With the Fed announcing its intent to taper asset purchases and the market expecting possible interest rate hikes as soon as 2022, many investors have been looking for a way to find more income in an inflationary environment. Several indicators have been signaling rising prices, and the Fed expects inflationary pressures to remain elevated into next year. For example, the Social Security Cost-of-Living adjustment for 2022 was 5.9% y/y—the highest annual increase since 1982.1 And headline numbers for the Consumer Price Index (CPI) increased 5.4% y/y in September (averaging over 4% annually).2

Recent inflationary pressures have been attributed to several lingering effects of the COVID-19 pandemic. Consumers shifted to buying goods over services, and demand for certain goods like home appliances and electronics increased significantly. Inventories were stretched thin, and supply chains were stressed as they were expected to move more goods on irregular routes. As a result, input costs rose including transportation costs and materials (e.g., copper, steel, semiconductors). Additionally, as many workers took unemployment and stimulus payments, companies scrambled to find workers as the economy re-opened, often having to resort to higher wages as incentive. As costs for corporations increased, companies with strong pricing power have increased prices of goods and services. These include sectors like healthcare and consumer staples, which have relatively stable demand in all economic conditions.

Why are investors concerned about inflation?

Inflation decreases purchasing power. Put simply—when the price of goods and services increases and your income does not increase (or increases at a slower rate), then you need more money to purchase the same goods. For an investor, this means that if inflation is 4% during the year and the investment portfolio also had a 4% total return, then the real return (i.e., inflation-adjusted return) is 0%. Theoretically, the investor could have held onto that money instead of spending time and effort investing.

Inflation can also diminish equity performance. The Fed can increase short-term interest rates in response to inflation. Equities generally react negatively to higher interest rates since the cost of borrowing becomes more expensive, which could reduce capital spending and hurt earnings growth. Additionally, higher interest rates can reduce valuations of future cash flows.

How do dividend investments perform during periods of high inflation?

While dividends are not a perfect inflation hedge, dividend payments are generally less volatile than earnings for several reasons. As mentioned earlier, those companies with strong pricing power can more effectively pass cost increases to customers and can maintain or even grow dividends during periods of high inflation. Even those companies that experience short-term earnings weakness due to inflation may still maintain their dividend payments to shareholders. Generally, dividend cuts are relatively uncommon since they send a negative signal about a company’s financial position and are often followed by price deterioration. When using an indexed product, the effect of one or even a few dividend cuts is reduced when averaged along with other constituents.

Other equity investments may also have additional inflation protection built into their dividends. Midstream companies, for example, often have contract provisions that protect them from inflation and offer the ability to pass on higher costs to customers.3 REITs also have inflation protection built into their dividend payments since real estate rental prices are typically tied to inflation—particularly for apartment leases which can typically be adjusted annually and for hotel REITs which can adjust room rates almost daily.

In contrast to equity dividends, bond coupons are usually paid at a fixed rate—so if inflation increases, the coupon payment stays low. This also decreases the selling price of the bond as new bonds are issued with higher coupons and older bonds become less valuable.

Bottom line:

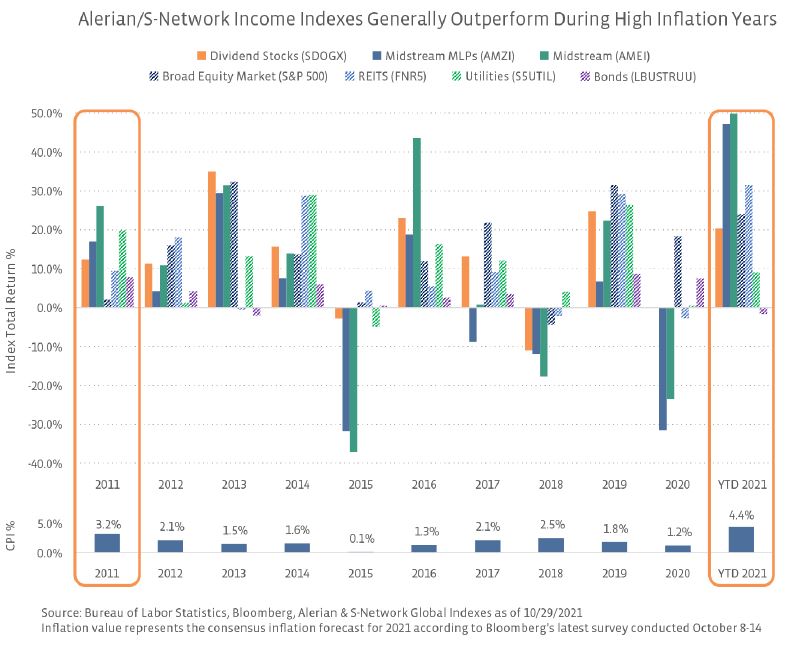

Equities which pay dividends are typically better positioned in an inflationary environment compared to the broader equity market or fixed income investments. While negative sentiment related to rising inflation or interest rates can hurt stock prices and temporarily weaken margins (and the price return of an investment), the relative stability of dividend income can help drive a higher total return. The total return for income-oriented indexes has often outperformed the broader market during high inflation years (e.g., 2011 and YTD 2021).

