Some of the most exciting entrepreneurial stories are taking place in the renewable energy space, where business leaders are striving to find profitable business models that are also beneficial for the environment.

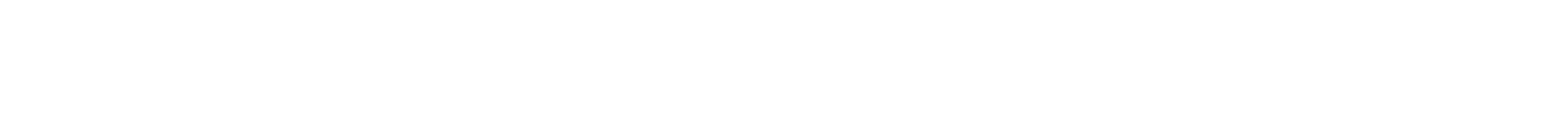

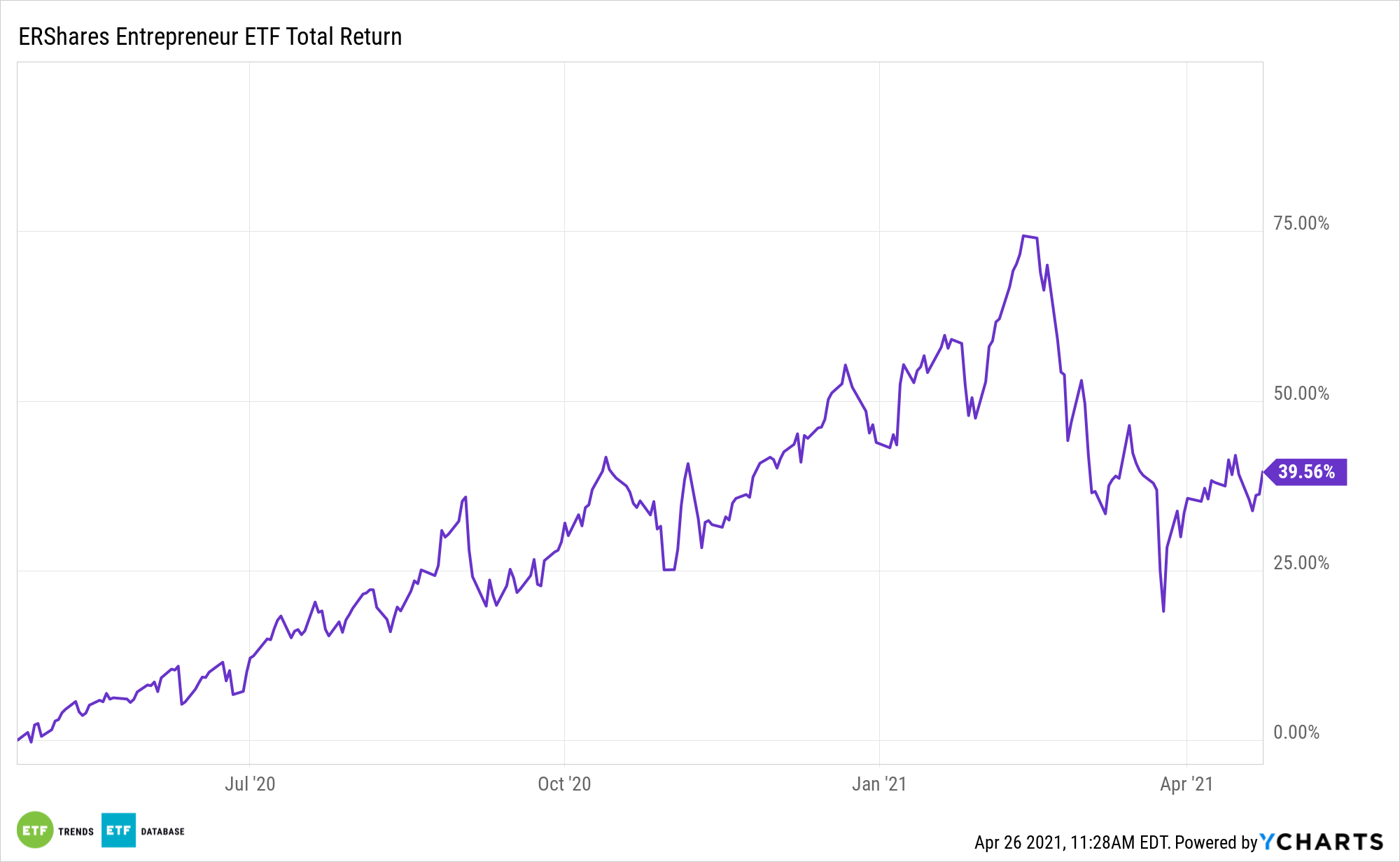

Investors looking to capture exposure to these renewable energy innovations may want to consider the ERShares Entrepreneurs ETF (ENTR) and the ERShares NextGen Entrepreneurs ETF (ERSX), which both contain companies working toward a brighter, cleaner energy future.

“At ERShares, we back the companies with the best entrepreneurial minds that invest in the right technology for a better and sustainable future,” says the ERShares website.

Through “disruptive advances in generating renewable energy in more efficient ways, reducing the construction costs or transmission loss for distribution, and integrating renewable energy into current industrials and households,” these entrepreneurial companies are quickly becoming leaders in their respective industries.

Categorizing Renewable Energy Companies

ERShares splits renewable energy into two categories: solar power—either power derived directly from solar energy sources (solar thermal and photovoltaics) or indirectly from solar energy sources (biomass, hydro, wind, and wave)—and power that isn’t solar at all in origin (like tidal and geothermal sources).

For example, Tesla Inc. (Nasdaq: TSLA) has scaled up from only producing electric cars to offering “infinitely scalable clean energy generation and storage products” currently, per the Tesla website. The founder-led company believes firmly in a future that is free of fossil fuels and continues to offer increasingly more affordable electric car options to consumers, while expanding into products that would allow for “homeowners, businesses, and utilities to manage renewable energy generation, storage, and consumption.” ENTR holds 1.75% of its portfolio in Tesla.

