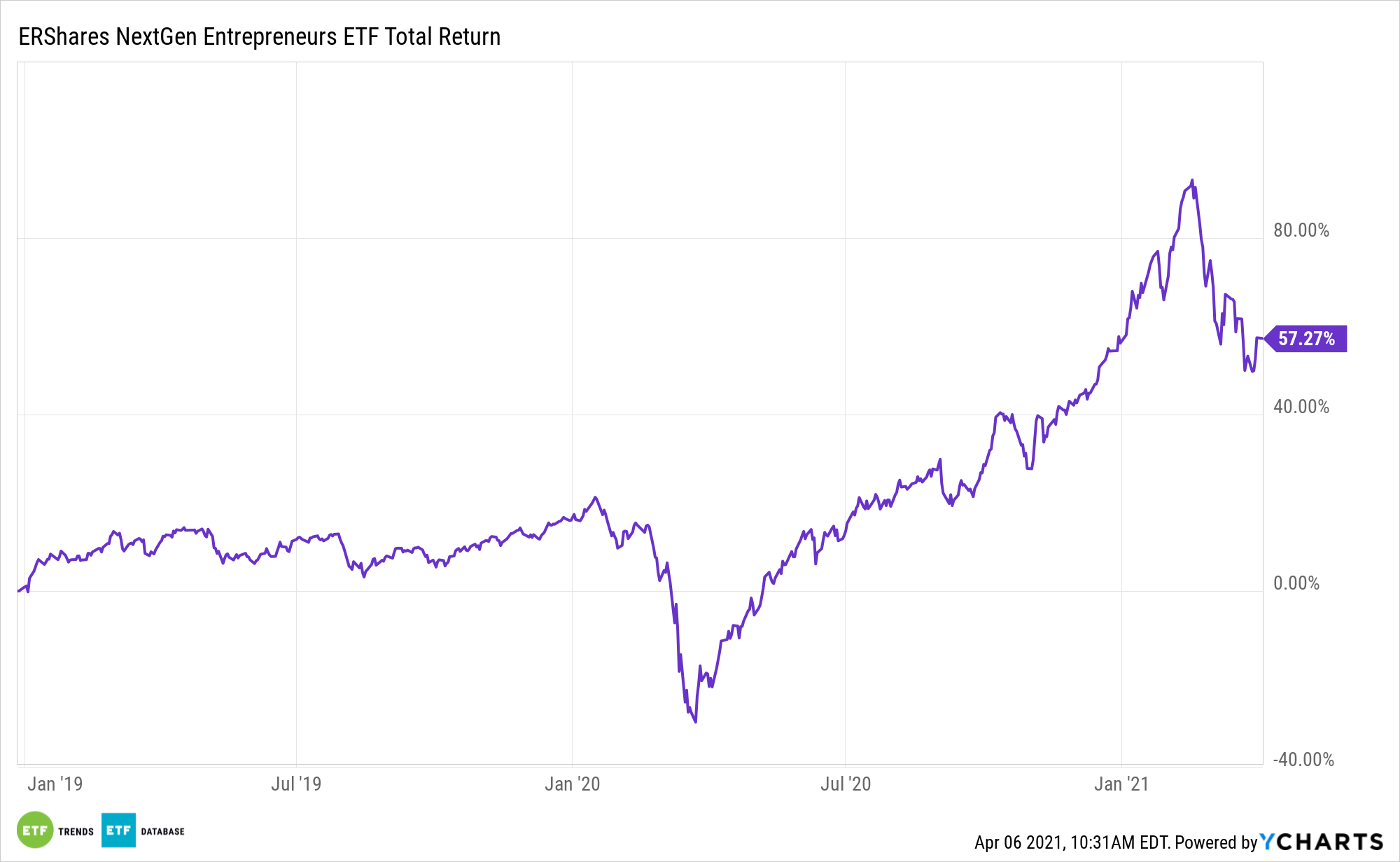

Small cap stocks and the ERShares NextGen Entrepreneurs ETF (ERSX) were hot for awhile. Then they weren’t. But multiple factors are swinging back in its favor.

ERSX selects the most entrepreneurial, primarily non-U.S. small cap companies that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers strong performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

“First, the next US budget may boost economic growth via spending on infrastructure, on-shoring manufacturing, health care, etc. Small caps are likely beneficiaries as they are much more highly levered to GDP,” according to Bank of America research. “Second, a stronger dollar is likely given the widening growth differential between the US & other developed economies. Small caps in the US rely much more on domestic revenue than larger companies and so should be relative winners.”

Timing the ‘ERSX’ Rally

ERSX isn’t a traditional ETF. It blends domestic and international exposure, which is relevant at time when many markets are betting international smaller stocks will top U.S. equivalents. Non-U.S. equities are poised to take flight, and it’s possible that this asset class is in for a substantial period of out-performance.

“The next US budget may boost economic growth via spending on infrastructure, on-shoring of manufacturing, health care, etc. Small caps are likely beneficiaries as they are much more highly levered to GDP and have tended to outperform large stocks during periods of faster economic growth,” notes Bank of America.

See also: ERSX: A Powerful Small Cap ETF for Stimulus Bets

A dollar rebound would also be supportive of ERSX upside.

“Our FX strategists expect USD strength because of the widening growth differential between the US & other developed economies and monetary policy divergence between the Fed and ECB. This will likely attract more foreign capital to US markets and benefit small-caps, which rely much more on domestic revenue than larger companies,” concludes Bank of America.

For more investing ideas, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.