Summary

- The potential for more dividend increases is improving as 2022 is setting up to be another year of strong free cash flow generation complemented by macro and micro tailwinds.

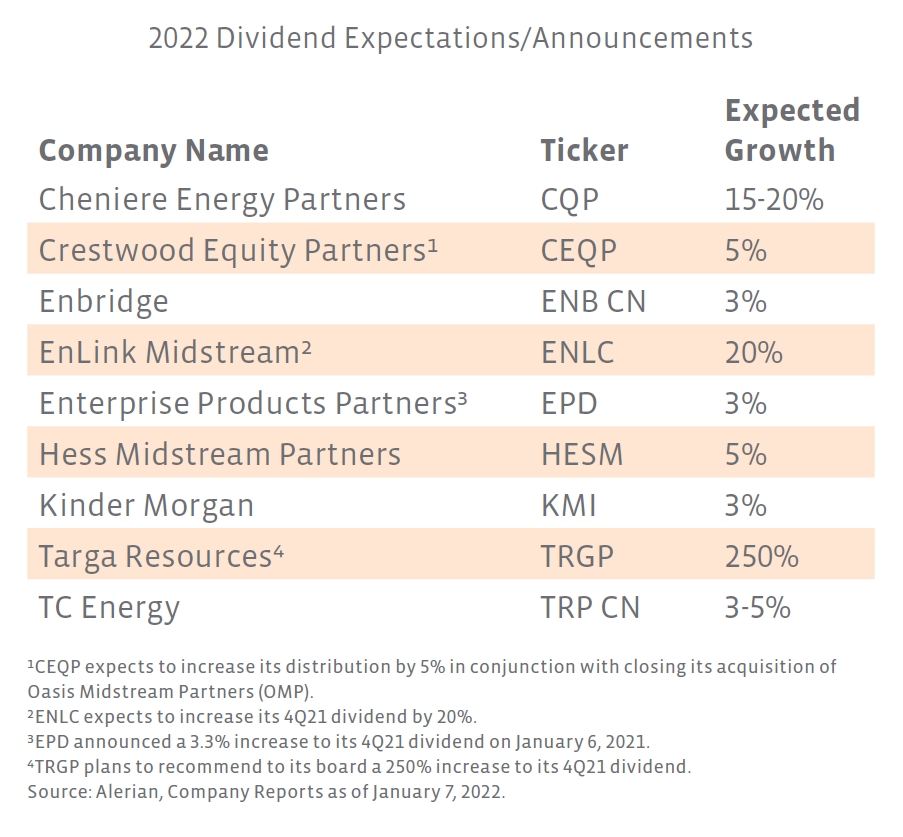

- Several midstream companies have announced plans to increase their payouts this year or have already declared a higher dividend. Most increases are expected to be modest (i.e., 5% or less), but some companies are expecting more significant growth.

- Expectations of robust free cash flow generation, improving balance sheets, more normalized yields, and a constructive 2022 midstream outlook contribute to a more conducive backdrop for midstream dividend increases than seen in sometime.

Income-oriented investors that have midstream exposure in their portfolios—and those contemplating potential midstream allocations to enhance yield—are likely wondering what’s in store for midstream/MLP dividends in 2022. To that end, several midstream companies have recently announced plans to grow their dividends this year. Relative to recent years, the potential for more dividend increases is improving as 2022 is setting up to be another year of strong free cash flow generation complemented by macro and micro tailwinds. Today’s note examines the midstream dividend outlook in view of recent company announcements and the contributing factors that could lead to more dividend increases in 2022.

2022 midstream dividends: expect more examples of growth.

As shown in the table below, a growing list of midstream companies have announced plans to increase their payouts this year or have already declared a higher dividend. Most dividend increases are expected to be modest (i.e., 5% or less) as companies focus on sustainably growing payouts. Relative to 2021, more examples of growth are expected in 2022, and some names that previously cut may provide a step-change in their payouts. Dividend cuts appear less likely for 2022. As a reminder, 3Q21 marked the first quarter in two years with no cuts across Alerian’s midstream indexes (read more), and positive momentum looks set to continue into 2022 with dividend increases potentially complementing buyback activity for many names (read more).

In December, a handful of large US and Canadian midstream corporations that typically increase payouts once a year announced expectations for 2022, largely guiding to modest dividend growth. Kinder Morgan (KMI), for example, announced a 3% increase with the release of its 2022 preliminary guidance. Similarly, Enbridge (ENB CN) declared a 3% increase, while TC Energy (TRP CN) reaffirmed its recently moderated dividend growth outlook of 3-5% (vs. 5-7% previously) during its Virtual Investor Day last month.

Some companies that cut in the past plan to increase their payouts by larger percentages off a lower base. EnLink Midstream (ENLC) announced plans last month to increase its 4Q21 distribution by 20%. Targa Resources (TRGP), which cut its 1Q20 dividend (paid in 2Q20) by 89%, announced in November that it would recommend to its board an increase in the quarterly dividend from $0.10 to $0.35 per share beginning with the 4Q21 dividend payable in February 2022.

Other names that have grown their payouts consistently are continuing their trend of growth, including Hess Midstream (HESM) and Cheniere Energy Partners (CQP). Enterprise Products Partners (EPD) declared its 4Q21 distribution last week, which represented a 3.3% increase relative to the 3Q21 and 4Q20 payouts. The increased payout in 2022 will mark EPD’s twenty-fourth straight year of distribution growth.

