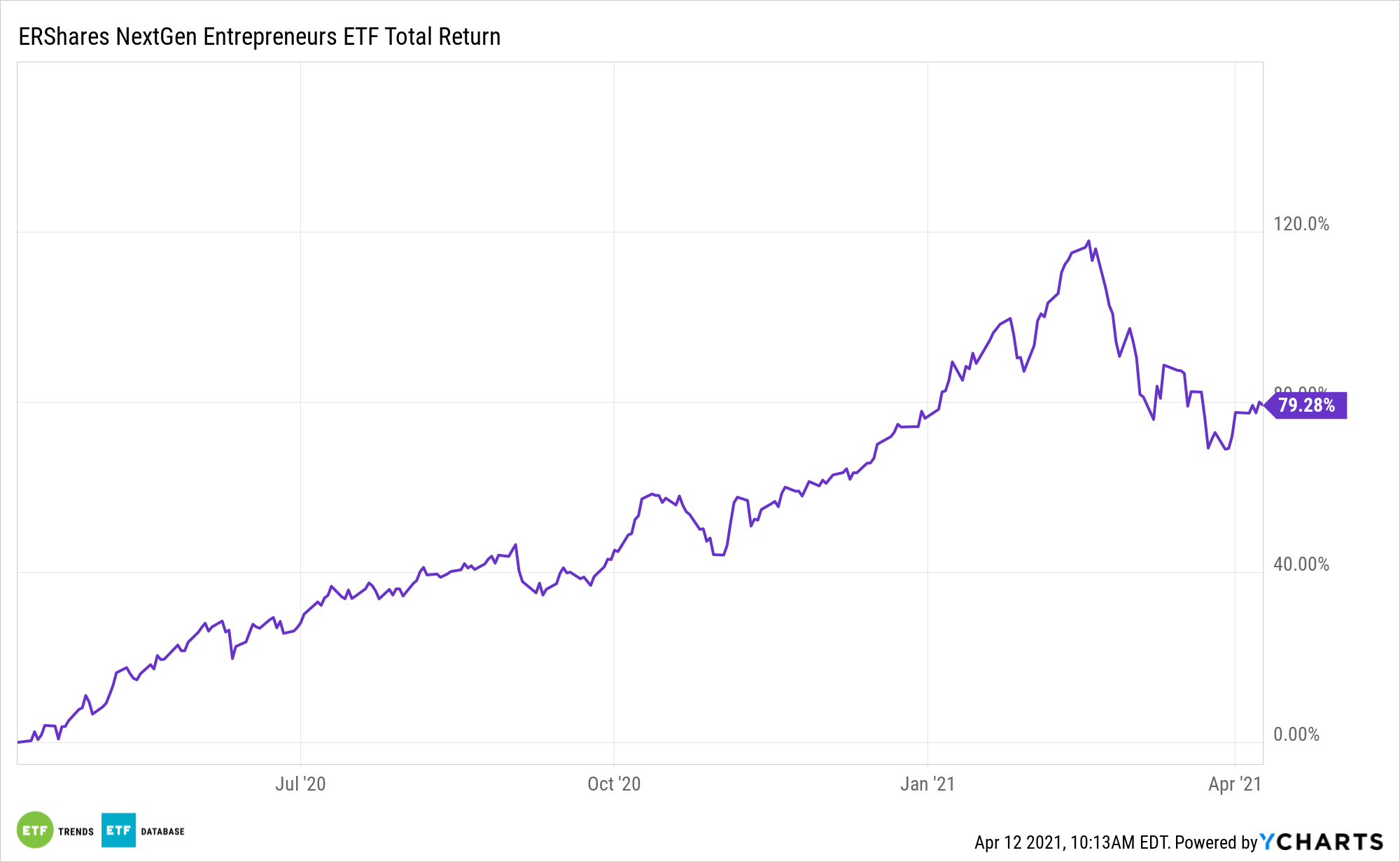

The ERShares NextGen Entrepreneurs ETF (ERSX) isn’t a standard small cap. By blending domestic and international exposure, this ETF can thrive in the second quarter and back half of the year.

ERSX selects the most entrepreneurial, primarily non-U.S. small cap companies that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

See also: The Small Cap ERSX ETF: Finding Hidden Gems Abroad

“International equities continued to rise in 2021’s first quarter, though at a slower pace than in 2020’s final frame when optimism about coronavirus vaccine approvals fueled double-digit gains,” notes Morningstar analyst Eric Schultz.

ERSX Right Mix for Second Half Comeback

NextGen entrepreneurs are the up and coming entrepreneurs with compelling growth potential. They are global in nature, smaller in market cap size, and typically unknown to most investors.

Small cap investors already know that looking at equities outside the large cap universe can yield substantial gains, but one area they may not have considered is looking abroad.

International small caps have “generated annual returns of only 6.7% for the past 10 years compared to 14% for the U.S. Large Company Index (per IFA data). However, valuations are attractive and there are two emerging catalysts that could propel the sector to outperform U.S. large caps in the coming years,” according to Seeking Alpha.

International small caps are generally export-oriented, globally structured, innovative, and have a high to dominant share of a niche market, often one in which the U.S. counterparts don’t compete effectively.

ERSX also blends growth and value.

“Value stocks’ resurgence relative to growth stocks, which started in late 2020, picked up steam last quarter. The foreign large-value Morningstar Category gained 8% versus foreign large-growth’s 0.6%. Similarly, foreign small/mid-value gained 8.8% against foreign small/mid-growth’s 1.3%. U.S. stocks followed the same pattern, with value beating growth across the market-cap spectrum,” adds Morningstar.

For more investing ideas, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.