In addition, Niu Technologies (Nasdaq: NIU) makes high-performance electric bicycles, mopeds, and motorcycles, an environmentally friendly alternative to cars. In a recent sales volume release in April by Niu Technologies, total sales for Q1 topped out at 149,649 e-scooters, representing a 272.6% year-over-year growth, while sales solely within China were up 321.5%. Currently, ENTR holds a 0.85% weight in Niu Technologies, while ERSX has a 1.83% weight.

Yadea Technology Group Co, Ltd (HKEX: 1585) is another electric bicycles and motorcycles manufacturer. Yadea sold over 5.6 million e-scooters in 2020, making it the largest e-scooter manufacturer globally. Currently, ERSX holds 3.41% of its portfolio in Yadea.

Meanwhile, Hong Kong-based Tianneng Power International Limited (HKEX: 819) focuses on eco-friendly battery production and battery accessories. Per Reuters, the company produces “lead-acid motive battery products, such as electrical bicycle batteries, electrical tricycle batteries and pure electric car batteries” and “recycled lead products, lithium battery products, as well as new energy storage battery products for wind and solar power generation systems.” ESRX has a 1.86% holding in Tianneng Power.

Finally, SolarEdge (Nasdaq: SEDG) is a leading solar inverter (PV inverter) manufacturer globally, offering products in residential, commercial, energy storage and backup solutions, home energy management, EV charging, grid services, and more. Since its IPO on Nasdaq in 2015, the firm has shown excellent growth in revenue. SolarEdge has a 2.23% holding in ESRX.

For more information, visit our Entrepreneur ETF Channel.