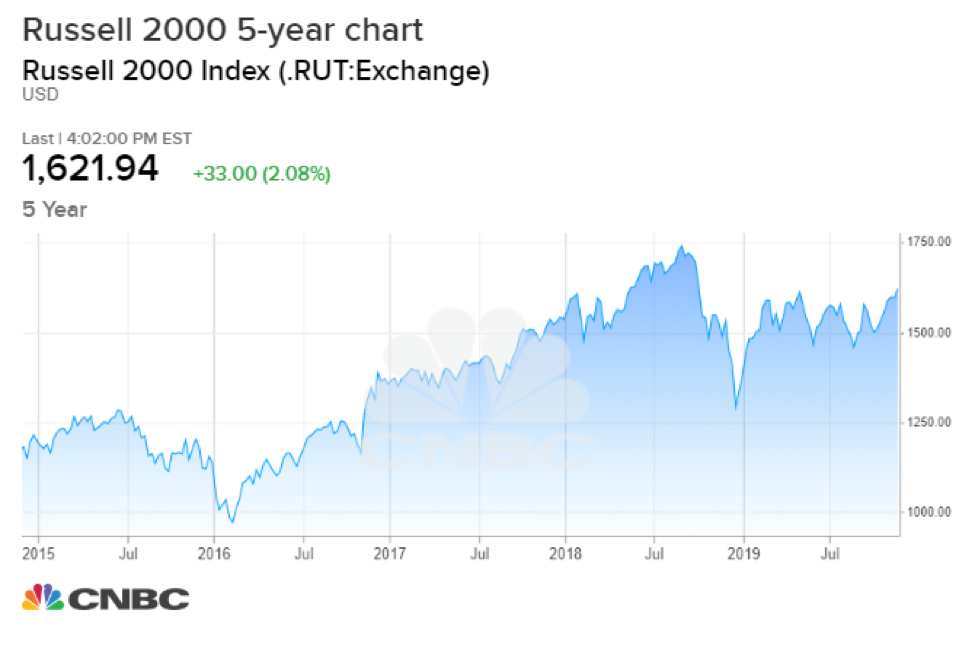

As the S&P 500 and Nasdaq Composite climbed to new highs on Monday, it was the lesser-known Russell 2000 index that reached a new 52-week high. The index, which is comprised primarily of small cap equities, could be flashing an opportunity for investors to get aboard the small cap train.

“The dynamics of this market are changing. The definition of this new uptrend that’s developing is that pullbacks should be shallower and shorter lived and and the upswings should be stronger,” said Ari Wald, technical strategist at Oppenheimer. “I think this is a market where global equities are breaking out across the board. It’s not just the U.S. large cap growth anymore. It’s U.S. broadly, and now small caps, a big breakout in the Russell 2000 today. You really have a market that is firing on all cylinders.”

The index has been trailing its bigger brethren indexes as they reached new highs, but it finally broke a previous high set back in May. Whether it can continue to rise past that level remains to be seen.

“One of the biggest divergences was that small caps have lagged, and this still has a while to go to recapture its all time highs from last fall,” said Frank Cappelleri, head market technician at Instinet. “This is really a step in the right direction, especially since it got through a level that was rejected a number of times.”

Here are three small cap ETFs to consider:

- Vanguard Small-Cap Index Fund ETF Shares (NYSEArca: VB): seeks to track the performance of a benchmark index that measures the investment return of small-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP US Small Cap Index, a broadly diversified index of stocks of small U.S. companies.

- Vanguard Small-Cap Value Index Fund ETF Shares (NYSEArca: VBR): seeks to track the performance of a benchmark index that measures the investment return of small-capitalization value stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP US Small Cap Value Index, a broadly diversified index of value stocks of small U.S. companies.

- Vanguard Small-Cap Growth Index Fund ETF Shares (VBK): eeks to track the performance of a benchmark index that measures the investment return of small-capitalization growth stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP US Small Cap Growth Index, a broadly diversified index of growth stocks of small U.S. companies.

For more market trends, visit ETF Trends.