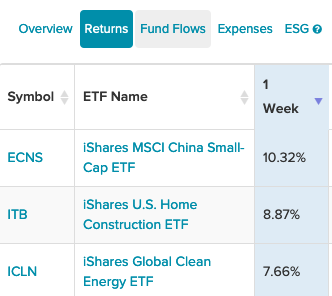

Themes like clean energy are showing up in some iShares strong performers. Other sectors are seeing noticeable gains in small cap China equities and home builders.

Small cap equity performance isn’t just relegated to the U.S. China is also seeing small cap strength in ETFs like the iShares MSCI China Small-Cap ETF (ECNS).

ECNS seeks to track the investment results of the MSCI China Small Cap Index. The fund generally will invest at least 90% of its assets in the component securities of the underlying index and in investments that have economic characteristics that are substantially identical to the component securities of the underlying index.

The index is a free float-adjusted market capitalization-weighted index designed to measure the performance of the small capitalization segment of Chinese equity securities markets, as represented by the H-shares and B-shares markets. The fund is up over 30% within the past year.

Home Builder and Clean Energy Strength

The real estate sector is showing signs of life. The ISE Exclusively Homebuilders Index is up 28% within the past year. This is helping ETFs like the iShares U.S. Home Construction ETF (ITB), which has also gained about 28% in the same time frame.

ITB offers exposure to the U.S. homebuilding industry and, as such, offers exposure to a corner of the domestic economy that tends to be cyclical in nature. In addition to pure-play homebuilders, this fund includes companies related to the homebuilding industry, such as Home Depot.

“U.S. home construction jumped 5.8% in December to 1.67 million units, a 14-year high that topped the strongest annual showing from the country’s builders in 15 years,” an article in The Mercury noted. “The better-than-expected December gain followed an increase of 9.8% in November when housing starts climbed to a seasonally adjusted annual rate of 1.58 million units, the Commerce Department reported Thursday. The December pace was the strongest since the building rate reached 1.72 million units in September 2006.”

Clean energy has been a strong-performing constant that is carrying over into 2021. The iShares Global Clean Energy ETF (ICLN), which seeks to track the S&P Global Clean Energy Index, is up over 160% the past year.

“The 2020s will be the decade in which the planet finally closes the chapter on destruction and pollution by fossil fuels and enters a new realm of clean and nearly free energy,” a Foreign Policy article said.

For more news and information, visit the Equity ETF Channel.