Strong fundamentals + lower yields = more dividend increases in 2022?

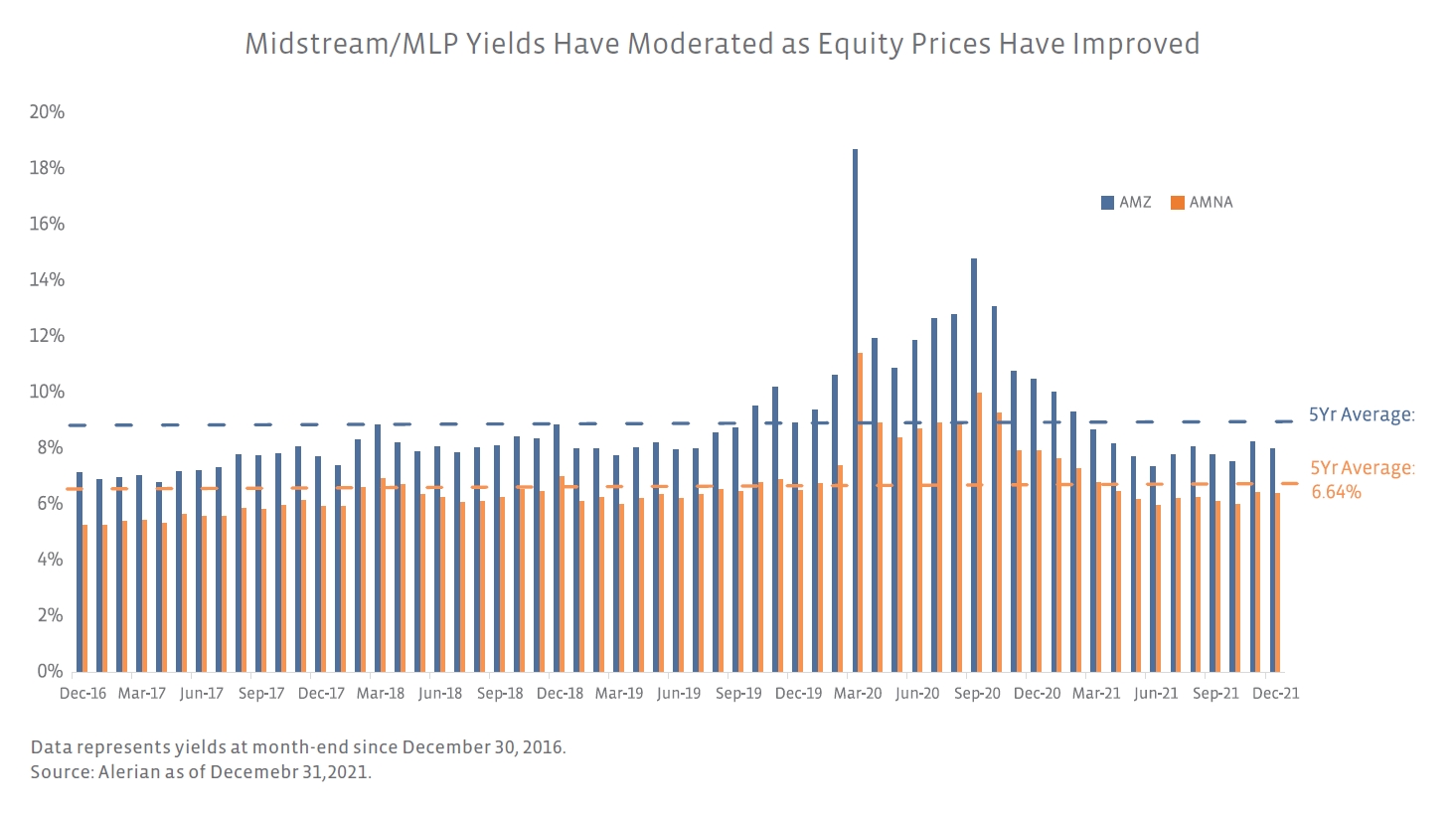

Expectations of robust free cash flow generation, improving balance sheets, and a constructive 2022 midstream outlook (read more) contribute to a more conducive backdrop for midstream dividend increases than seen in sometime. While commodity prices could see volatility, US benchmark oil prices around $78 per barrel and benchmark natural gas prices over $4 per million British thermal unit reflect a much improved macro environment that is supportive for moderate US energy production growth. Additionally, normalized midstream yields make dividend increases more palatable for management teams. From a capital allocation standpoint, it is less attractive to grow the dividend if yields are elevated and the equity price does not seem to reflect the value of the dividend being paid. As of December 31, yields for the Alerian MLP Index (AMZ) and the Alerian Midstream Energy Index (AMNA) were well off their 2020 levels and below their 5-year averages by 91 and 30 basis points, respectively.

Bottom Line:

Company announcements pointing to modest dividend growth reinforce a constructive outlook for midstream payouts in 2022, which is further underpinned by robust free cash flow expectations and an improved macro backdrop.

AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA). AMZ is the underlying index for the JP Morgan Alerian MLP Index ETN (AMJ), the ETRACS Alerian MLP Index ETN Series B (AMUB), and the ETRACS Quarterly Pay 1.5X Leveraged Alerian MLP Index ETN (MLPR).

Originally published by Alerian on January 4, 2022.

For more news, information, and strategy, visit the Energy Infrastructure Channel.