Research shows that women-led entrepreneurial firms tend to outperform their less-diverse peers. That’s the investment thesis behind EntrepreneurA, an SMA strategy managed by investment management firm, ERShares.

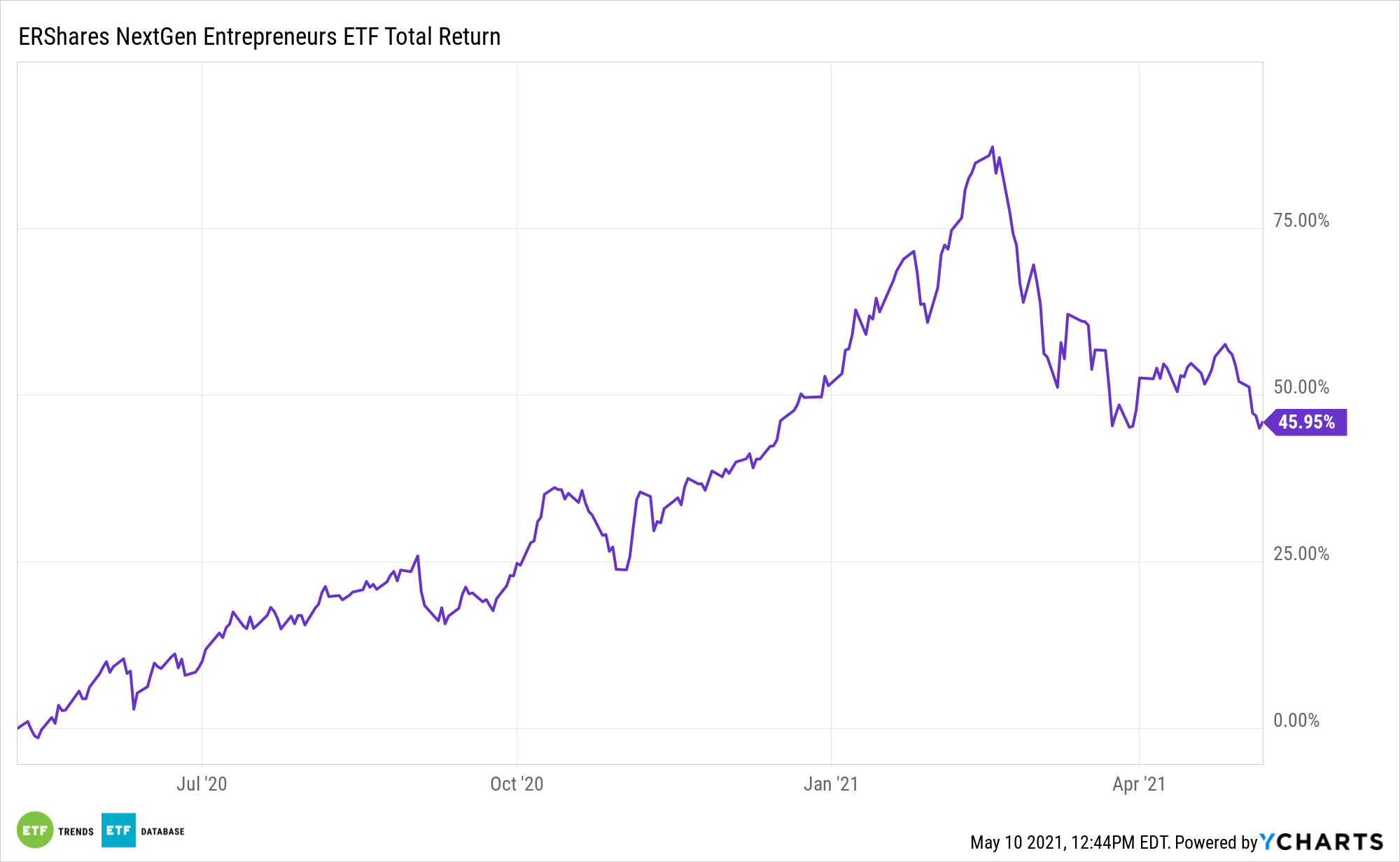

ERShares already has two entrepreneurial ETFs on the market: the ERShares Entrepreneurs ETF (ENTR) and the ERShares NextGen Entrepreneurs ETF (ERSX).

EntrepreneurA incorporates the same proprietary Entrepreneur Factor® that drives those two funds, but with an focus toward women-led companies.

“Women leadership has translated into better performance and astounding results,” says ERShares on the EntrepreneurA website.

Stronger Organization, Substantial Change

The idea is simple: research has shown that women in leadership positions tend to create “stronger organizational performance.” In the entrepreneurial space this has been “proven to bring substantial change within all industries,” says ERShares.

Beyond the firm’s signature Entrepreneur Factor®, the EntrepreneurA strategy distinguishes itself in several key ways, including its focus on entrepreneurial disruption, an investment process that’s truly global by design, and an emphasis on putting environmental, social, and corporate governance (ESG) principles into practice. For example, EntrepreneurA’s management team nears gender parity, with women in almost 50% of leadership positions.

In fact, ERShares’s research shows that female leaders can be especially conscious of the ESG impacts their companies have on the world, and that they’ll often work to mitigate environmental impacts while creating strong growth opportunities.

Women Leading Disruptive Change

EntrepreneurA capitalizes on the fact that women are assuming more and more leadership roles worldwide, bringing fresh perspectives and skill sets to create growth in traditionally male-dominated fields.

“Women-led organizations often behave differently from typical companies, especially on important social responsibility, corporate turnover, compensation and Board composition metrics,” says the EntrepreneurA website.

What’s more, investing in female leaders on a global level offers great diversification opportunities for investors, and may help create a more stable portfolio with better risk-adjusted returns.

To learn more about the benefits of investing in female entrepreneurs, visit the EntrepreneurA website.

For more news, information, and strategy, visit the Entrepreneur ETF Channel.