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR). SDOGX is the underlying index for the ALPS Sector Dividend Dogs ETF (SDOG).

Current Yields vs. History

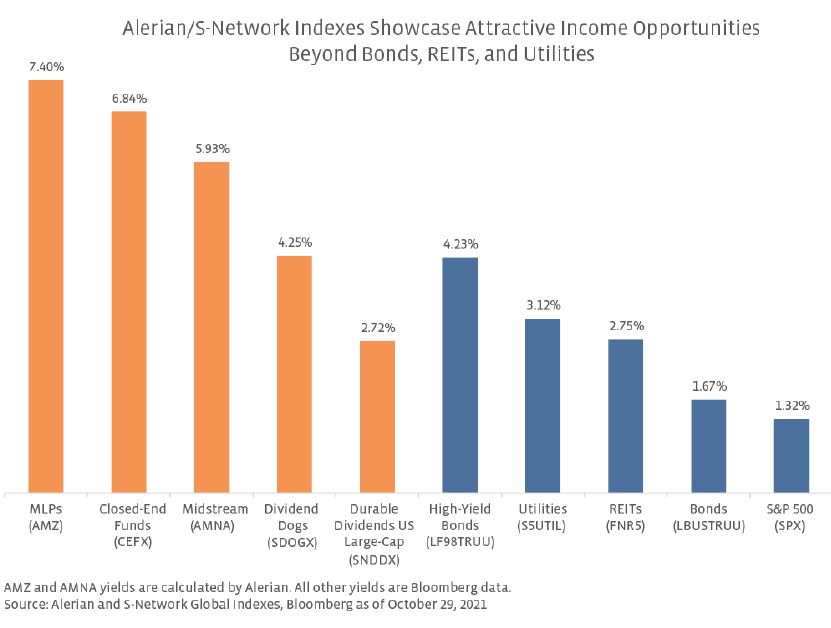

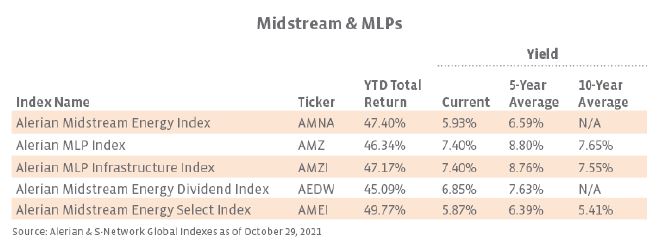

Following significant price improvement year-to-date through October, midstream yields are generally below 5-year historical averages, but YTD total returns are close to 50%.

Of the S-Network Sector Dividend Dogs, SDOGX and RDOGX have YTD total return over 20%. SDOGX has a current yield only modestly below its 5-year average.

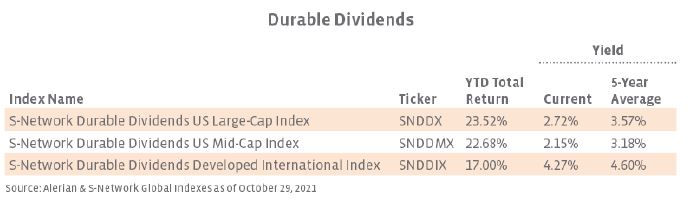

Multiple screens for dividend durability, including evaluating cash flows, EBITDA, and debt-to-equity ratios, help ensure reliable income from the durable dividend indexes. While current yields are below the 5-year average, they are well above the S&P 500’s current 1.32% yield.

Though current yields are below historical averages, closed-end funds continue to represent an attractive option for enhancing the yield of an income-oriented portfolio.

Related Research:

Robust Free Cash Flow Generation Sets Midstream Apart

Midstream Partnering for a Cleaner Tomorrow

US Production Outlook: Modest Growth Could Be Just Right

A Lesson on Leverage in Municipal Bond Closed-End Funds

Income Opportunities: High Yields Don’t Have to Mean Low Quality

Underlying Index |

Associated Product |

| Midstream/MLPs | |

| Alerian Midstream Energy Index (AMNA) | ETRACS Alerian Midstream Energy Index ETN (AMNA) |

| Alerian MLP Index (AMZ) | JP Morgan Alerian MLP Index ETN (AMJ), ETRACS Alerian MLP Index ETN Series B (AMUB), ETRACS Quarterly Pay 1.5X Levered Alerian MLP Index ETN (MLPR) |

| Alerian Midstream Energy Dividend Index (AEDW) | ETRACS Alerian Midstream Energy High Dividend Index ETN (AMND), Alerian Midstream Energy Dividend UCITS ETF (MMLP) |

| Alerian MLP Infrastructure Index (AMZI) | Alerian MLP ETF (AMLP), ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB) |

| Alerian Midstream Energy Select Index (AMEI) | Alerian Energy Infrastructure ETF (ENFR) |

| Sector Dividend Dogs | |

| S-Network Sector Dividend Dogs Index (SDOGX) | ALPS Sector Dividend Dogs ETF (SDOG) |

