Bonds are usually thought of as safe investments. The problem is, investors will often miss out on better returns to get them.

Some market observers believe it is appropriate for some investors to consider dialing back fixed income exposure in favor of international equities and small caps, two asset classes married in the ERShares NextGen Entrepreneurs ETF (ERSX).

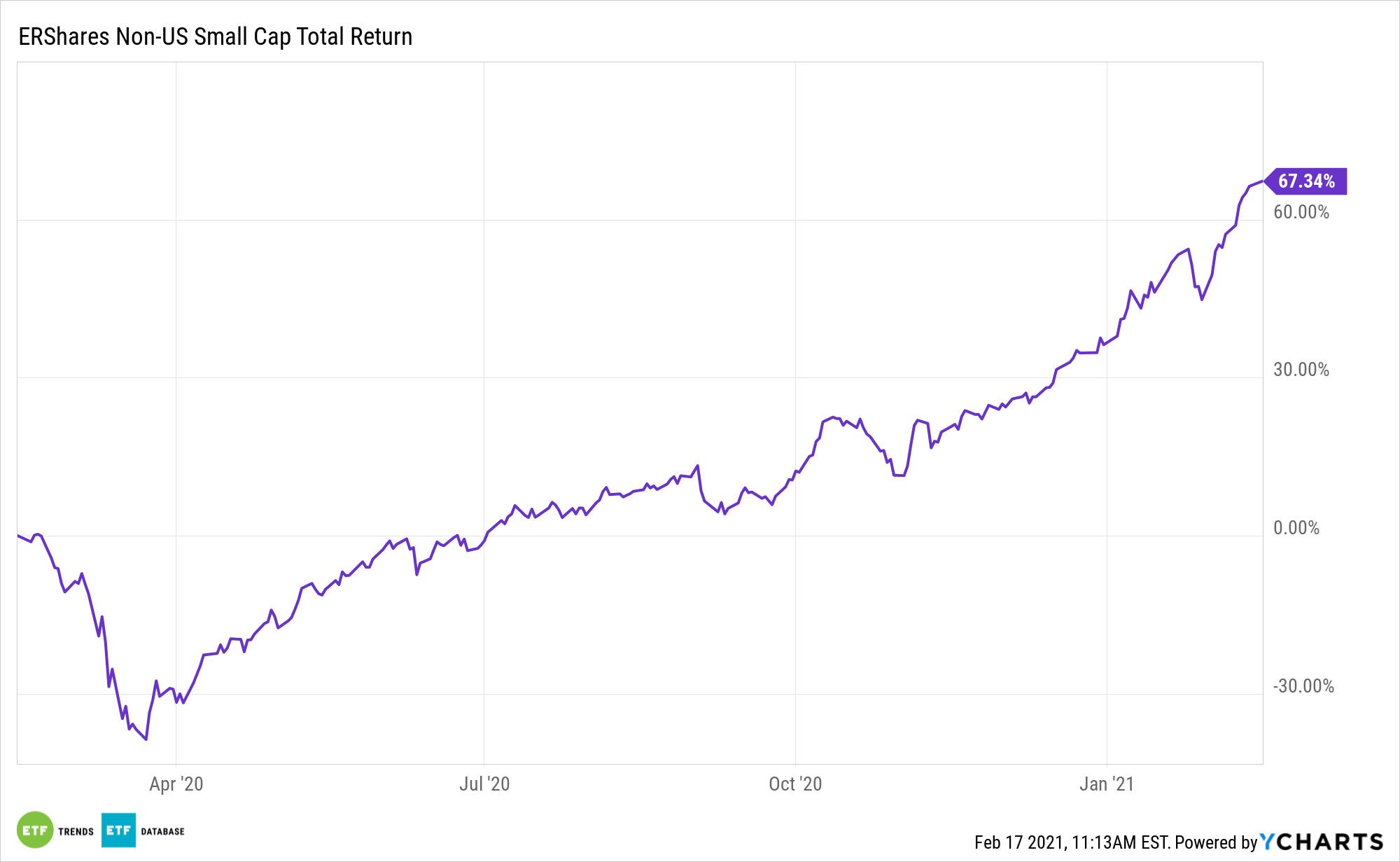

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

ERShares’ Joel Shulman notes that “investors should not be concerned about rising interest rates and inflation, though bond investors should be worried. Recent data support this conclusion. Last month-long bonds lost 5% while the S&P 500 increased by more than 4% for the largest differential in a decade. Shulman believes that International and Small Cap equities are the best places to invest and encourages investors to leave bonds,” according to the issuer.

Is the Time Right to Dial Back the Bond ETFs?

ERSX tracks a fundamental-selected index of global small cap ex-US equities weighted by market capitalization. The fund’s index is benchmarked against the FTSE All-World Ex-US Small Cap Index, a market-capitalization weighted index representing small cap stocks’ performance in developed and emerging markets excluding the United States. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalization.

With some long-running market trends poised to reverse this year, ERSX is all the more appealing.

“Bonds have experienced a 40-year period of general interest rate declines and 10-year rolling bond returns have generally been the same or better than stocks over the past decade,” notes ERShares, citing Shulman. “This has been bucking historical patterns. Moreover, US Large Cap stocks have outperformed US Small caps by 60% over the past 5 years and US equities have significantly outperformed international over the past 10. He believes all of these patterns will now reverse and is positioning ERShares portfolios to take advantage of this direction.”

For more investing ideas, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.