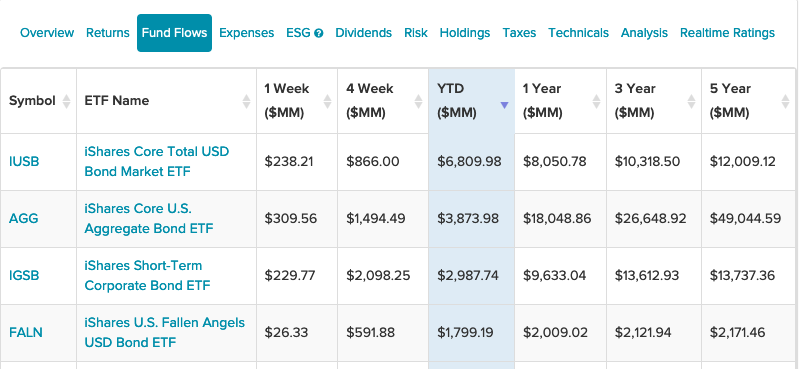

The iShares brand has a plethora of bond-focused ETFs to consider and one place to start is to look at which funds are receiving the highest inflows thus far this year.

Core Bond Exposure

Getting core bond exposure still has its place in a portfolio. At the top of the iShares YTD fund flows is the iShares Core Total US Bond Market ETF (IUSB).

IUSB seeks to track the investment results of the Bloomberg Barclays U.S. Universal Index. The fund generally will invest most of its assets in the component securities of the index and may also invest in certain futures, options and swap contracts, cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates, as well as in securities not included in the underlying index, but which BFA believes will help the fund track the underlying index.

Next is the iShares Core U.S. Aggregate Bond ETF (AGG), which has been the go-to fund for investors who want that core bond exposure since 2003. AGG eeks to track the investment results of the Bloomberg Barclays U.S. Aggregate Bond Index.

The index measures the performance of the total U.S. investment-grade bond market. The fund generally invests at least 90% of its net assets in component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the economic characteristics of the component securities of its underlying index.

Short-Term and Fallen Angels

Getting corporate bond exposure in the short-term horizon gives investors the ability to obtain yield, but minimize duration risk. For investors who opt for the short end of the yield curve, there’s the iShares Short-Term Corporate Bond ETF (IGSB).

With its low 0.06% expense ratio, IGSB seeks to track the investment results of the ICE BofA 1-5 Year US Corporate Index. The underlying index measures the performance of investment-grade corporate bonds of both U.S. and non-U.S. issuers that are U.S. dollar-denominated and publicly issued in the U.S. domestic market and have a remaining maturity of greater than or equal to one year and less than five years.

Finally, there’s the iShares Fallen Angels USD Bond ETF (FALN). The fund seeks to track the investment results of the Bloomberg Barclays US High Yield Fallen Angel 3% Capped Index composed of U.S. dollar-denominated, high yield corporate bonds that were previously rated investment grade.

The fund generally will invest at least 90% of its assets in the component securities of the index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash, and cash equivalents. The index is designed to reflect the performance of U.S. dollar-denominated, high yield corporate bonds that were previously rated investment grade.

For more news and information, visit the Equity ETF Channel.