| S-Network International Sector Dividend Dogs Index (IDOGX) | ALPS International Sector Dividend Dogs ETF (IDOG) |

| S-Network Emerging Sector Dividend Dogs Index (EDOGX) | ALPS Emerging Sector Dividend Dogs ETF (EDOG) |

| S-Network REIT Dividend Dogs Index (RDOGX) | ALPS REIT Dividend Dogs ETF (RDOG) |

| Closed-End Funds | |

| S-Network Composite Closed-End Fund Index (CEFX) | Invesco CEF Income Composite ETF (PCEF), ETRACS 1.5X Leveraged Closed-End Fund ETN (CEFD) |

| S-Network Municipal Bond Closed-End Fund Index (CEFMX) | VanEck Vectors CEF Municipal Income ETF (XMPT) |

- The United States Social Security Administration – 2022 Cost-of-Living adjustment

- Bureau of Labor Statistics – September 2022 Consumer Price Index Summary

- Alerian & S-Network Global Indexes – Midstream/MLPs: Well-Positioned for Inflation

Originally published by Alerian on November 4, 2021.

For more news, information, and strategy, visit the Energy Infrastructure Channel.

Disclaimers

This Document Is Impersonal and Not a Solicitation. In jurisdictions where Alerian, S-Network Global Indexes, or their affiliates do not have the necessary licenses, this document does not constitute an offering of any security, product, or service. Alerian and S-Network Global Indexes receive compensation in connection with licensing its indices to third parties. All information provided by Alerian and S-Network Global Indexes in this document is impersonal and not customized to the specific needs of any entity, person, or group of persons. Alerian, S-Network Global Indexes, and their affiliates do not endorse, manage, promote, sell, or sponsor any investment fund or other vehicle that is offered by third parties and that seeks to provide an investment return linked to or based on the returns of any Alerian or S-Network Global Indexes index.

No Advisory Relationship. Alerian and S-Network Global Indexes are not investment advisors, and Alerian, S-Network Global Indexes, and their affiliates make no representation regarding the advisability of investing in any investment fund or other vehicle. This document should not be construed to provide advice of any kind, including, but not limited to, tax and legal.

You Must Make Your Own Investment Decision. It is not possible to invest directly in an index. Index performance does not reflect the deduction of any fees or expenses. Past performance is not a guarantee of future returns. You should not make a decision to invest in any investment fund or other vehicle based on the statements set forth in this document, and are advised to make an investment in any investment fund or other vehicle only after carefully evaluating the risks associated with investment in the investment fund, as detailed in the offering memorandum or similar document prepared by or on behalf of the issuer. This document does not contain, and does not purport to contain, the level of detail necessary to give sufficient basis to an investment decision. The addition, removal, or inclusion of a security in any Alerian or S-Network Global Indexes index is not a recommendation to buy, sell, or hold that security, nor is it investment advice.

No Warranties. The accuracy and/or completeness of any Alerian or S-Network Global Indexes index, any data included therein, or any data from which it is based is not guaranteed by Alerian or S-Network Global Indexes, and it shall have no liability for any errors, omissions, or interruptions therein. Alerian and and S-Network Global Indexes make no warranties, express or implied, as to results to be obtained from use of information provided by Alerian and S-Network Global Indexes and used in this service, and Alerian and S-Network Global Indexes expressly disclaim all warranties of suitability with respect thereto.

Limitation of Liability. While Alerian and S-Network Global Indexes believe that the information provided in this document is reliable, Alerian and S-Network Global Indexes shall not be liable for any claims or losses of any nature in connection with the use of the information in this document, including but not limited to, lost profits or punitive or consequential damages, even if Alerian and S-Network Global Indexes have been advised of the possibility of same.

Research May Not Be Current. This document has been prepared solely for informational purposes based on information generally available to the public from sources believed to be reliable. Alerian and S-Network Global Indexes make no representation as to the accuracy or completeness of this document, the content of which may change without notice. Alerian and S-Network Global Indexes expressly disclaim any obligation to update the contents of this document to reflect developments in the energy Master Limited Partnership sector. The methodology involves rebalancings and maintenance of indices that are made periodically throughout the year and may not, therefore, reflect real-time information.

Linked Products. Alerian and S-Network Global Indexes licenses its indexes to third parties for the creation of investment funds or other vehicles. Alerian and S-Network Global Indexes are not responsible for the information on these websites or for anything that they provide.

Policies and Procedures. Analytic services and products provided by Alerian and S-Network Global Indexes are the result of separate activities designed to preserve the independence and objectivity of each analytic process. Alerian and S-Network Global Indexes have established policies and procedures to maintain the confidentiality of material non-public information received during each analytic process. Alerian, S-Network Global Indexes, and their affiliates provide a wide range of services to, or relating to, many organizations, and may receive fees or other economic benefits from these organizations.

Copyright. No Unauthorized Redistribution. Alerian and S-Network Global Indexes © 2021. All rights reserved. This document, in whole or in part, may not be redistributed, reproduced, and/or photocopied without prior written permission.