Standard exchange traded funds focusing on growth stocks are just that: standard. The Entrepreneur 30 Fund (NYSEArca: ENTR) offers a fresh, modern approach to the revered growth factor.

With the aid of AI and Thematic Research, ERShares incorporates a macro-economic, top-down approach that integrates changing investment flows, innovation entry points, sector growth and other characteristics into a dynamic, global perspective model. ENTR’s positioning as a growth play is relevant following the 2020 elections.

“In contrast to research, most investment products focused on Growth stocks select stocks based on various backward-looking accounting metrics like sales or earnings growth, which does not necessarily equate to selecting the most expensive stocks,” according to Factor Research.

The Entrepreneur 30 Fund tries to reflect the performance of the Entrepreneur 30 Index, which is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards. ENTR is considered a large-cap growth ETF, a good status to have in recent years.

More on the ERShares Fund

“Many investors use Growth and technology stocks interchangeably,” notes Factor Research. “And indeed, the technology sector contributed approximately 25% of the stocks to the Growth portfolio since 1990, compared to only 13% to the overall stock market. The second largest contributor was the consumer discretionary sector, followed by industrials and healthcare.”

Technology, consumer cyclicals and healthcare are among the most prominent sector allocations found in the ERShares fund.

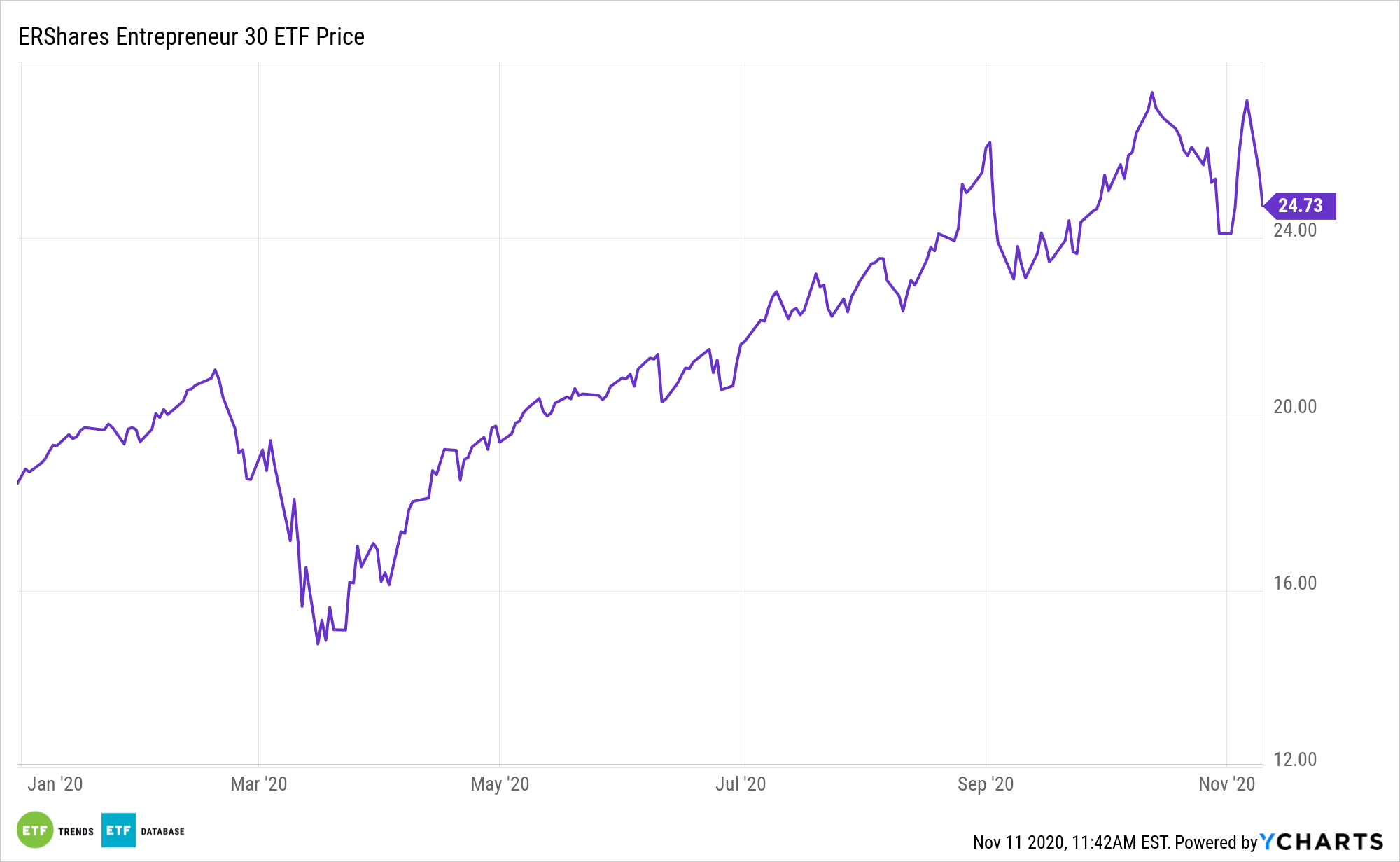

‘Disruptive growth’ is becoming a prominent investment catchphrase, and rightfully so. But it remains a vexing proposition for some investors. ENTR can ease that burden. Data confirm ENTR’s strategy has compelling long-term potential.

“We observe that an index comprised of the top 10% of fastest-growing companies in the US outperformed the stock market since 1992. However, the US Growth index only outperformed in certain periods and underperformed in market downturns like during the global financial crisis between 2008 and 2009. These performance characteristics are explained by Growth stocks featuring a beta of 1.2 on average, which effectively made Growth akin to a leveraged bet on the stock market,” notes Factor Research.

For more on entrepreneurial strategies, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.