While economies in Latin America are cooling down, revenue for MercadoLibre Inc. (NASDAQ: MELI) is heating up. The Argentina-based e-commerce giant posted record revenue and stronger-than-expected profits, reporting net sales of $2.6 billion for the three months ended June 30, up 53% from a year earlier. This is above the $2.5 billion average estimate of analysts Bloomberg surveyed.

While operating margins fell to 9.6% from 9.8% in the same period last year, Wall Street was forecasting margins to contract to roughly 7%.

MercadoLibre has been investing across the region for years. Operations in Mexico had their first profitable quarter since starting up five years ago, Chief Financial Officer Pedro Arnt said in an interview with Bloomberg.

“We aim to deliver incremental profits for many years to come,” Arnt added.

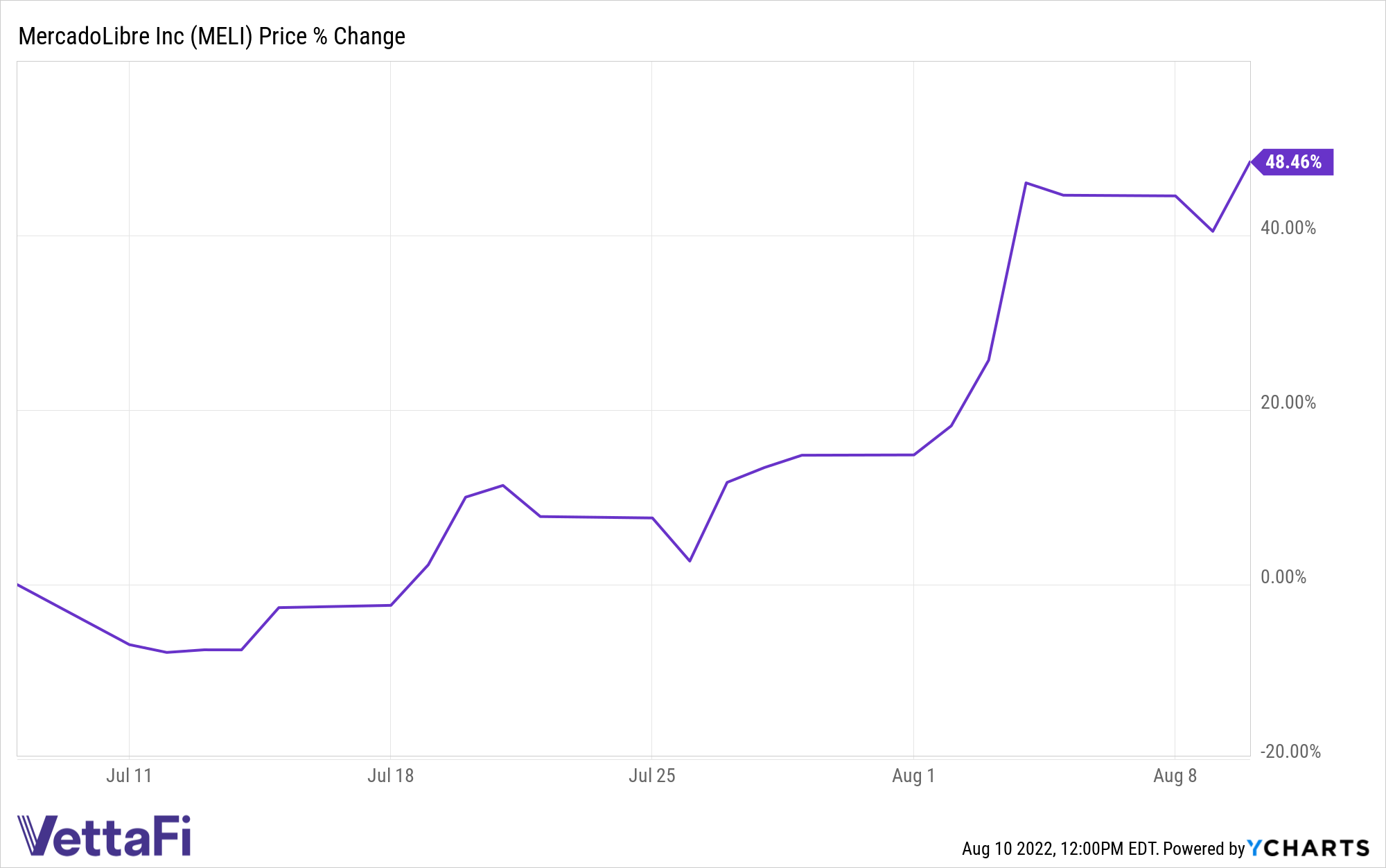

The company’s stock has risen by nearly 50% over the past month.

MercadoLibre is the ninth largest holding in EMQQ Global’s Emerging Markets Internet & Ecommerce ETF (NYSE Arca: EMQQ) and the top holding in the Next Frontier Internet & Ecommerce ETF (FMQQ), which are designed to provide exposure to the internet and e-commerce sectors within the developing world.

By focusing on the internet and e-commerce in emerging markets, EMQQ looks to capture the growth and innovation happening in some of the largest and fastest-growing populations in the world. More than 60% of EMQQ’s assets are weighted toward China.

FMQQ, meanwhile, seeks to provide investment results that, before fees and expenses, generally correspond to the price and yield performance of the Next Frontier Internet and Ecommerce Index (FMQQetf.com). While it has the same investment philosophy as EMQQ, FMQQ has no China-based holdings. Securities must meet a minimum of a $300 million market cap and pass a liquidity screen that requires a $1 million average daily turnover.

For more news, information, and strategy, visit the Emerging Markets Channel.