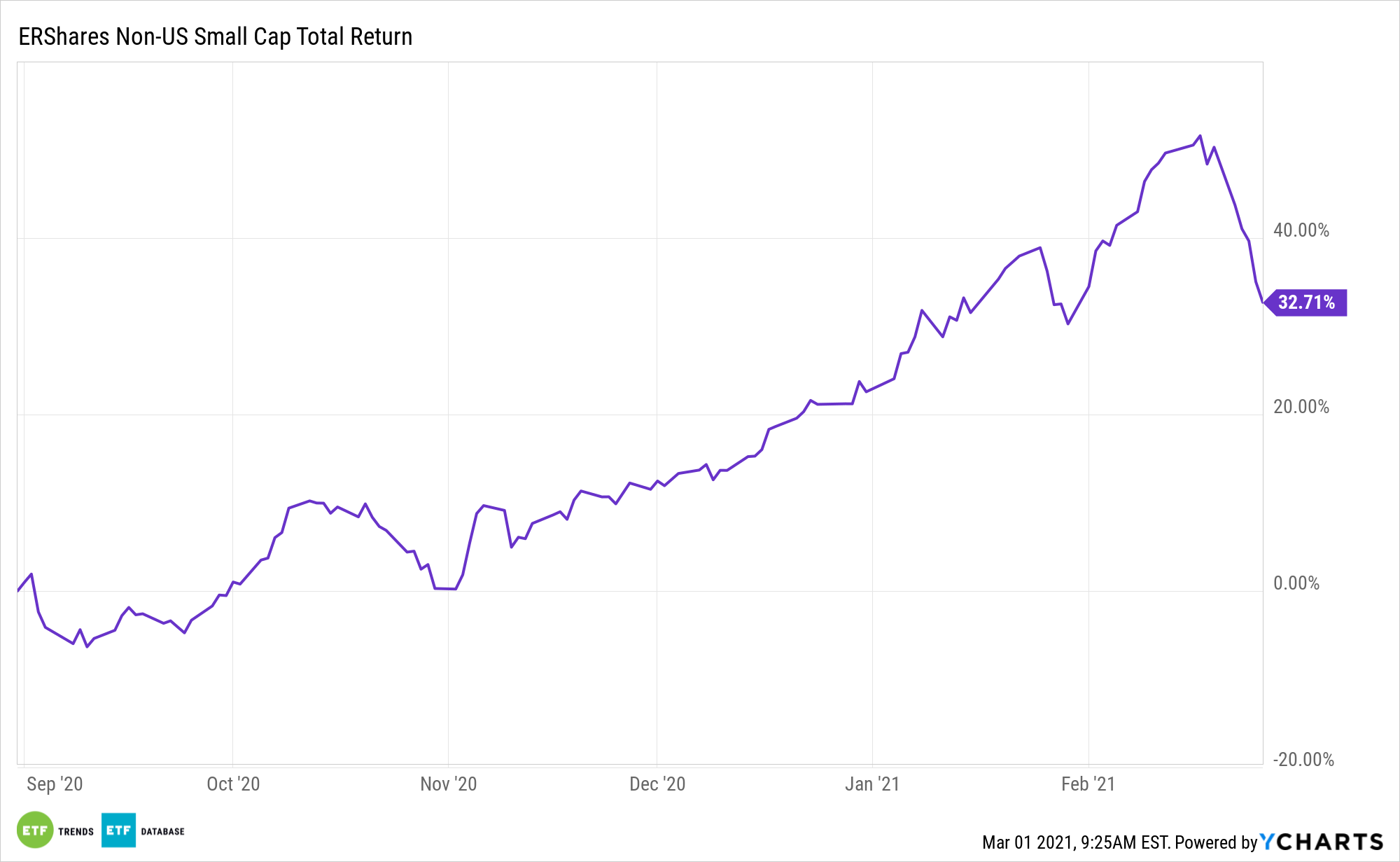

Small cap stocks are hot. The ERShares NextGen Entrepreneurs ETF (ERSX) is standing out as well positioned ETF in the small cap space to take advantage of potential upside resulting from the steepening yield curve.

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

Investors should consider the implications of a steeper yield curve as it relates to smaller stocks.

“The steepness of the yield curve is a decent indicator of future financial-market liquidity. It is tough to depict all of the different bond yields along the entire maturity spectrum, and so I am simulating that yield-curve steepness by looking at the spread between 10-year Treasury note yields and three-month T-bill yields. And the key insight is that the movements of this yield spread tend to get echoed approximately 15 months later in the relative-strength ratio of the Russell 2000 versus Russell 1000,” according to McClellan Financial Publications.

A Credible Catalyst for ERSX

The yield curve elevates when interest rates on longer-term bonds are higher than those on the shorter term bonds and, as a result, the spread between them broadens. In the spring and summer, the opposite occurred.

ERSX isn’t any old small cap ETF. It blends domestic and international exposure, which is relevant at time when many markets are betting international smaller stocks will top U.S. equivalents. Non-U.S. equities are poised to take flight, and it’s possible that this asset class is in for a substantial period of out-performance.

Another benefit with ERSX under a steepening scenario is that the fund has international exposure, meaning it’s ideal for elevated risk appetite and for investors seeking compelling valuations.

For more investing ideas, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.