DT Midstream is looking at a possible carbon neutral expansion for its liquified natural gas exports.

“We’re announcing a first-of-its-kind in the sector, a wellhead-to-water, carbon-neutral expansion,” DT Midstream CEO David Slater said. “This system can be expanded by up to 2 Bcf/d. The market that we’re targeting is all of our LNG customers, whom we currently directly tie into… We’re partnering with not only our producers, but our LNG customers, to really create a continuous pathway to have a verifiable low-carbon LNG source that can come out of us and serve the world market.”

The expansion of the Haynesville system would allow DT Midstream to move fuel to the Gillis hub of Louisiana, an important delivery point for industrial supply in the Gulf Coast region. The proposed facilities would be paired with carbon capture and storage and utilize electric compression supplied by renewable generation. Additionally, there are plans for carbon offsets to counteract the residual emissions. Electrical glycol pumps, instrument air systems, vent control devices, hydrogen, and biosequestration offsets are all on the table.

Slater said to a crowd at the LDC Gas Forum, “It’s clearly a societal priority for us to move to a lower carbon economy. This journey isn’t a U.S. journey, or a North American journey. This is a global journey.” Slater went on to discuss the need for a holistic view, however, noting that some lower income people “cannot afford massive energy cost increases. They may aspire to a lower carbon future, but again, these are forces that we have to balance…We can’t disenfranchise one-third of our population. They can’t afford what maybe many of us in this room could afford.”

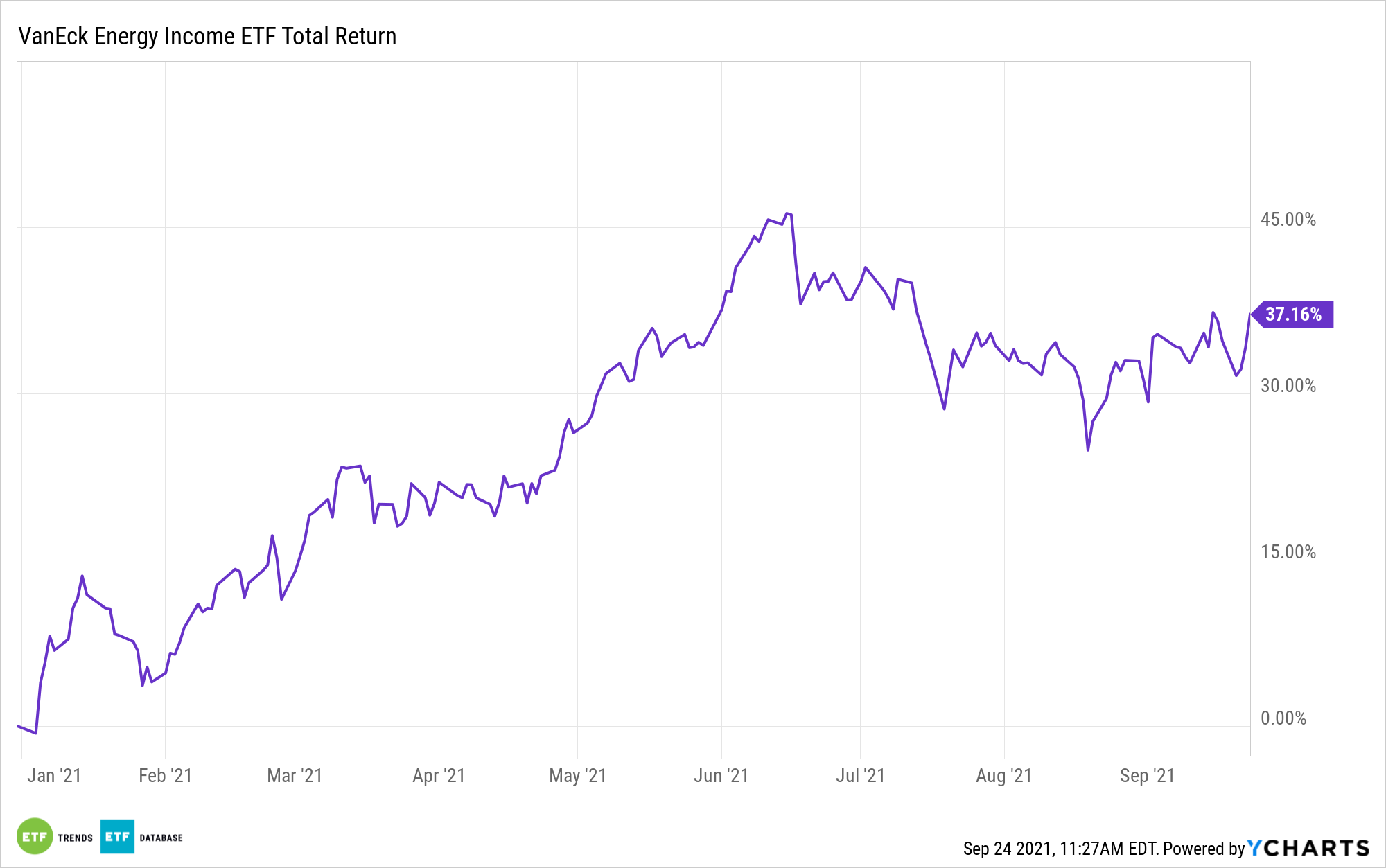

DT Midstream is held by a number of ETFs, including the VanEck Energy Income ETF (EINC), which allocates 3.45% of its holding to the company. EINC marries the high income potential that MLPs are known for without the burdensome K-1 tax reporting, providing investors with easy exposure to the midstream. EINC has an expense ratio of 0.45.

For more news, information, and strategy, visit the Energy Infrastructure Channel.