As the extended bull run is manifesting itself in new highs for the S&P 500 and Dow Jones Industrial Average, it’s been companies like Amazon that have been leading the charge with growth. The online retail giant is also in the forefront of hiring, which puts three ETFs on watch.

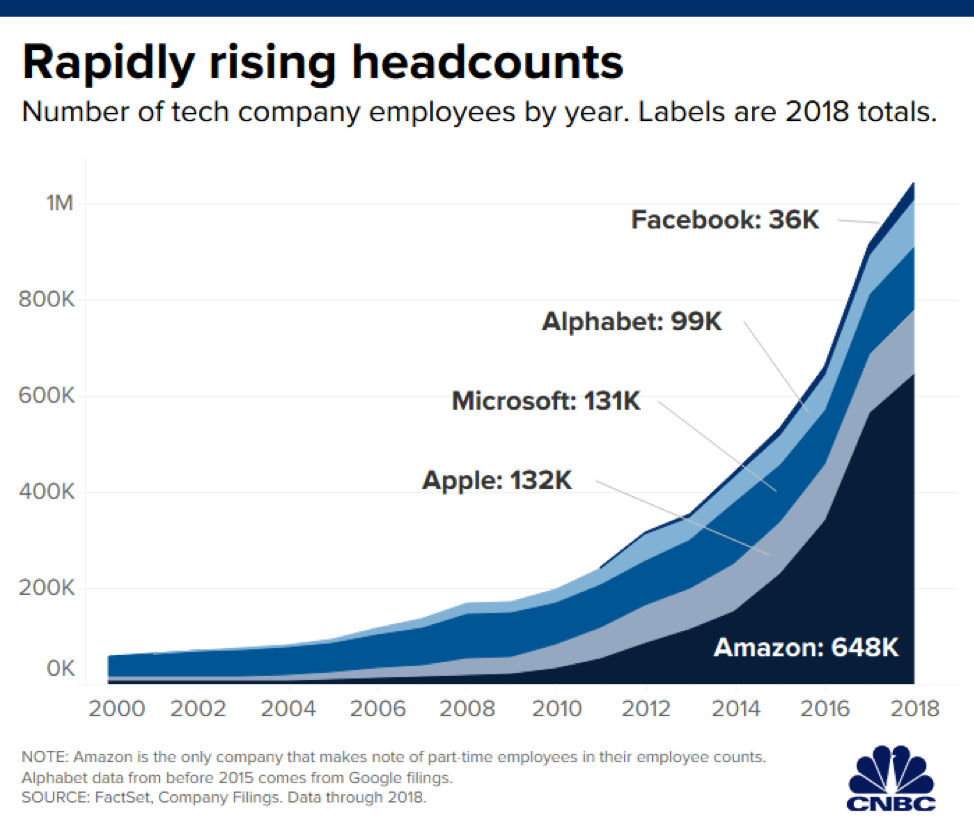

“Since 2000 (or since the earliest available data), Alphabet has grown the most, with a 2018 headcount a whopping 347 times what it was in 2001, according to a CNBC analysis,” said a CNBC report. “Amazon, meanwhile, is 72 times as large as it was in 2000. While Amazon has generated more jobs than any of the other four firms included above, the comparison is not quite apples-to-apples.”

“Amazon has hundreds of thousands of employees staffing its fulfillment centers and handling other distribution tasks, many of whom are paid hourly wages starting at $15 an hour,” the article added. “Amazon is also the only one of the big five tech companies to include part-time employees, and it noted that its headcount, which stood at 647,500 at the end of December 2018, can fluctuate depending on seasonal demand.”

3 ETFs to consider with heavy Amazon holdings:

- Fidelity MSCI Consumer Discretionary Index ETF (FDIS): seeks to provide investment returns that correspond generally to the performance of the MSCI USA IMI Consumer Discretionary Index. The index represents the performance of the consumer discretionary sector in the U.S. equity market.

- Consumer Discret Sel Sect SPDR ETF (NYSEArca: XLY): seeks investment results that correspond to the price and yield performance of publicly traded equity securities of companies in the Consumer Discretionary Select Sector Index. The index includes securities of companies from the following industries: retail; hotels, restaurants and leisure; textiles, apparel and luxury goods; household durables; automobiles; auto components; distributors; leisure products; and diversified consumer services.

- ProShares Online Retail ETF (NYSEArca: ONLN): seeks investment results, before fees and expenses, that track the performance of the ProShares Online Retail Index. The index tracks retailers that principally sell online or through other non-store channels. The index uses a modified market-capitalization weighted approach, is rebalanced monthly and is reconstituted annually. Retailers may include U.S. and non-U.S. companies. To be eligible, retailers must: be classified as an online retailer, an e-commerce retailer, or an internet or direct marketing retailer, according to standard industry classification systems; have a market capitalization of at least $500 million; have a six-month daily average value traded of at least $1 million; and meet other requirements.

For more market trends, visit ETF Trends.