.S. equity market. Its 5-year factor profile via Morningstar, shows that it’s never one-sided toward any particular factor.

Per Morningstar performance numbers, the fund has churned out a 2.62% return thus far this year, but given the market tumult in 2020, it’s still an accomplishment to be in the green. With the markets starting to swing to the upside, USMV will be able to capture any broad market gains while protecting ETF investors from further the downside should another market downturn occur.

2021 Prognosis

Where’s the market heading in 2021? With all the positive momentum surrounding the creation of a COVID-19 vaccine, things seem to keep heading towards the green, but the pandemic always remains a wildcard.

Even the best and brightest in the hedge fund world are still wary of the virus:

Per a New York Post article, “Billionaire hedge fund investor Bill Ackman said Thursday that he expects to see market gains next year but warned there could be volatility in the months ahead as the coronavirus continues to take its toll. Ackman told investors that he’s ‘happy to be long’ on equity exposure and is ‘bullish’ on 2021 at a time of low interest rates, more expected stimulus and infrastructure spending.”

“But he also warned that dark days lie ahead as the United States passed a milestone with 250,000 coronavirus deaths,” the article added. “While he is generally optimistic, the investor said it is ‘prudent’ to insure his portfolio now amid a range of uncertainties that can lead to market volatility.”

For more news and information, visit the Equity ETF Channel.