![]()

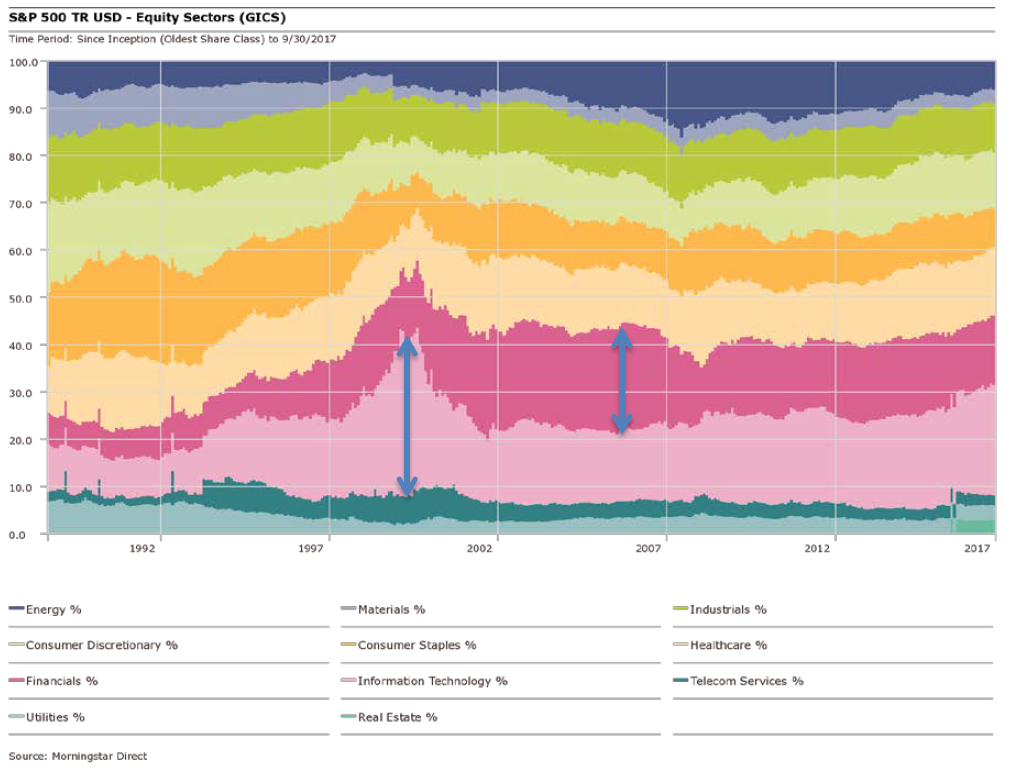

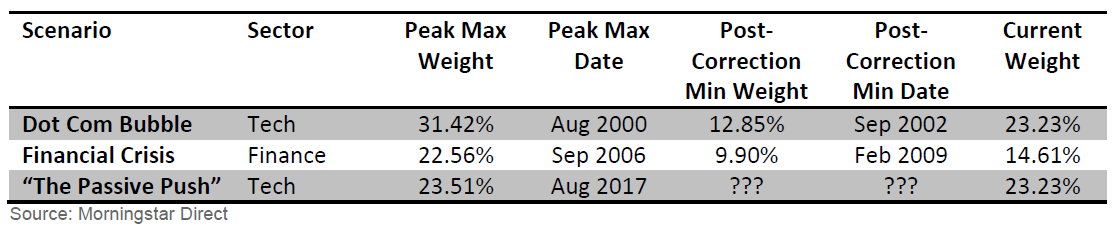

Following the bear markets of 2000-02 and 2007-09, technology and finance were reduced to well less than half of their peak weight in the S&P 500. Today, years later, they have yet to fully recover to their peak levels. While it’s anybody’s guess as to how much longer technology’s current run will go on, it is accurate to say that technology’s current weight is greater than it’s been since January 2001.

