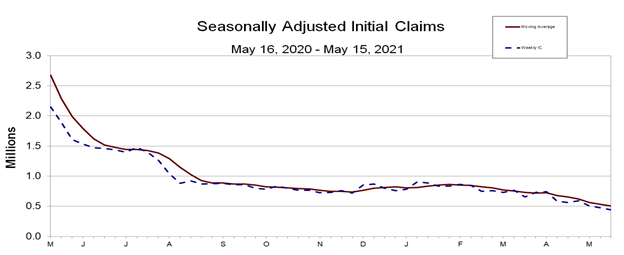

Last week, the number of US jobless claims fell to 440,000, the lowest number since the COVID-19 pandemic began last March, the Department of Labor reported.

The number of weekly claims has continued to fall all year, an encouraging sign that the job market continues to improve, spurred by the continuing vaccination rollout and the relatively rapid re-opening of the U.S. economy.

Source: Department of Labor, May 20, 2020.

As of the week ending May 1, about 16 million Americans were still receiving unemployment benefits, down from 16.9 million Americans the week prior.

That too suggests an America that’s getting back to work.

Entrepreneurs: Poised to Benefit from the Re-Opening

Much of this improvement in the U.S. employment market can be traced back to entrepreneurial firms, which tend to be job creators, hiring aggressively to serve an aggressive pace of growth.

Entrepreneurial companies provide the products and services that disrupt their industries, leveraging cutting-edge technology and the latest scientific advancements to change the way business is done in everything from bioscience to fashion.

Used to disrupting the status quo, these companies also can often offer attractive perks for prospective employees, including flex work hours, generous PTO and parental leave policies, and remote work options.

That makes them particularly poised to benefit from an economic reopening that acknowledges the new realities in employees’ lives, including virtual/hybrid schooling, increased caretaking responsibilities, and greater reliance on virtual forms of communication and collaboration.

Access Entrepreneurs with ‘ENTR’

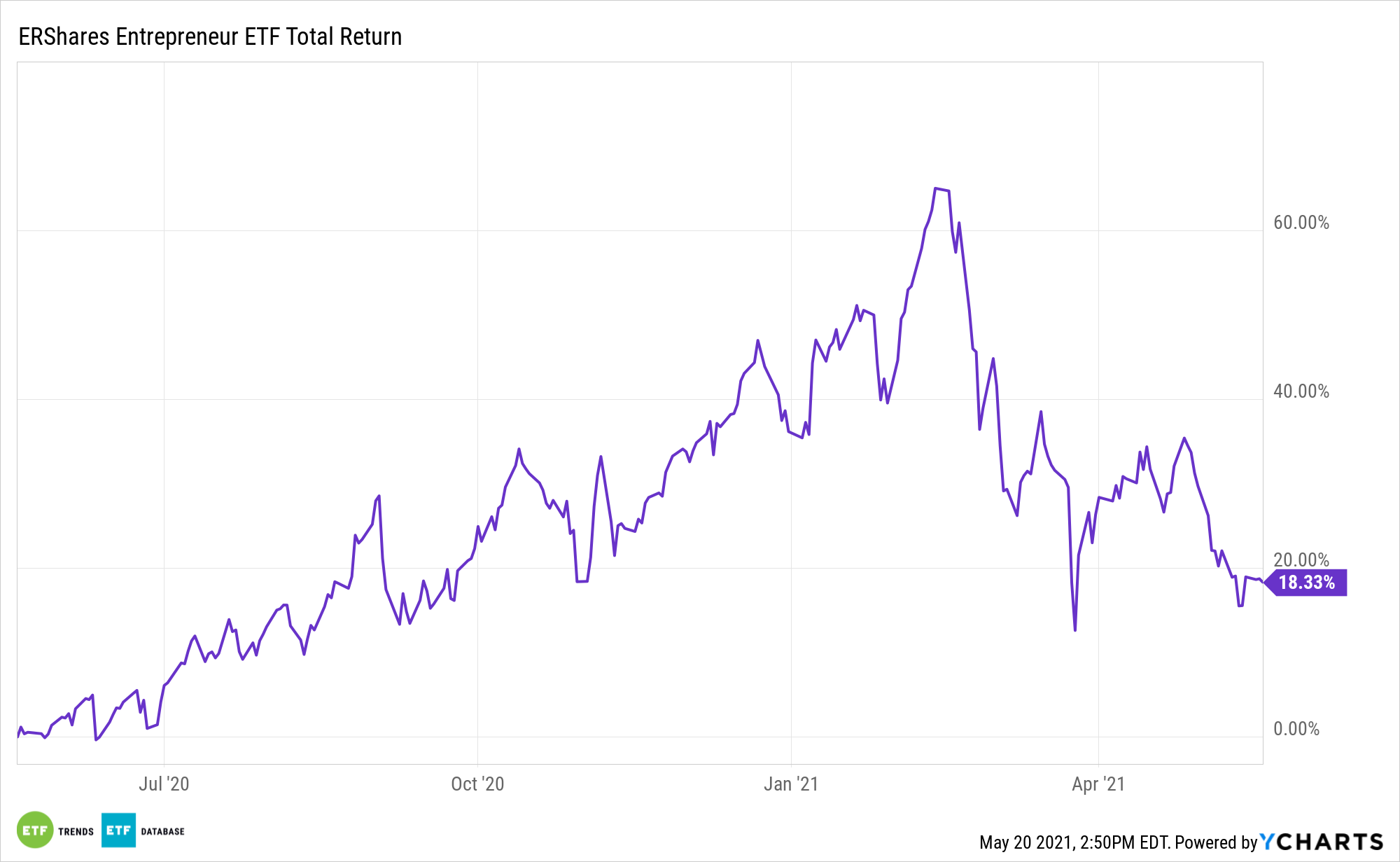

Investors seeking exposure to these job-creating entrepreneurial stocks can look to the ERShares Entrepreneurs ETF (ENTR), from ERShares.

ENTR holds a concentrated basket of U.S. mid- and large-cap stocks that are screened against the issuer’s proprietary Entrepreneur Factor model, which combines active management with machine learning techniques.

Currently, the fund’s top sector exposures include information technology (36%), healthcare (23%), and communication services (17%).

See also: How to Access the 5G Revolution through Entrepreneurial Stocks

Inside the portfolio are several of the usual FAANG names—Facebook (FB), Alphabet (GOOGL), and Amazon (AMZN)—but also some less familiar plays on the disruptive innovation theme, including Mercado Libre (MELI) and EPAM Systems (EPAM).

ENTR, which currently has $128 million in assets under management, has an expense ratio of 0.47%.

For more information, visit the Entrepreneur ETF channel.