The Value of Equal Weight

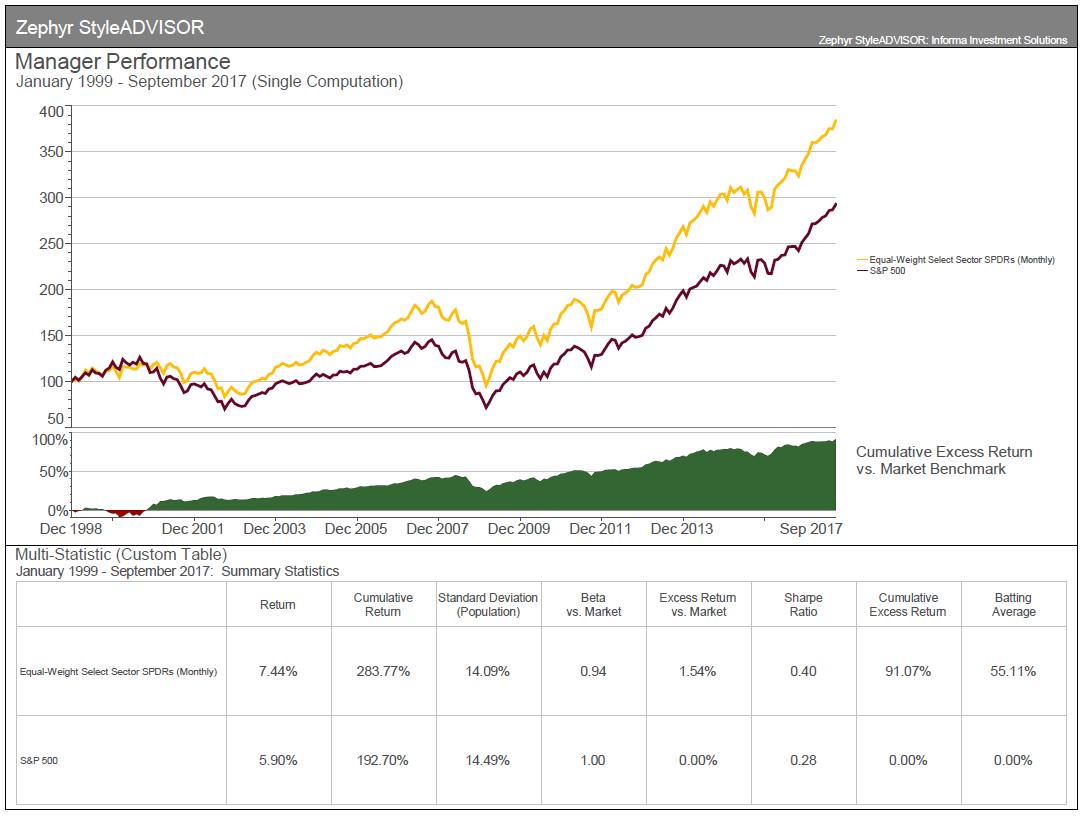

Equally weighting the sectors is a way to reduce the impact the positive feedback loop from the cap-weighted approach. As certain sectors run, the equal weight approach systematically reallocates to undervalued sectors. Such an approach is not making tactical calls on the relative strength or weakness of a given sector. Instead, it is a way of systematically “selling high, buying low.”

Also, equal weighting the sectors is more of a value, long-term investing approach. One way to think about a cap-weighted strategy is as a “momentum” strategy. The stocks or sectors that go up continue to attract assets until the tipping point is hit and the momentum reverses itself. With the equal-weighted sector approach being more of a “value” strategy, it shuns momentum and trends and focuses more on the long-term value of a company.

The aggregate impact on the portfolio is that you have more of a value tilt and less of an emphasis on the megacap names. Sometimes this works, sometimes it doesn’t. In 2015, when the “FANG” stocks delivered almost all of the S&P 500’s returns, the equal-weight strategy lagged. However, in 2016 equal weight was a positive driver to performance, as sectors like energy rallied. In 2017, the equal weight approach has trailed the S&P 500 as growth stocks have run circles around value stocks, again led by “FANG”. Long-term, however, the equal weight strategy still appears to be superior.

The DRS is in It for the Long Haul

Since the DRS is meant to be a long-term investment, the equal weight approach is aligned with our purpose. It has always been Swan’s philosophy that it is worth giving up some of the upside in order to potentially protect more on the downside. Minimizing losses is more important that maximizing gains. Obviously, the hedge is the most direct way we manage downside risk, but the equal weighted sector approach is another defensive aspect of the Defined Risk Strategy.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.